Is Accounting a High-Income Skill?

Are you curious about whether accounting is a high-income skill?

Accounting is a profession that involves the recording, classifying, and summarizing of financial transactions. It is necessary in all businesses and organizations to make it a stable career choice.

But does it pay well?

According to my recent research, accounting is indeed a high-income skill, with the potential to earn a six-figure salary.

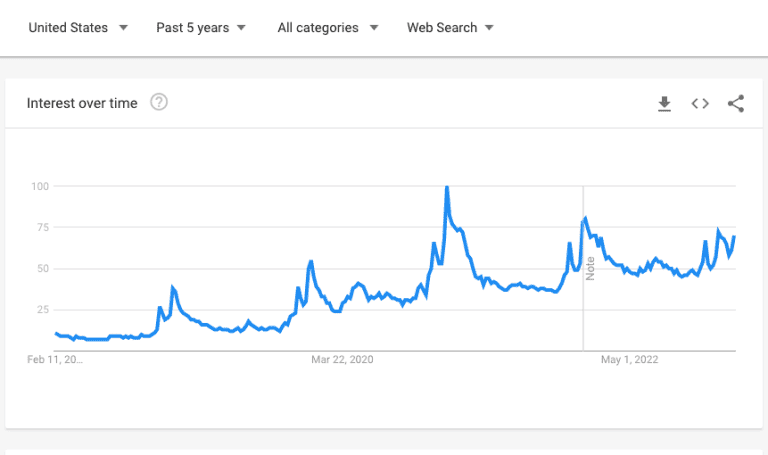

In fact, the job market for accountants is expected to grow by 4% from 2019 to 2032, which is faster than the average for all occupations. This growth is due to the increasing complexity of tax and regulatory requirements and the overall growth of the economy.

What is Accounting Really About?

Accounting is a crucial aspect of any business, and it involves recording, summarizing, and analyzing financial transactions. It helps businesses keep track of their financial records, make informed decisions, and comply with legal requirements.

The primary goal of accounting is to provide accurate and reliable financial information to stakeholders, including investors, creditors, and management.

Financial statements, such as the balance sheet, income statement, and cash flow statement, are the most common way of communicating this information.

Accountants use Generally Accepted Accounting Principles (GAAP) to ensure that financial statements are consistent and comparable across different businesses. They follow rules and guidelines to record transactions, prepare financial statements, and disclose information to stakeholders.

Financial statements are essential for businesses because they provide a snapshot of the company’s financial position, performance, and cash flow.

The balance sheet shows the company’s assets, liabilities, and equity at a specific time. The income statement shows the company’s revenue, expenses, and net income over some time.

The cash flow statement shows the company’s sources and uses of cash over some time.

Accounting is a high-income skill because it requires specialized knowledge and expertise. Accountants must deeply understand financial principles, regulations, and software. They must also be able to analyze data, communicate effectively, and work with others in a team environment.

Is Accounting a High-Income Skill?

The short answer is yes; accounting can be a high-income skill, depending on your expertise and experience.

Mastery of financial reporting, tax preparation, auditing, and financial analysis can secure high-paying roles across multiple industries. However, it is important to note that the potential for high income in accounting is not guaranteed and may vary based on location, industry, and company size.

To give you an idea of the earning potential in accounting, the following table shows the median annual salaries for various accounting positions in the United States, according to the Bureau of Labor Statistics:

| Accounting Position | Median Annual Salary |

|---|---|

| Accountant | $73,560 |

| Financial Analyst | $85,660 |

| Auditor | $73,560 |

| Tax Preparer | $47,520 |

| Bookkeeper | $42,410 |

As you can see, accounting can be a lucrative career path with the potential for high income. However, it is important to remember that earning a high income in accounting requires dedication, hard work, and ongoing professional development.

How Much You Can Make as an Accountant?

Your salary as an accountant depends on various factors such as your experience, education, location, and industry. According to the U.S. Bureau of Labor Statistics (BLS), the median annual salary for accountants and auditors was $78,000 in 2022. The highest-paid 25% earned $101,150, while the lowest-paid 25% earned $60,920.

However, it is essential to note that these figures are just averages, and your salary may vary based on your circumstances. For instance, if you have a CPA certification, you may be able to command a higher salary than someone without it.

Moreover, the industry you work in can also impact your salary. For example, accountants working in finance and insurance tend to earn higher salaries than those working in government or non-profit organizations.

Here is a table summarizing the average salaries for accountants in different industries based on data from PayScale:

| Industry | Average Salary |

|---|---|

| Finance and Insurance | $63,000 |

| Manufacturing | $60,000 |

| Professional, Scientific, and Technical Services | $59,000 |

| Healthcare | $56,000 |

| Retail | $53,000 |

Remember that these figures are just averages, and your salary may vary based on location, experience, and other factors. However, accounting is generally considered a high-income skill, and with the right qualifications and experience, you can earn a comfortable living as an accountant.

Can Accounting Make You Rich?

The short answer is yes, accounting can make you rich, but it depends on several factors.

Firstly, it’s important to note that the average salary for an accountant is between $100,000 and $120,000 per year. This is certainly a comfortable income, but it may take several years to accumulate a million dollars or have the capital to invest in other physical assets.

However, there are several ways to increase your earning potential as an accountant. For example, you can specialize in a high-demand area such as tax accounting or financial planning. Additionally, you can pursue advanced degrees or certifications such as a CPA or CFA, leading to higher salaries and more job opportunities.

Another way to increase your income as an accountant is to start an accounting firm or consulting business. This can be a lucrative option, but establishing and growing your business requires a significant investment of time and money.

How Do Accountants Make Money?

There are different ways to make money as an accountant, and your earning potential can vary depending on your experience, skills, and the type of accounting work you do.

Here are some of the ways accountants make money:

Salary

Many accountants work as employees for companies or accounting firms and receive a salary. According to the US Bureau of Labor Statistics, the median annual wage for accountants and auditors was $78,000 in 2022. However, this amount can vary depending on the industry, location, and experience level. Senior-level accountants can earn six-figure salaries.

Hourly Rate

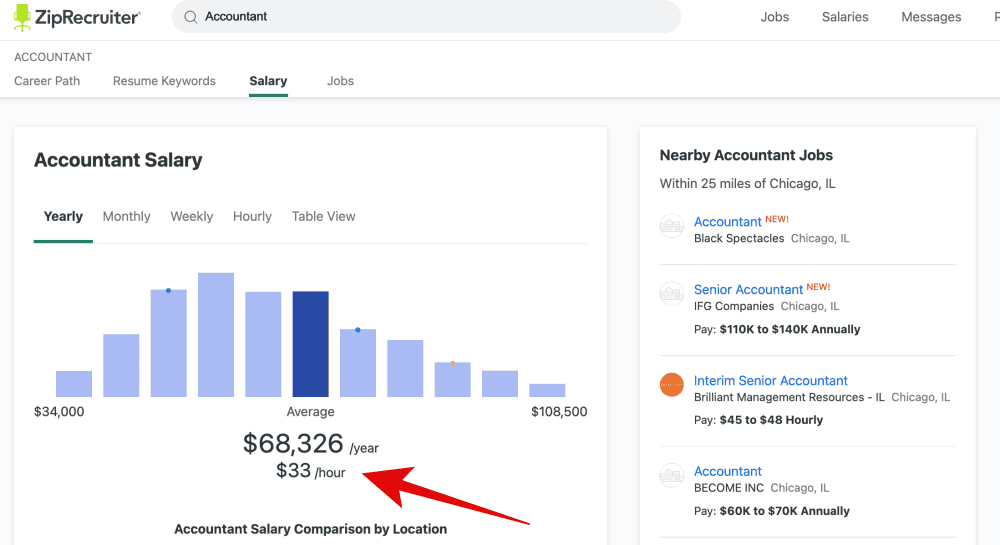

Some accountants work as freelancers or independent contractors and charge an hourly rate for their services. The hourly rate can vary depending on the accountant’s experience and the complexity of the work. According to ZipRecruiter, the average hourly rate for an accountant in the United States is $29 per hour.

Consulting Fees

Accountants can also earn money by providing consulting services to businesses or individuals. Consulting fees can vary depending on the scope of the project, the accountant’s expertise, and the required time. Accountants specializing in niche areas such as tax law or forensic accounting can charge higher consulting fees.

Commission

Some accountants work in sales roles, such as selling accounting software or financial products. In these roles, accountants can earn commissions based on their sales performance. Commission rates can vary depending on the product and the company.

Where Can I Find High-paying Accounting Jobs?

If you are an accounting professional looking for a high-paying job, many options are available.

Here are some of the best places to look:

1. Public Accounting Firms

Public accounting firms are some of the largest employers of accounting professionals.

These firms offer various services, including audit, tax, and consulting, and employ accountants at various experience levels. Some of the largest public accounting firms include the “Big Four” (Deloitte, PwC, EY, and KPMG) and other large firms such as Grant Thornton and BDO.

2. Financial Services Companies

Financial services companies, such as banks, investment firms, and insurance companies, also employ many accounting professionals. These companies require accountants to manage their financial operations, including financial reporting, tax compliance, and risk management.

3. Corporate Accounting Departments

Many companies have accounting departments that are responsible for managing their financial operations. Depending on the company’s size, these departments may be small or large and may offer a range of opportunities for accounting professionals.

4. Government Agencies

Federal, state, and local government agencies also employ accounting professionals. These agencies require accountants to manage their financial operations, including budgeting, financial reporting, and tax compliance.

5. Nonprofit Organizations

Nonprofit organizations like charities and educational institutions also employ accounting professionals. These organizations require accountants to manage financial operations, including financial reporting, tax compliance, and budgeting.

Wrapping Up

In conclusion, accounting is a high-income skill that can provide a stable and lucrative career path for those who possess the necessary skills and qualifications. From my research, the average salary for an accountant in the United States ranges from $34,000 to $120,000 per year, depending on experience, education, and location.

Accounting requires combining technical knowledge, analytical skills, and attention to detail.

It involves bookkeeping, financial reporting, tax preparation, and auditing. To succeed in this field, you should have a strong foundation in accounting principles and proficiency in accounting software and other tools.

In addition to technical skills, accountants should also possess soft skills such as communication, teamwork, and problem-solving. These skills are essential for building relationships with clients and colleagues, as well as for analyzing financial data and making informed decisions.

It is important to keep up with the latest trends and developments in the accounting industry to stay competitive. This may involve pursuing continuing education courses or certifications, such as the Certified Public Accountant (CPA) designation. It may also involve developing data analysis, technology, or financial statement analysis skills.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.