Sales Funnel for Financial Services: A Comprehensive Guide

Financial services companies use sales funnels to convert potential customers into paying clients.

A sales funnel is a marketing strategy that guides customers through a series of steps designed to educate them about the company’s services, build trust, and, ultimately, encourage them to make a purchase.

According to recent statistics, the average conversion rate across all industries is 3.9%, with B2B tech as low as just 1.7% and professional services averaging around 9.3%.

An effective sales funnel can help financial services companies increase conversion rates, build long-term client relationships, and drive revenue growth.

Creating a successful sales funnel for financial services requires a deep understanding of the company’s target audience, the ability to create relevant content, and the leverage of digital marketing strategies.

In this guide, I will explore the critical steps in creating a sales funnel for financial services, including collecting leads, setting up a funnel to book appointments, and making a passive hook to increase conversion.

What is a Financial Service Sales Funnel?

A sales funnel is a marketing strategy that guides potential clients through a series of steps to convert them into paying customers. Financial service sales funnels are a specific type of sales funnel financial service providers use to attract and convert potential clients.

The financial service sales funnel typically consists of three stages:

- Awareness Stage: In this stage, potential clients become aware of the financial service provider and their services. This could be through various marketing channels such as social media, online ads, or word-of-mouth referrals.

- Consideration Stage: Once potential clients know the financial service provider, they move on to the consideration stage. In this stage, they evaluate the services the provider offers and compare them to other options available in the market.

- Conversion Stage: The final stage of the financial service sales funnel is the conversion stage. In this stage, potential clients become paying customers by signing up for the financial services offered by the provider.

Financial service providers must create relevant and engaging content that addresses their target audience’s needs and pain points to guide potential clients through the sales funnel effectively. This could be in the form of blog posts, videos, webinars, or whitepapers.

Providers can use a financial service sales funnel to increase their chances of converting potential clients into paying customers, build long-term relationships, and drive revenue growth.

Why Do You Need a Financial Services Sales Funnel?

A sales funnel is crucial for any financial services business looking to increase conversions, build long-term relationships, and drive revenue.

By guiding potential customers through the sales funnel, financial services providers can better understand their target audience, create relevant content, leverage digital marketing strategies, and analyze the results for continuous improvement.

One of the main reasons why financial services businesses need a sales funnel is to improve brand awareness.

A well-designed sales funnel can help businesses create a consistent and compelling message that resonates with their target audience.

By delivering the right message at the right time, businesses can establish trust and credibility with their potential customers, ultimately leading to more conversions.

Another reason a financial services sales funnel is necessary is that it allows businesses to anticipate and address the needs and concerns of their potential customers.

By understanding the customer’s purchasing journey, companies can create and deliver relevant and timely marketing messages that address the customer’s questions and doubts at various stages.

Stages of the Financial Services Sales Funnel

A sales funnel is a marketing model that outlines a potential customer’s journey from initial contact to final purchase.

Like any other industry, the financial services industry uses sales funnels to guide its customers through buying. Understanding the stages of the financial services sales funnel is crucial for financial service providers to create successful marketing campaigns and increase conversions.

The Awareness Stage (Top of the Funnel, TOFU)

The awareness stage is the first stage of the financial services sales funnel.

At this stage, potential customers become aware of the problem they need to solve or the need they have. They may not know your financial services yet, so your goal is to make them aware of your brand and services.

During this stage, you must create awareness by providing valuable content that resonates with your target audience.

You can reach your potential customers through blog posts, social media, and email marketing. By providing valuable content, you can build trust with your audience and establish yourself as a thought leader in the industry.

The Consideration/Evaluation Stage (MOFU)

The consideration/evaluation stage is the second financial services sales funnel stage. At this stage, potential customers have become aware of your financial services and are considering whether or not to use them.

During this stage, you must provide in-depth information about your services to help potential customers make an informed decision.

You can use case studies, whitepapers, and webinars to showcase your expertise and provide value to your potential customers. Doing so can build trust and establish yourself as a reliable and trustworthy financial service provider.

Purchase Stage (Bottom Of The Funnel)

The purchase stage is the third and final stage of the financial services sales funnel. At this stage, potential customers have decided to purchase your financial services.

You must provide your customers with a seamless and hassle-free purchasing experience during this stage.

You can use online forms, chatbots, and other tools to make purchasing easy. Doing so can increase the likelihood of repeat purchases and build long-term relationships with your customers.

Post-Purchase Stage

The post-purchase stage is the stage that comes after a customer has made a purchase.

During this stage, you must provide excellent customer service to ensure your customers are satisfied with their purchase.

You can use follow-up emails, surveys, and other tools to gather feedback and improve your services. Doing so can increase customer satisfaction and build a positive reputation for your financial services business.

Repeat Purchase Stage

The repeat purchase stage is when a customer makes a second or subsequent purchase from your financial services business. During this stage, you must provide ongoing value to your customers to encourage them to make additional purchases.

You can use loyalty programs, discounts, and other incentives to encourage repeat purchases. This will increase customer loyalty and build a loyal customer base for your financial services business.

The financial service sales funnel requires a clear understanding of your target audience, building awareness, generating leads, nurturing them towards becoming paying customers and converting them into paying customers. Following these steps, you can create a successful financial service sales funnel that drives business growth.

How Do I Create a Financial Service Sales Funnel?

Creating a financial service sales funnel involves several steps critical to ensuring that potential customers become paying customers.

Below are the steps involved in creating a financial service sales funnel and why each step matters:

Step 1: Define Your Target Audience

Defining your target audience is crucial in creating a financial service sales funnel. Knowing your target audience helps you tailor your marketing messages to the right people, increasing the chances of converting them into paying customers.

You can define your target audience by considering age, income, location, and interests.

Step 2: Build Awareness

The next step is to build awareness of your financial services.

You can do this by creating relevant content that addresses the needs of your target audience. This can be in blog posts, social media posts, or videos. Creating content that resonates with your target audience increases their chances of engaging with your brand.

Step 3: Generate Leads

Generating leads is an essential part of any sales funnel. You can generate leads by offering free resources, such as whitepapers or eBooks, in exchange for contact information. This allows you to follow up with potential customers and nurture them towards becoming paying customers.

Step 4: Nurture Leads

Once you have generated leads, nurturing them to become paying customers is essential.

This involves providing them with relevant information and resources that address their pain points. By nurturing leads, you build trust and credibility, increasing their chances of doing business with your financial services company.

Step 5: Convert Leads into Paying Customers

The final step in creating a financial service sales funnel is converting leads into paying customers. This involves providing a clear call to action that encourages them to take the next step.

This could be a free consultation, a trial of your financial services, or a discount on their first purchase.

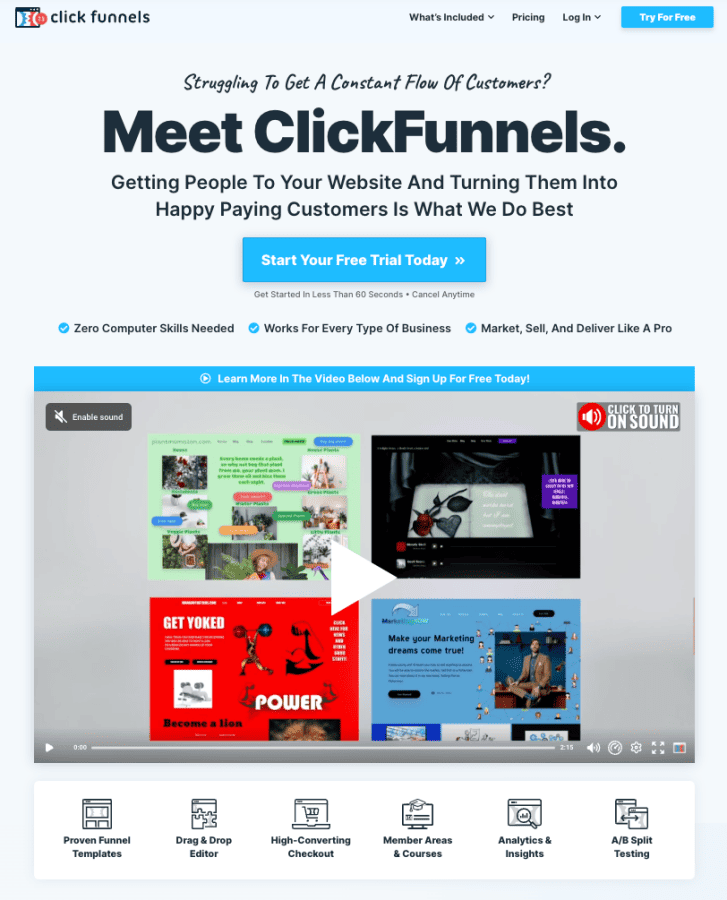

What is The Best Funnel Software for Financial Services?

Reliable and efficient sales funnel software is crucial for building and growing a business in financial services.

ClickFunnels is considered the best sales funnel software for financial services due to its unique features, which help entrepreneurs build sales funnels faster and easily scale their businesses.

One of ClickFunnels’ critical features is its financial services features, which include upsells and downsells. These allow you to offer additional products and services to your customers.

This feature is handy for financial services entrepreneurs who want to increase their revenue by offering complementary services to their existing clients.

ClickFunnels also offers free funnel templates specifically designed for financial services businesses. These templates can help you get started quickly and easily without having to spend a lot of time and resources designing your own sales funnel from scratch.

ClickFunnels provides a shopping cart and checkout feature that makes it easy for customers to purchase your products and services. This feature is essential for financial services businesses that want to offer a smooth checkout experience for their clients.

ClickFunnels also includes a CRM (customer relationship management) system that helps you manage customer data and interactions. This feature is crucial for financial services businesses that must keep track of their client’s financial information and transactions.

ClickFunnels provides various analytics tools to track your sales and marketing performance. These tools can help you identify areas for improvement and optimize your sales funnel for better results.

Frequently Asked Questions

What is a funnel in the financial services business?

In the financial services business, a funnel represents the customer’s journey from the first interaction with the brand to the ultimate goal: conversion.

It is a visual representation of a potential customer’s stages before purchasing or becoming a client. The funnel is used to guide customers through the sales process and to optimize the conversion rate.

What are the key stages in developing a financial service sales funnel?

The key stages in developing a financial service sales funnel are awareness, interest, consideration, and conversion.

In the awareness stage, potential customers become aware of the brand and its products or services. In the interest stage, potential customers show interest in the brand and its offerings. The consideration stage is where potential customers evaluate the brand and its offerings.

The conversion stage is where potential customers become clients and make a purchase.

How do you create an effective financial service sales funnel?

To create an effective financial service sales funnel, one should focus on the customer’s needs and preferences.

The funnel should be designed to guide customers through the sales process and to optimize the conversion rate. The funnel should be easy to navigate and provide customers with the information they need to make an informed decision.

How can I optimize my financial services funnel for higher conversion rates?

One should focus on the customer’s needs and preferences to optimize a financial services funnel for higher conversion rates.

The funnel should be designed to guide customers through the sales process and optimize the conversion rate. It should be easy to navigate and give customers the information they need to make an informed decision. The funnel should also be tested and refined to improve its effectiveness.

What metrics are crucial for analyzing the performance of a financial services funnel?

The metrics crucial for analyzing the performance of a financial services funnel are conversion rate, lead-to-customer ratio, customer acquisition cost, customer lifetime value, and return on investment.

These metrics provide insight into the funnel’s effectiveness and help identify areas for improvement.

What are the stages of the financial services funnel?

The stages of the financial services funnel are awareness, interest, consideration, and conversion.

In the awareness stage, potential customers become aware of the brand and its products or services. In the interest stage, potential customers show interest in the brand and its offerings. The consideration stage is where potential customers evaluate the brand and its offerings.

The conversion stage is where potential customers become clients and make a purchase.

How do industry benchmarks influence financial services conversion funnel performance?

Industry benchmarks provide a standard for comparison and help identify areas for improvement.

By comparing the performance of a financial services conversion funnel to industry benchmarks, one can identify areas where the funnel is underperforming and take steps to improve its effectiveness.

Industry benchmarks also provide insight into the competition and help to identify best practices.

Wrapping Up

In conclusion, creating a sales funnel for financial services can be challenging, but with the right strategy, it can be gratifying.

By understanding your target audience, creating relevant content, leveraging digital marketing strategies, and analyzing the results for continuous improvement, you can guide potential customers through the sales funnel, increase conversions, build long-term relationships, and drive business growth.

It’s important to remember that the sales funnel is not a one-time process but rather a continuous one. It requires constant monitoring and tweaking to ensure that it’s working effectively.

By using the right metrics, such as conversion rates, customer acquisition costs, and lifetime value, you can track your progress and make data-driven decisions to optimize your sales funnel.

Ultimately, a successful sales funnel for financial services provides value to your customers and helps them achieve their financial goals.

Focusing on their needs and preferences and providing them with the correct information at the right time can build trust and establish you as a trusted advisor.

So, to grow your financial services business, consider implementing a sales funnel strategy today. With the right approach and mindset, you can succeed and help your customers achieve financial freedom.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.