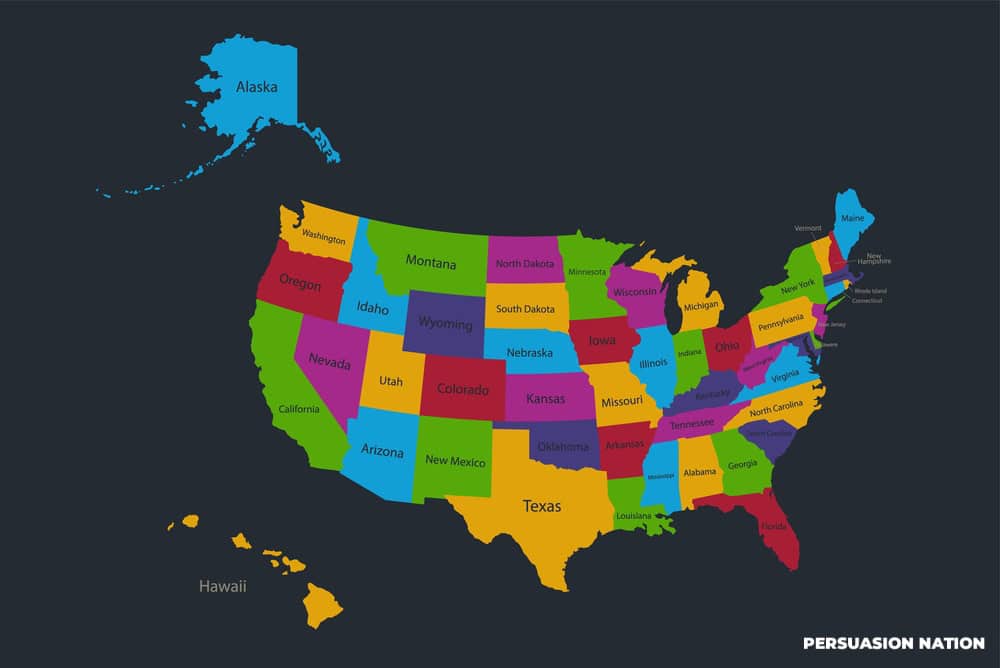

5 Best States For Non-resident LLCs in the U.S.

Starting a business as a non-resident in the United States can be a great opportunity, but choosing the right state for your LLC is KEY.

I’m a Nigerian, but I formed my Non-resident LLC four years ago in Florida. Even though FL is not the best state to form your LLC as a Non-US, I’ve enjoyed the benefits of having a presence in the U.S market, and my clients and partners trust and recognize me as a trusted entity.

The thing is:

The best state for non-resident LLC formation depends on various factors such as privacy protection, tax advantages, and overall business-friendly environments.

If I were to incorporate another company in the United States today, I would consider these factors before proceeding—a rookie mistake I made years ago taught me this lesson.

The purpose of this guide is to help you avoid that mistake.

Quick Summary

Delaware is the best state for non-US LLCs and is often praised for its favorable tax laws and privacy protections, making it my top choice for non-resident LLCs. Similarly, Wyoming is known for being the incorporation haven due to its robust legal framework and flexible business laws.

The third best state for Non-resident LLCs is New Mexico, which stands out for its low filing fee and no annual report requirements, reducing ongoing costs. Finally, Nevada offers strong privacy laws and low business taxes.

Top 5 States for Non-Resident LLC Formation

| State | Filing Fees | Annual Report Fees | Anonymity | State Income Tax |

|---|---|---|---|---|

| Delaware | $110 | $300 | High (no member names in public filings) | None (for LLCs not operating in-state) |

| Wyoming | $100 | $60 | Complete (no owner names disclosed) | None (for LLCs not operating in-state) |

| Nevada | $436 | $350 | High (strong privacy protections) | None (for LLCs not operating in-state) |

| New Mexico | $50 | None | High (no member names in public records) | None (for LLCs not operating in-state) |

| Florida | $125 | $138.75 | Moderate (members’ names required) | None (for LLCs not operating in-state) |

When choosing a state to form your LLC, consider privacy, income tax, anonymity, and asset protection. Each state’s law may offer different benefits, so weigh these elements according to your business needs.

1. Delaware: The Incorporation Haven (My Top Pick)

Delaware offers numerous advantages for non-resident LLCs, making it a top choice for many business owners. It provides favorable tax conditions, simplified formation processes, and strong legal protections.

Delaware Taxation

Delaware is particularly attractive due to its tax-friendly policies.

As a non-resident LLC, you will not need to pay state income tax if your business does not operate within Delaware. No sales tax benefits e-commerce and other non-physical businesses. Additionally, franchise taxes are relatively low. This makes Delaware an appealing choice for minimizing tax burdens and maximizing profits.

Delaware LLC Formation and Annual Fees

Forming an LLC in Delaware is straightforward and relatively inexpensive. The initial filing fee is $100, and you can typically expedite the process for an additional fee. Annually, you must pay a $300 franchise tax lower than many other states. The ease and low cost of forming and maintaining your LLC in Delaware simplify business operations.

Delaware Privacy and Anonymity

Delaware offers significant privacy protections. When you file your LLC, the state does not require you to list member names and addresses in public records. This means you can maintain anonymity. This is crucial if you value your privacy or wish to keep your business operations discreet. Many entrepreneurs and investors choose Delaware because of its privacy advantages.

Delaware Asset Protection

Delaware provides robust protection for your business assets.

The state’s laws prevent creditors from seizing personal assets to satisfy business debts, except in cases of fraud or other illegal activities. This means your personal property is safeguarded, giving you greater peace of mind. Additionally, Delaware’s strong legal framework ensures fair handling of disputes and claims, providing a reliable buffer against unforeseen legal complications.

Delaware State Laws and Regulations

Delaware is known for its user-friendly and modern corporate laws. The state has a specialized court system, the Court of Chancery, which handles business disputes efficiently and with expertise. This court does not use juries, so you can expect quicker resolutions by experienced judges. Delaware’s legal environment is designed to favor business interests, making compliance easier and reducing regulatory burdens. This makes it the quintessential state for incorporating your non-resident LLC.

2. Wyoming: Privacy and Tax Advantages

Wyoming is an excellent choice for forming a non-resident LLC due to its strong privacy protections, favorable taxation, and cost-effective filing fees. Below, you’ll find detailed information on taxation, formation requirements, privacy, asset protection, and relevant state laws.

Wyoming Taxation

Wyoming LLCs benefit from no state income tax, either personal or corporate. This means fewer tax filings and less money spent on taxes. Additionally, there is no franchise tax, which often burdens LLCs in other states. Your LLC will only be subject to federal taxes unless you have a physical business presence in another state.

This tax environment is particularly beneficial for non-resident LLC owners, making Wyoming a top choice for minimizing tax liabilities.

Wyoming LLC Formation and Annual Fees

Forming a Wyoming LLC is straightforward. The filing fee is generally low, creating an affordable entry point for business owners. The annual report fee is minimal at around $60. You’ll also need a registered agent, which usually costs between $25 and $100 per year.

These fees are designed to be manageable, even for small businesses or startups, making financial planning easier and more predictable.

Wyoming Privacy and Anonymity

Privacy is a cornerstone of Wyoming’s LLC regulations. The state does not require you to disclose the names of members or managers in public records. This ensures your personal information remains confidential, a significant advantage for many business owners.

Wyoming is one of the few states that allow anonymous LLCs, which provides an added layer of privacy not available in most other states.

Wyoming Asset Protection

Wyoming offers solid asset protection for LLC members. The state’s laws provide a robust shield against personal liability, preventing creditors from seizing your assets in most cases. LLC owners can also benefit from charging order protection, a unique feature that limits a creditor’s claim to the distribution rights of a member’s ownership interest.

This makes Wyoming favorable for those looking to safeguard personal and business assets from legal actions.

Wyoming State Laws and Regulations

Wyoming has business-friendly laws and minimal bureaucracy. The state’s regulatory environment is designed to support business growth and flexibility. LLCs do not have annual minutes or meeting requirements, simplifying compliance.

Understanding and navigating state laws is straightforward, enhancing your ability to focus on growing your business rather than dealing with red tape. This regulatory simplicity makes Wyoming an attractive option for LLC formation.

3. New Mexico

New Mexico is a top pick for forming an LLC, especially for non-residents. The state offers advantages like low costs, privacy, and straightforward regulations. These aspects, such as taxation, formation fees, privacy, asset protection, and laws, make New Mexico a strong candidate for your LLC.

New Mexico Taxation

New Mexico does not impose a state income tax on LLCs. This helps you save significantly on taxes compared to other states. Also, there are no franchise taxes, making it a cost-effective choice for small businesses.

You will still need to pay federal taxes, but New Mexico’s tax structure ensures that your state-level tax burden is minimal.

New Mexico LLC Formation and Annual Fees

Registering an LLC in New Mexico is straightforward and affordable. The filing fee is just $50, one of the lowest in the country. This low entry cost makes it attractive for new and small businesses.

Another benefit is that New Mexico does not require annual reporting or annual fees. This reduces your paperwork and ongoing costs, allowing you to focus more on growing your business.

New Mexico Privacy and Anonymity

New Mexico offers significant privacy benefits. When you form an LLC here, you do not need to disclose the names of the LLC’s members or managers in the public filing. This anonymity can be crucial if you want to keep your involvement in the business private.

Furthermore, the state does not require annual reports that list LLC members, adding another layer of privacy.

New Mexico Asset Protection

New Mexico LLCs offer robustness in asset protection. When you form an LLC in this state, your assets are shielded from business liabilities. This protection means creditors can only go after the LLC’s assets, not your personal property.

Additionally, New Mexico laws limit the extent to which creditors can charge your membership interest in the LLC. This adds an extra layer of safeguard for your personal and business assets.

New Mexico State Laws and Regulations

The state laws and regulations surrounding LLCs in New Mexico are favorable and straightforward. They provide a user-friendly environment for business owners. The state has worked to create a business-friendly atmosphere with fewer bureaucratic hurdles.

Complying with New Mexico’s business regulations is easy, which helps you streamline your operations and focus on growth.

4. Nevada

Nevada is a top choice for forming an LLC due to its favorable tax environment, straightforward formation process, strong privacy protections, robust asset protection, and business-friendly laws.

Nevada Taxation

Nevada is known for its business-friendly tax environment. There is no state income tax for corporations or individuals, which is a significant advantage for LLCs, especially for non-residents. Additionally, there is no franchise tax, which reduces the overall tax burden. These tax policies make Nevada an attractive option for entrepreneurs looking to maximize their profits and minimize tax liabilities.

Nevada LLC Formation and Annual Fees

Forming an LLC in Nevada involves filing Articles of Organization with the Secretary of State and paying a $436 filing fee. Once formed, LLCs must submit an annual list of managers and members accompanied by a $350 fee.

Additionally, there is no annual franchise tax. The formation process is streamlined, and the state’s business portal provides detailed guidelines and support, making it straightforward for non-residents to set up and maintain their LLCs efficiently.

Nevada Privacy and Anonymity

Nevada offers strong privacy protections for LLC owners. The state does not require the disclosure of LLC member’s or managers’ names in public records. This anonymity is particularly appealing to non-resident entrepreneurs who value privacy.

Moreover, Nevada does not share information with the IRS, adding an extra layer of confidentiality. This privacy feature can help protect the identities of business owners and reduce the risk of personal information being accessed by third parties.

Nevada Asset Protection

Nevada provides robust asset protection laws for LLCs. The state’s charging order protection ensures that creditors cannot directly seize an LLC member’s interest in the business. Instead, they are limited to receiving distributions, if any, made by the LLC.

This legal framework helps safeguard business assets and personal wealth. Non-resident LLC owners can rest assured that their assets will be protected from business liabilities and vice versa.

Nevada State Laws and Regulations

Nevada’s business laws are designed to be flexible and accommodating. The state has a well-established legal framework that supports LLC formation and operation.

For instance, Nevada allows LLCs to have a single member and offers extensive freedom in internal management structures. The state also provides a fast-track processing option for filing documents, ensuring entrepreneurs can quickly get their businesses up and running. This flexibility and efficiency make Nevada favorable for non-resident LLC owners looking for ease of operation and strong legal support.

5. Florida

Florida offers numerous benefits for non-residents forming an LLC, such as favorable tax laws, straightforward formation procedures, strong privacy measures, and solid asset protection. These perks make Florida an attractive option for many international entrepreneurs.

Florida Taxation

Florida is known for its low tax rates, especially for businesses. There is no state income tax on individuals, meaning your earnings from the LLC are not taxed at the state level. This can save you significant amounts compared to states with higher tax burdens. Additionally, Florida does not have a corporate income tax for LLCs, providing a favorable environment for business growth.

Florida LLC Formation and Annual Fees

Forming an LLC in Florida is straightforward. You need to file Articles of Organization with the Florida Division of Corporations, and it’s relatively inexpensive compared to other states. Remember to get a registered agent if you don’t have a physical address in Florida. Annual fees in Florida are also manageable, ensuring that maintaining your LLC is cost-effective.

Florida Privacy and Anonymity

Privacy is a key benefit when forming an LLC in Florida. The state allows you to manage your business affairs without having to disclose extensive personal information. This is particularly beneficial for non-resident entrepreneurs who value discretion. Florida does not require LLC members to be listed publicly, helping protect your identity.

Florida Asset Protection

Florida offers significant asset protection benefits. For example, the state has robust laws protecting your assets from business liabilities. If your LLC faces legal issues or debt, your personal properties are generally safe. This level of asset protection is a considerable advantage, especially for international business owners.

Florida State Laws and Regulations

Florida’s business-friendly laws and regulations further enhance its appeal for non-residents. The state provides clear guidelines on LLC operations and regulatory compliance, simplifying your business’s management. Moreover, the state is known for being responsive and supportive to business needs, reducing administrative burdens.

Forming my LLC in Florida four years ago has been a smooth experience, and I have consistently enjoyed the state’s benefits. The clear regulatory environment and strong legal protections have made it much easier for me to focus on growing my business.

Do I Pay Tax As a Non-US Resident LLC Owner?

Non-resident LLC owners are only taxed on income sourced in the US. If your LLC does not generate US-sourced income, you generally do not need to pay US income tax.

US-Sourced Income Taxation

You will be taxed on US-sourced income from a US trade or business. Passive US-sourced income, such as interest or dividends, is subject to a 30% withholding tax.

Taxpayer Identification Number (TIN)

Every LLC owner must have a Taxpayer Identification Number. As a non-resident, you need to obtain this number from the IRS.

Filing Requirements

If you engage in a US trade or business during the year, you must file a tax return using Form 1040NR. You must still file an informational report with the IRS, even without US tax liability.

Annual Report

Non-resident LLC owners must file an annual report with the state and pay any required fees.

Critical Factors to Consider When Choosing a State

These include the legal framework, privacy protections, tax implications, and personal asset protection.

Legal Framework and Business Laws

When choosing a state for your non-resident LLC, it’s crucial to consider the legal framework and business laws. Some states, like Wyoming, have favorable business laws that make operating easier. These laws may include simplified registration procedures, lower filing fees, and less stringent regulatory requirements. Look for states that have a reputation for being business-friendly and have well-established legal precedents that support business operations.

Privacy and Anonymity Protections

Privacy is another important factor. States like Delaware offer privacy and anonymity protections to LLC owners. This means that the state does not require the disclosure of member names in public records, providing you with an extra layer of security. This is a big draw for many, especially if you value keeping your personal information private. Consider the state’s Registered Agent laws and whether they ensure your privacy.

Tax Implications and Fees

Tax obligations can vary widely by state. For non-resident LLCs, states like Wyoming don’t impose a state income tax, franchise tax, or personal property tax. This can lead to significant savings. Check for annual fees and other filing fees that might affect overall costs. Understanding the tax implications ahead of time can help you avoid unexpected costs and make the best financial decision for your business.

Legal Protection on Personal Asset

Finally, consider the state’s track record on protecting personal assets. Some states offer stronger legal protections against personal liability for business debts. For instance, Wyoming is known for its strong asset protection laws. These laws help ensure that personal property remains safe if your business faces legal challenges. Ensure the chosen state prioritizes limiting liability and effectively separates personal and business assets.

My Final Words – Which State Should Choose?

Well, based on the comparison of these top states for foreign LLC formation, it is clear that each state offers unique advantages in terms of filing fees, annual report fees, anonymity, and state income tax. Delaware stands out for its high level of anonymity and lack of state income tax for LLCs not operating in-state, though its annual report fees are relatively high at $300.

Wyoming offers complete anonymity with the lowest annual report fees at $60 and no state income tax, making it an attractive option. Nevada provides strong privacy protections but comes with higher filing and annual report fees.

New Mexico boasts the lowest filing fees at $50 and no annual report fees, alongside high anonymity and no state income tax, making it an economical choice. Florida, while having moderate anonymity and no state income tax, is less competitive due to higher annual report fees and the requirement to disclose members’ names.

Overall, Wyoming emerges as the best state for non-resident LLC formation. It offers complete anonymity, low filing and annual report fees, and no state income tax for LLCs not operating in-state, providing an optimal balance of privacy, cost-efficiency, and tax benefits.

Frequently Asked Questions

What’s the Difference between Wyoming vs Delaware LLC for Non-residents?

Wyoming is known for its business-friendly laws, low taxes, strong privacy protections, and minimal reporting requirements. Delaware is popular for its well-established legal system and business-friendly court, the Court of Chancery. This state also offers strong privacy protections.

What’s the Difference between Wyoming LLC vs Nevada LLC for Non-residents?

Wyoming offers low taxes and privacy protections, making it attractive for non-residents. Nevada also provides high privacy levels but has slightly higher costs compared to Wyoming. Nevada is often chosen for its favorable asset protection laws.

Which state offers the lowest overall tax liability for non-resident LLCs?

Wyoming has the lowest tax liability due to its lack of personal, corporate, and franchise income tax. This makes it highly advantageous for non-resident LLCs.

Can a non-resident open an LLC in the USA?

Yes, non-residents can open an LLC in the USA through a registered agent online. No citizenship or residency requirements make it accessible for foreign entrepreneurs.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.