How To Start a Wyoming LLC as a Non-Resident (Clear Guide)

Starting a business as a non-resident can be daunting, but with the right guidance, it can be a rewarding venture. Thanks to its business-friendly environment and low taxes, Wyoming is a popular destination for non-resident entrepreneurs looking to start a business.

In this guide, you will learn how to start a Wyoming LLC for non-US residents, including the benefits, requirements, and steps involved.

Key Highlights: Wyoming LLC as a Non-Resident

Starting a Wyoming LLC as a non-resident involves filing the necessary paperwork with the Wyoming Secretary of State and obtaining the necessary licenses and permits using a registered agent with a physical address in Wyoming. Amongst all the services, I found Northwest registered agent the best for this.

My favorite part about forming an LLC in Wyoming is that the state has a low tax burden, making it an attractive destination for entrepreneurs looking to minimize their tax liability.

Wyoming LLC Non-resident Requirements

To start a Wyoming LLC as a non-resident, you must meet several requirements, such as a registered Agent/LLC Service, Articles of Organization, Employer Identification Number (EIN), and Operating Agreement.

I explained these requirements below:

Registered Agent/LLC Service

As a non-resident, you must have a registered agent in Wyoming because you probably might not be present to receive legal documents or official correspondence.

A registered agent serves as your point of contact for these important communications, ensuring that you are promptly informed of any legal actions, compliance requirements, or government notices related to your business.

Your registered agent of choosing must have a physical street address in Wyoming and be available during business hours to receive legal documents.

File Your Wyoming Articles of Organization

The Articles of Organization is a legal document that formally creates your Wyoming LLC. It includes basic information about your LLC, including its name, address, and purpose. You must pay the Wyoming Secretary of State fee to file the Articles of Organization. You can file the Articles of Organization online or by mail.

Here are the steps to file the Articles of Organization:

- Choose a name for your LLC that is available and complies with Wyoming naming requirements.

- Choose a registered agent for your LLC.

- Complete the Articles of Organization form.

- File the form and pay the filing fee.

Wyoming provides a “New Business Entity Wizard” for electronic article filing. Filing your articles costs $100, with an additional $2 fee for online submissions.

Here’s their Mailing Address if you wish to do it yourself.:

Wyoming Secretary of State

2020 Carey Ave

Suite 700

Cheyenne, WY 82002

Wyoming’s privacy laws make the LLC filing process virtually anonymous. You’re not required to name members in the articles; you can choose to have the registered agent represent the company. This is cool! As your personal address is never part of the public record.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number the IRS assigns to your LLC for tax purposes.

You can apply for an EIN online or by mail as a non-resident. To apply for an EIN, you must provide basic information about your LLC, such as the name, address, and type of business. You can apply for an EIN for free on the IRS website.

Operating Agreement

An Operating Agreement is a legal document that outlines your LLC’s ownership and operating procedures. Although it is not required by Wyoming law, it is highly recommended that you have one.

An Operating Agreement can help you avoid disputes and clarify the roles and responsibilities of the members of your LLC. You can create an Operating Agreement or a registered agent services to draft one.

Critical Note: Here’s What You Do Not Need Initially as a Non-resident Business Owner

Firstly, you do NOT need an ITIN (Individual Taxpayer Identification Number) to start a Wyoming LLC as a non-resident. The ITIN has been replaced by the EIN (Employer Identification Number), which is required for tax purposes and can be obtained easily online.

Secondly, depending on your situation, you may NOT need to obtain business licenses or permits initially. Researching and determining if your business requires licenses or permits before starting operations could be essential.

Thirdly, you do not need a physical address in Wyoming to start a Wyoming LLC as a non-resident. You can use the address of your registered agent, which is also a safe option. This means that you can operate your business from anywhere in the world.

Lastly, if your business is registered in another state or country, you may not need to file for foreign qualification in Wyoming. It is important to consult with a legal professional to determine if foreign qualification is necessary for your business.

Steps on How to Form Your LLC in Wyoming as a Non-resident

Step 1. Selecting Your Business Name (new or existing)

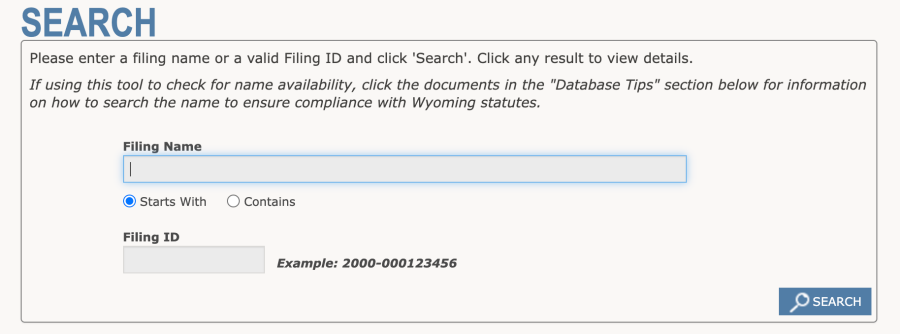

First, I would search the Wyoming Secretary of State’s business database to confirm your desired name is still available. This search ensures that the name you want is not already used by another entity, preventing potential legal issues and confusion.

Follow Wyoming’s naming guidelines, which typically include avoiding names that could be misleading or too similar to existing businesses.

Step 2. Appointing a Wyoming Registered Agent (I use Northwest)

As I highlighted earlier, a registered agent is a person or company that accepts legal documents on behalf of your business. As a non-resident, you are required to appoint a registered agent in Wyoming.

I use Northwest Registered Agent and highly recommend them.

Besides the fact that you can get started with them for as little as $39, they are reliable and provide consistent service, ensuring I never miss important legal documents or correspondence.

One key benefit I’ve found with Northwest is their privacy protection—they use their address instead of mine, keeping my personal information confidential.

Step 3. Sign up For Northwest Registered Agent

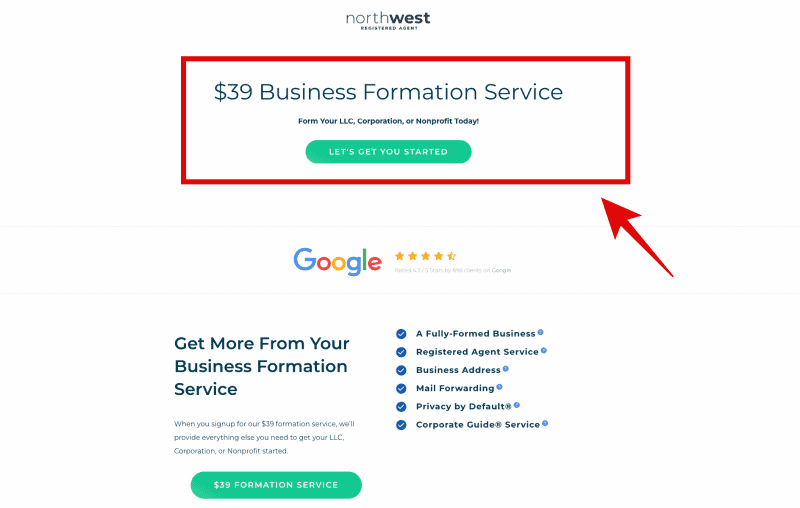

To sign up for Northwest Registered Agent, go to their website and click on the “LET’S GET YOU STARTED” button.

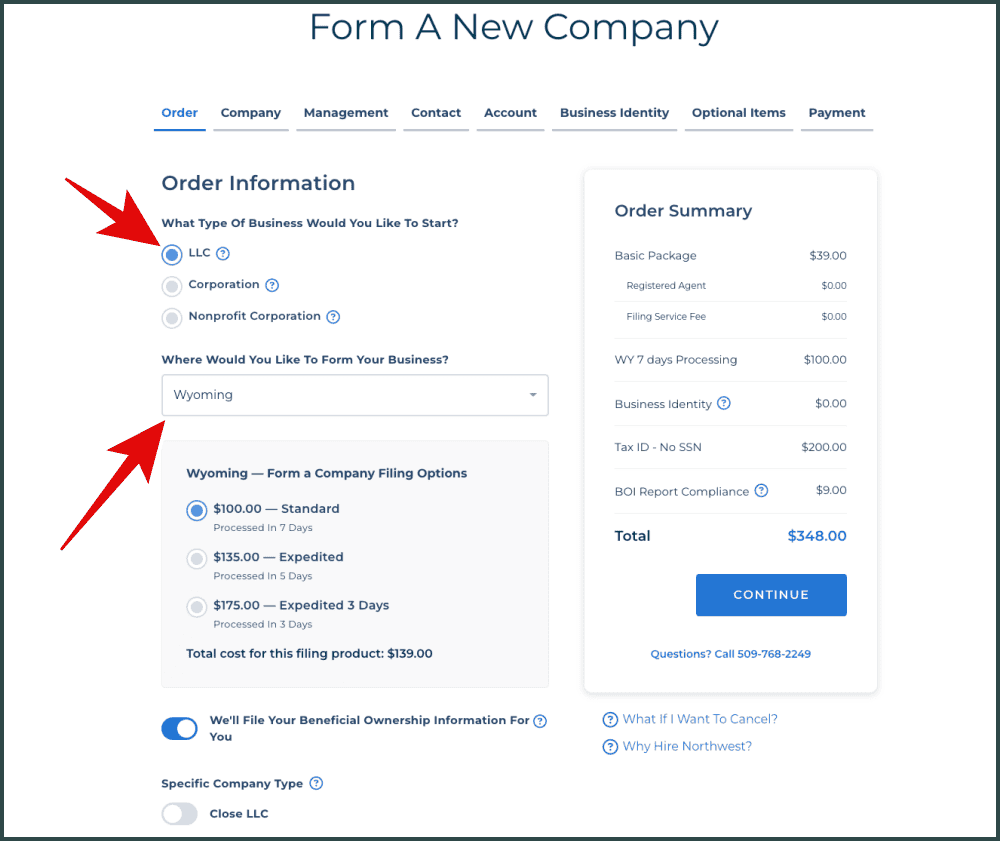

Choose your business entity as LLC and select Wyoming (of course!) as your preferred state.

Step 4. Enter Your New/Existing Company Details

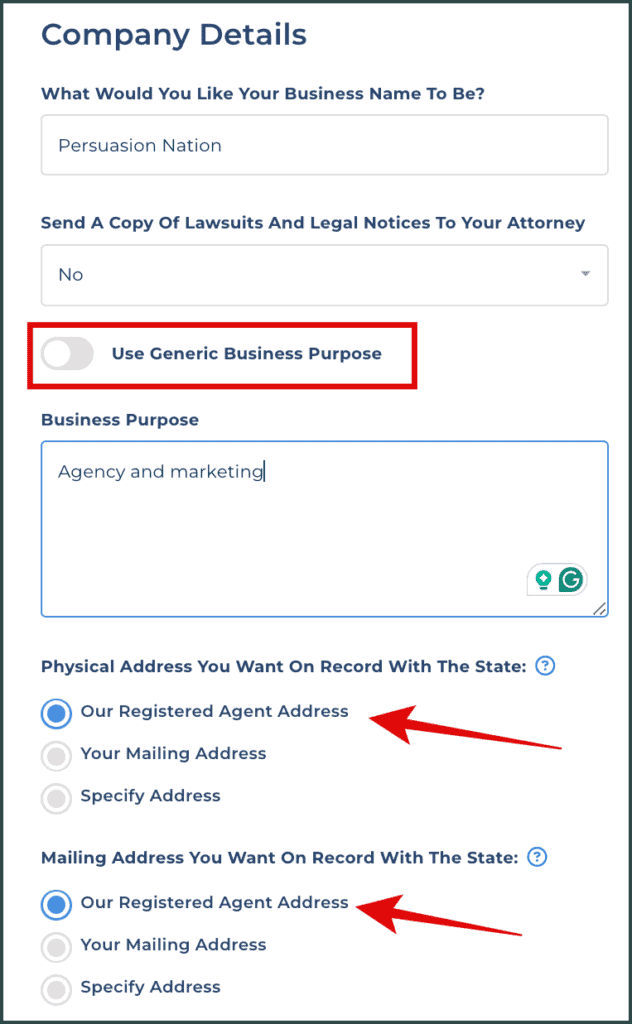

Enter your new or existing business details, including your company/business name, address, and other relevant information.

If unsure about your business purpose, simply toggle on the “Use Generic Business Purpose.”

You can also use Northwest Registered Agents and mailing addresses as your business address, eliminating the need for a separate US address.

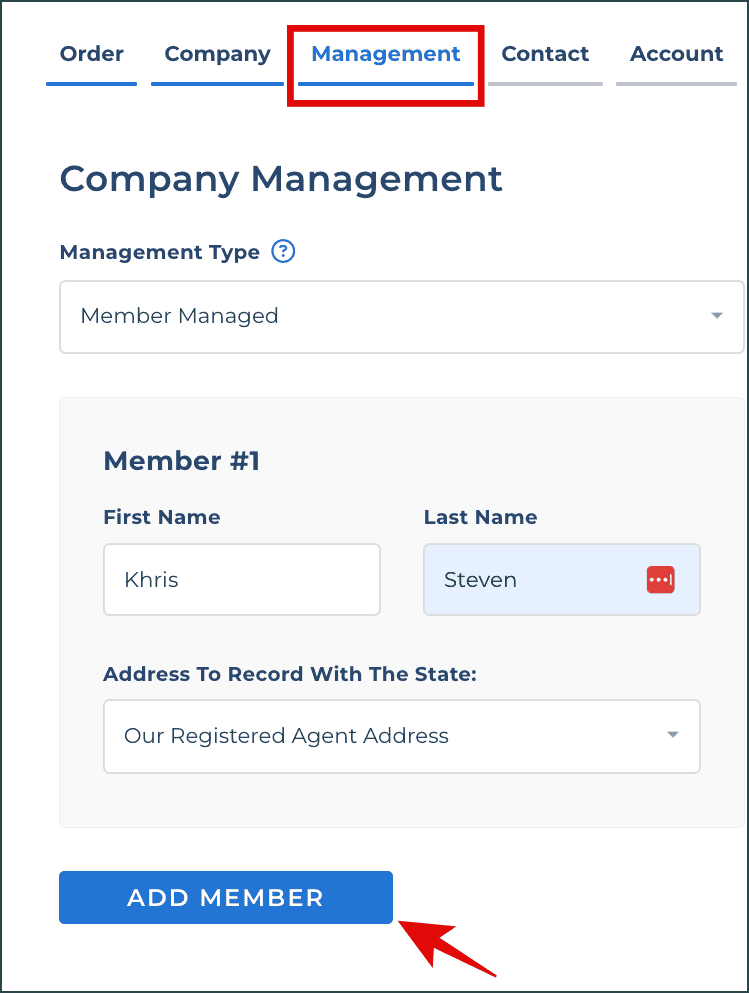

Step 5. Enter The Management For Your LLC

Enter the management information for your LLC, including the names and addresses of your managers and their roles in the company. If you are a single-member business, leave it at one member and enter your name.

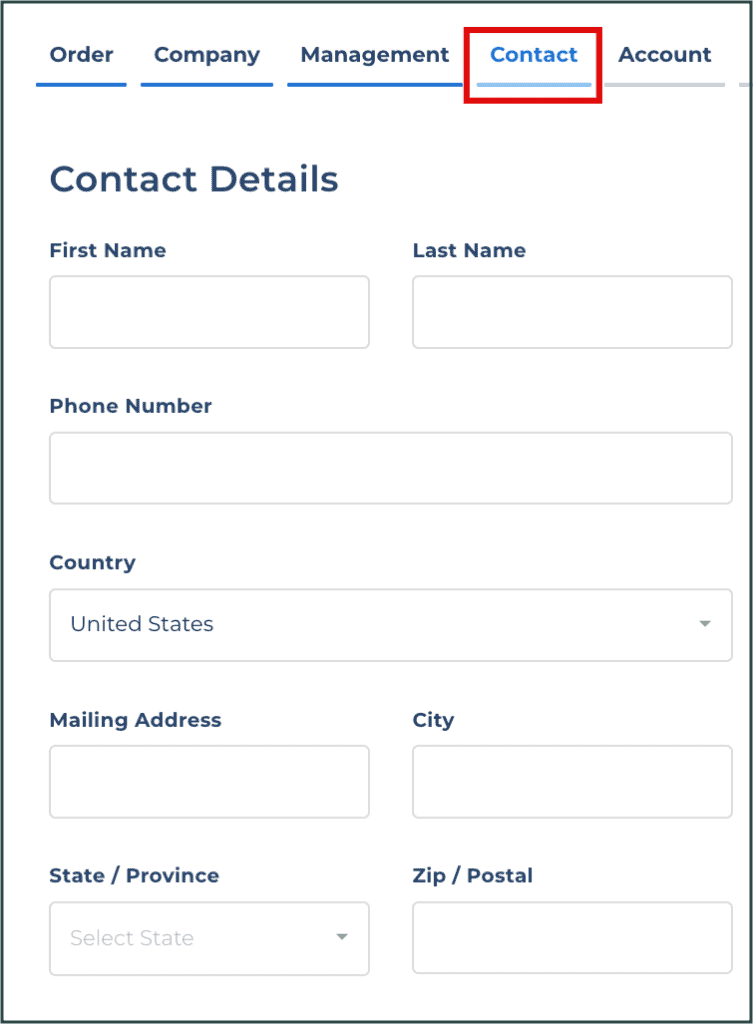

Step 6. Fill in Your Contact Details

Fill in your contact details, including your local foreign address, phone number, and email. You do not necessarily need a U.S. contact detail for your Northwest account creation.

These details will serve as your primary communication between you and Northwest, and NOT with Wyoming State. So, it is safe to use your local address.

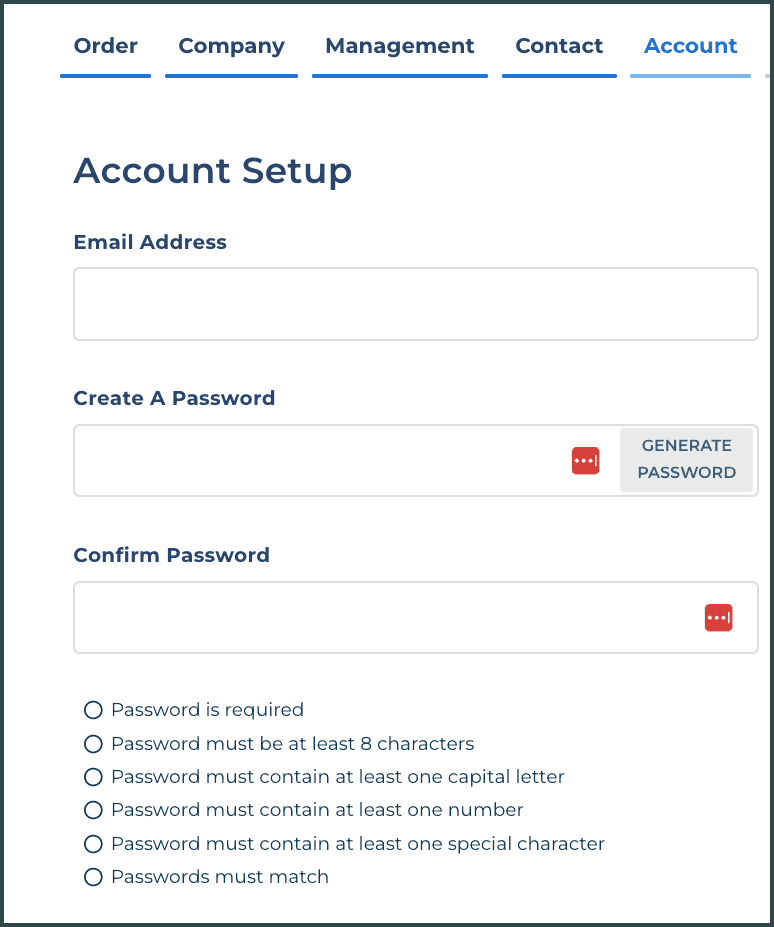

Step 7. Setup Your Account with Northwest Registered Agent

Set up your account with Northwest Registered Agent using your email and preferred password. This will allow you to access their services and complete the following steps to form your Wyoming LLC.

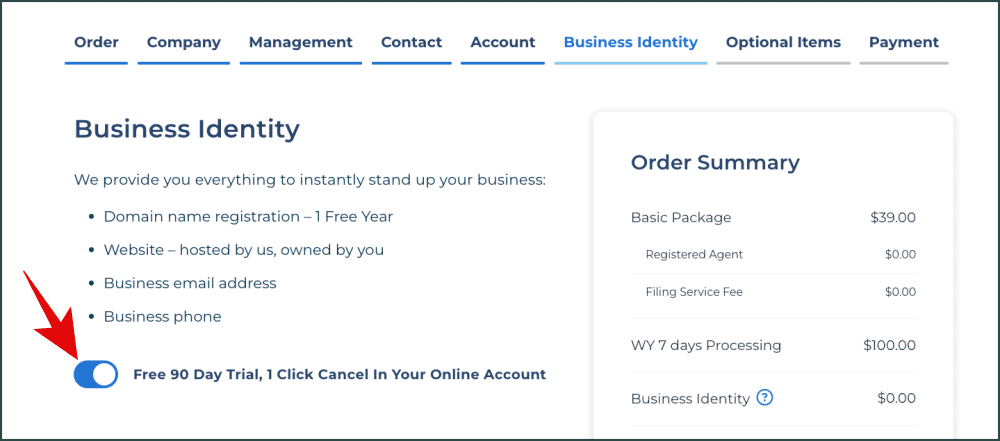

Step 8. Get Your Business Identity (optional)

You can add the Northwest Business Identity option for your LLC.

It includes the following, free for 90 days:

- Domain name registration – 1 Free Year

- Website – hosted by us, owned by you

- Business email address

- Business phone

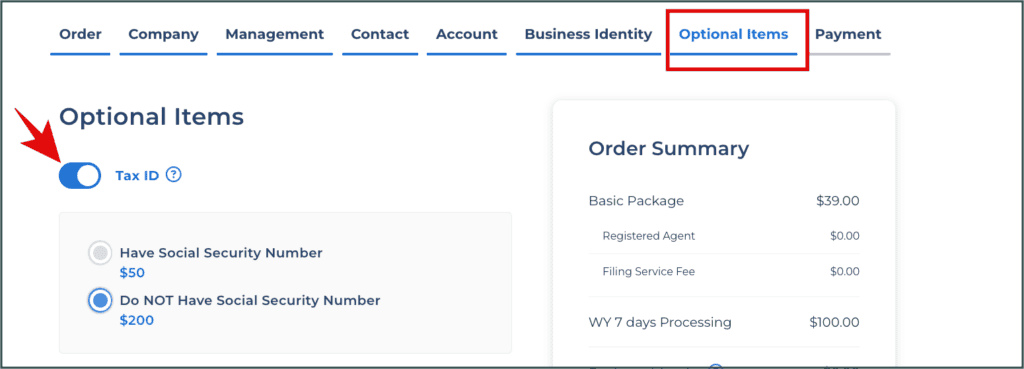

Step 9. Getting Your Tax ID or EIN – optional

If you want your LLC’s tax ID (EIN), you can obtain it through Northwest Registered Agent.

Just toggle on the “Tax ID” and select “Do NOT Have Social Security Number“.

They will help you complete and submit the necessary forms to the IRS. This is particularly beneficial if you lack a Social Security Number (SSN) or are a foreign entity. Northwest Registered Agent will obtain your EIN or Tax ID for a fee of $200.

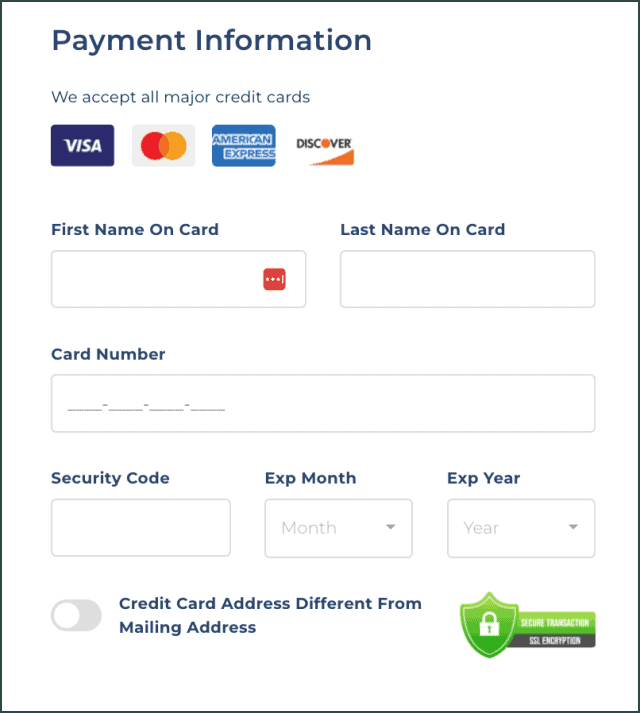

Step 10. Checkout/Payment (Congratulations!)

Once you’ve completed the previous steps, you can check and finalize your Wyoming LLC formation.

Enter your valid card information, then click Done!

Wyoming LLC Non-resident Benefits

As a non-resident, there are several benefits to forming an LLC in Wyoming.

Here are some of the most significant:

No State Income Tax

Wyoming does not impose a state income tax on individuals or corporations. As a non-resident, you will not be subject to state income tax on any income earned through your Wyoming LLC. This can lead to significant tax savings and is one of the main reasons Wyoming is a popular choice for entrepreneurs.

Strong Asset Protection

Wyoming offers strong legal protections for LLC owners, including charging order protection. This protection helps protect personal assets from business liabilities. This is particularly important for non-residents because protecting their assets in a foreign country can be challenging. Wyoming’s strong asset protection laws make it an attractive option for non-resident business owners.

Privacy

Wyoming allows for the formation of anonymous LLCs. Owners’ names are not required to be listed in public records, offering enhanced privacy. This particularly appeals to non-residents who may not want their personal information publicly available. The ability to form an anonymous LLC in Wyoming provides an additional layer of privacy protection.

Low Fees

Wyoming has relatively low filing and annual fees compared to other states, making it cost-effective to maintain an LLC in Wyoming. As a non-resident, keeping costs low is essential, and Wyoming’s low fees make it an attractive option.

No Citizenship Requirements

Wyoming does not require LLC owners or members to be U.S. citizens or residents. This makes it accessible for international entrepreneurs who want to form an LLC in the United States. As a non-resident, this is particularly important because it means you can form an LLC in Wyoming without having to become a U.S. citizen or resident.

Flexibility in Management

Wyoming allows for flexible management structures, including single-member LLCs and manager-managed LLCs. This flexibility is particularly appealing to non-residents who may want to have more control over their business operations.

Ease of Formation and Maintenance

Forming and maintaining an LLC in Wyoming is straightforward and can often be completed online. For non-residents, this is particularly important because it means you can form and maintain your LLC from abroad without having to travel to Wyoming.

Wyoming’s ease of formation and maintenance makes it an attractive option for Non-residents.

Perpetual Existence

Unless otherwise specified, a Wyoming LLC has perpetual existence, meaning it continues to exist even if the owner dies or leaves the company. This is particularly important for non-residents who may not be able to manage their LLC in person. Wyoming’s perpetual existence provision ensures that your LLC will continue to exist even if you can no longer manage it.

Series LLCs

Wyoming allows for the creation of Series LLCs, which can hold multiple assets or business ventures under a single LLC, each with separate liability protections. This particularly appeals to non-residents who want to have multiple business ventures under one LLC.

Business-friendly Environment

Wyoming is known for its business-friendly laws and regulations, making it a popular choice for entrepreneurs. This is particularly important for non-residents because it means they will have a supportive environment to operate their businesses.

No Business License Requirements

Wyoming does not require a state business license, though local licenses may apply. This particularly appeals to non-residents who want to keep costs low and avoid the hassle of obtaining a state business license.

Low Sales Tax

Wyoming has one of the lowest state sales tax rates in the U.S., which can benefit businesses that sell goods within the state. This is particularly important as a non-resident because it means you can keep your costs low and remain competitive.

Limited Reporting Requirements

The state has minimal reporting requirements, reducing the administrative burden on LLC owners. This is particularly important for non-residents because they will have fewer administrative tasks.

How Much Does it Cost in Total to Form an LLC in Wyoming as a Foreigner?

The total cost of forming an LLC in Wyoming as a non-resident includes the state filing fee, registered agent fee, and any additional services you choose.

The state filing fee is $100, and the registered agent fee is $125 per year. If you use Northwest Registered Agent, the initial cost to form your non-resident LLC is $148 (excluding an EIN/Tax ID). If you opt for an EIN, the total cost is $348, with the EIN service being a one-time fee.

Wyoming LLC Taxation/Taxes for Non-US Residents – How Does it Work?

One of the main advantages of forming a Wyoming LLC as a non-US resident is the favorable tax treatment. Wyoming has no income or franchise tax, making it an attractive option for LLC owners. Additionally, sales tax is lower than the national average at just 4%.

For US-sourced income, non-US residents will pay a flat income tax rate of 30% directly to the IRS.

However, Wyoming’s foreign income is not subject to taxation, which can result in significant tax savings for non-US residents.

It is important to note that limited liability companies in Wyoming must file an annual report with the Secretary of State and pay an annual report fee for Wyoming-based properties.

The annual report filing fee is only $60, which helps keep maintenance costs low for your LLC.

Non-US residents who have formed a Wyoming LLC must also obtain an Employer Identification Number (EIN) from the IRS. This number is used for tax filing purposes and is required for LLCs that have employees or are taxed as corporations.

Regarding tax filing, non-US residents who have formed a Wyoming LLC must file Form 1040-NR with the IRS for US-sourced income. LLCs that are taxed as a corporation will need to file Form 1120.

What’s The Best Bank for Non-US-residents?

When starting a Wyoming LLC as a non-resident, one of the most important things to consider is choosing the right bank to handle your business finances. As a non-US resident, you may face some challenges when opening a bank account in the United States. However, several banks cater to non-residents, making opening an account relatively easy.

One bank that stands out from the rest is Mercury.

Mercury is a digital bank that offers a range of services specifically designed for small businesses. Its straightforward account opening process can be completed entirely online, making it easy for non-US residents to open an account and manage their finances anywhere.

Mercury offers a range of features that make it an ideal choice for non-US residents.

They offer free ACH transfers, so you can easily transfer funds between Mercury and other US bank accounts. They also offer a debit card that can be used worldwide, making it easy to access your funds anywhere. Read my Mercury bank review here.

In addition to Mercury, several other banks are worth considering. Wise is a popular choice for non-US residents due to its low fees and ability to hold multiple currencies. Relay and Bluevine are also worth mentioning, offering various services designed specifically for small businesses.

Frequently Asked Questions

Can a non-resident open an LLC in Wyoming?

Yes, non-residents are eligible to form an LLC in Wyoming.

What are the steps for a non-resident to establish an LLC in Wyoming?

Establishing an LLC in Wyoming for a non-resident includes choosing a unique name, appointing a registered agent, filing Articles of Organization with the Wyoming Secretary of State, and obtaining any necessary licenses and permits.

Can I use a registered agent for my Wyoming LLC registration as a non-resident?

Yes, non-residents can use a registered agent for their Wyoming LLC registration.

What are the annual costs associated with maintaining a Wyoming LLC for non-residents?

The annual cost of maintaining a Wyoming LLC for non-residents is $60 for the state’s annual report (due on the first day of your LLC’s anniversary month). This fee must be paid annually based on the total value of your LLC’s assets.

Is a physical presence required in Wyoming to form an LLC as a non-resident?

No, a physical presence in Wyoming is not required to form an LLC as a non-resident.

What’s the best method to open a Wyoming LLC non-resident bank account?

Mercury is a popular option for non-resident Wyoming LLC owners looking to open a bank account.

What are the best states to form an LLC as a non-resident?

New Mexico, Wyoming, Delaware, and Nevada are often considered the best states to form an LLC as a non-resident due to their favorable tax laws and business-friendly regulations.

Can a non-resident Wyoming LLC owner hire employees in the US?

Yes, non-resident Wyoming LLC owners can hire employees in the US. However, they must comply with all federal and state employment laws and regulations.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.