Is Stripe Available in Kenya? (How to Open an Account)

Does Stripe Work in Kenya? Well, Stripe is not yet available in Kenya. However, there are still ways for Kenyan businesses to use Stripe to accept online payments.

Stripe is a popular payment gateway that offers a simple and secure way to accept payments from customers worldwide.

In this article, I’ll explore whether Stripe is currently available in Kenya and explain how to set up a Stripe account for your business in less than five minutes.

Key Takeaways

- While Stripe does not officially list Kenya as a supported country, you can still create an account by meeting specific requirements.

- The best option is to set up a US-based LLC and obtain an Employer Identification Number (EIN), allowing you to create a Stripe account.

- While this process may seem daunting, it’s quite straightforward and can be done online using Northwest’s registered agent service.

If you want to open a Stripe account in Kenya, follow this step-by-step guide.

Does Stripe Work In Kenya?

Stripe is currently supported in 46 countries, but Kenya is not one of them. To open a Stripe account in Kenya, you must have a business in any Stripe-supported country and provide basic information, such as your name, email address, and date of birth.

Stripe is not limited to any particular industry or business type, and it can be used by anyone who needs to process payments online.

Stripe account can be opened from Kenya by following these steps:

- Create/form an LLC in the United States (use Northwest)

- Visit the Stripe website and create an account.

- Enter your business information, including your name, address, and phone number.

- Provide your EIN (with the help of Northwest)

- Provide your tax ID and government-issued ID.

- Verify your email address and phone number.

- Add a bank account in Kenya, where Stripe supports processing payments.

- Start accepting payments.

Once you’ve opened a Stripe account in Kenya, you can receive payments from customers anywhere in the world via credit cards, debit cards, mobile payments, and many more.

Requirements To Open A Stripe Account In Kenya For Your Business

To open a Stripe account in Kenya, you must meet several requirements. These requirements include:

| Requirements | Where to Get |

|---|---|

| A Business Formation In The U.S (LLC) | Through a Registered Agent (Northwest) |

| Obtaining An Employer Identification Number (EIN) Or Tax ID | Through the IRS |

| A U.S Business Address | Through a Virtual Mailbox Service |

| A U.S Phone Number | Through a Virtual Phone Number Service |

| A U.S Bank Account (To Be Linked To Stripe For Payouts) | Use Wise or Mercury |

You must have a legal entity in the United States, such as an LLC, to open a Stripe account in Kenya. You can form an LLC through a registered agent who can assist you with registering your business in the United States.

You can open a Stripe account in Kenya and accept payments from customers worldwide by meeting these requirements.

Let’s delve in further.

1. A Business Formation In The U.S (LLC)

If you’re looking to create a Stripe account in Kenya, one of the first steps you’ll need to take is to form a business entity. One popular option is to form a Limited Liability Company (LLC) in the United States. Stripe requires businesses to be registered in a supported country to use their platform.

Forming an LLC has several benefits.

First, it provides personal liability protection for the business owners, meaning that their assets are separate from the business’s assets.

This can be important in case the business is sued or goes bankrupt.

An LLC is a flexible business structure that allows for pass-through taxation, meaning that the business’s profits and losses are reported on the owner’s tax returns. This can be a simpler and more cost-effective option than filing a separate business tax return.

There are several options for setting up an LLC, including doing it yourself, using an online formation service, or hiring a registered agent.

While doing it yourself may seem like the cheapest option, it can be time-consuming and result in errors that can cause problems. Using an online formation service can be an excellent middle ground, but navigating the process on your own can still be challenging.

The best option is to use a registered agent, such as Northwest Registered Agent. They can handle the paperwork and legal requirements of forming an LLC and provide ongoing support to ensure the business complies with state regulations.

2. Obtaining An Employer Identification Number (EIN) Or Tax ID

An EIN is a unique nine-digit number the Internal Revenue Service (IRS) assigns to identify your business entity for tax purposes.

Why is an EIN necessary for your LLC?

An EIN is necessary for your LLC because it helps to establish your legal identity. It’s like a social security number for your business. You’ll need an EIN to open a business bank account, file taxes, and hire employees. Stripe also requires an EIN to verify your business entity and comply with tax regulations.

How does an EIN work with your Stripe account?

When you sign up for a Stripe account, you must provide your EIN to verify your business entity. Stripe uses your EIN to comply with tax regulations and to report your transactions to the IRS. By providing your EIN, you can access all the features and benefits of Stripe, including accepting payments, managing subscriptions, and issuing refunds.

Best ways to go about getting an EIN after forming your LLC

There are several ways to obtain an EIN for your LLC. You can apply for an EIN through the IRS website, mail, fax, or phone. If you’re uncomfortable doing it yourself, you can use a registered agent to help you obtain an EIN.

Here are a few benefits of using a registered agent:

- They can help you prepare and file your EIN application.

- They can provide you with a physical address for your business.

- They can receive legal and tax documents on behalf of your LLC.

3. U.S Business Address

A non-resident business owner based in Kenya must have a U.S. business address to open a Stripe account. Stripe requires a physical address in the country where your business is registered.

You can consider renting a virtual mailbox to obtain a U.S. business address. This service provides you with a physical address in the U.S. that you can use for your business. You can receive mail and packages at this address, which will be forwarded to you in Kenya.

Another option is to use a mail forwarding service. This service receives your mail and packages at a U.S. address and then forwards them to your address in Kenya. With this option, you can use a U.S. address for your business without having to physically be in the country.

It is important to note that having a U.S. business address does not mean you must be physically present in the country. With the abovementioned options, you can easily obtain a U.S. business address as a non-resident business owner based in Kenya.

4. A U.S Phone Number

You need a U.S. phone number to create and verify a Stripe account in Kenya. Stripe requires a phone number that can receive text messages to verify your account.

Several apps and services make obtaining a U.S. phone number easy. For example, you can use Dingtone or Skype to get a U.S. phone number to receive text messages.

Once you have obtained a U.S. phone number, you can use it to verify your account during the Stripe account creation process. Stripe will send a verification code to your U.S. phone number, which you can enter into the Stripe website to complete the verification process.

5. U.S Bank Account (To Be Linked To Stripe For Payouts)

To receive payouts from Stripe, you must link a U.S. bank account to your Stripe account.

This is because Stripe only supports payouts to bank accounts in countries where it operates. Unfortunately, Stripe is unavailable in Kenya, so you must use a U.S. bank account to receive payouts.

There are different ways to get a U.S. bank account that you can link to Stripe for payouts.

One way is to use Wise, a borderless account that allows you to hold and manage money in multiple currencies. With Wise, you can get a U.S. bank account number and routing number that you can use to receive payouts from Stripe.

Another option is to use Payoneer, a global payment platform that allows you to receive payments from companies like Stripe. With Payoneer, you can get a U.S. bank account to link to Stripe for payouts.

Lastly, Mercury is a U.S. bank designed for startups and small businesses. With Mercury, you can get a U.S. bank account to receive payouts from Stripe. Mercury also provides other banking services tailored to startups and small businesses.

What’s the Best State to Form Your LLC as a Foreigner in Kenya?

The three most popular states are New Mexico, Delaware, and Wyoming. Each state has unique advantages for different types of companies.

Wyoming

Wyoming is a popular choice for non-US residents looking to form an LLC due to its low cost and low maintenance. It only costs around $150 to file an LLC and an annual report. Additionally, Wyoming does not have taxes at the corporate level, but you will still need to pay federal taxes. Wyoming could be a solid option if you are looking for a relatively low-cost and low-maintenance option.

Delaware

Delaware is a popular option if you think you will raise money from investors in the future.

Nearly 80% of US public companies choose to incorporate in Delaware. The major downside is the higher cost of filing and maintaining the company. However, the benefits of incorporating in Delaware include flexible business laws and a well-established legal system.

New Mexico

New Mexico is another attractive option because the filing costs are low, and you do not have to file an annual report.

It is also one of the few US states that does not require the member or manager’s name to be included in the certificate of formation filing. A $50 filing fee is required to register an LLC in New Mexico, but no annual report fees are required.

Understanding each state’s filing and maintenance requirements is essential before deciding. Some states, like California, have high franchise tax fees, which can burden small businesses.

Based on the benefits and drawbacks of each state, Wyoming is the recommended state for non-US residents looking to form an LLC. It is a low-cost option with a business-friendly environment, making it an attractive option for foreign entrepreneurs.

Steps On How To Form Your LLC & Open A Stripe Account

Here are the steps you need to follow to form your LLC and open a Stripe account:

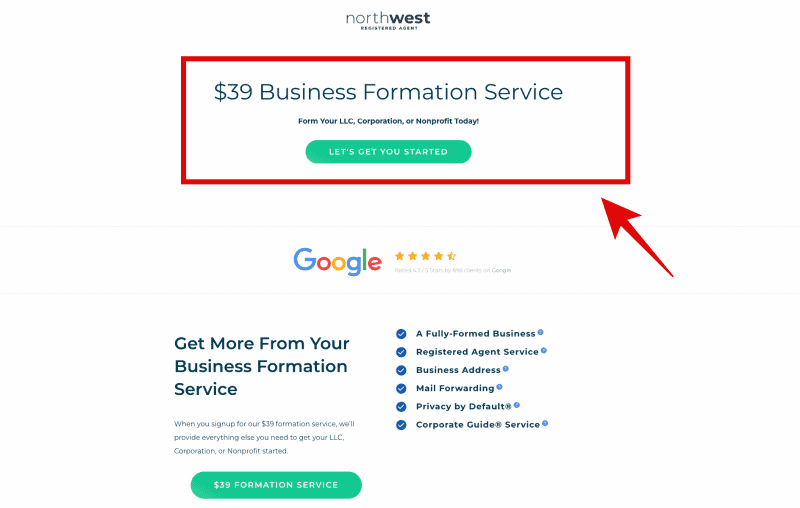

Step 1. Sign up For Northwest Registered Agent

The first step in forming your LLC is signing up with Northwest Registered Agent. This company will help you create your LLC and provide you with a registered agent, which is required by law.

You can sign up for their services on their website.

Go to https://www.northwestregisteredagent.com/

You’ll be directed to the page below. Click on the button – “LET’S GET YOU STARTED.”

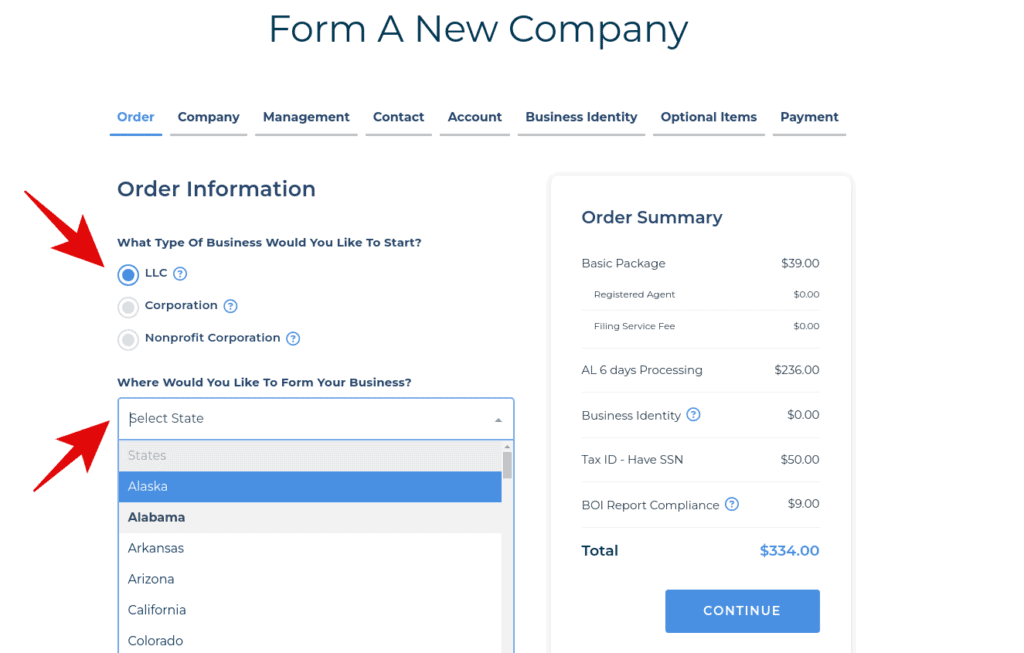

Step 2. Choose Your Business Entity and State

Once you click the button, you’ll be redirected to a page where you can choose your business entity and state.

You can choose from various business entities, including LLCs, corporations, and partnerships.

You’ll also need to select the state where you want to form your LLC.

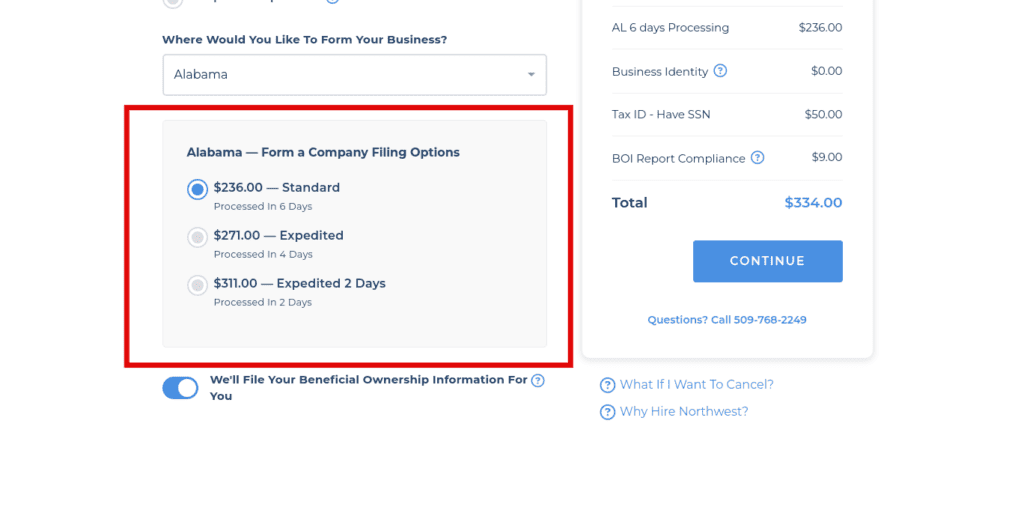

The state you choose and the processing time (Standard and Expedited) would determine the total amount.

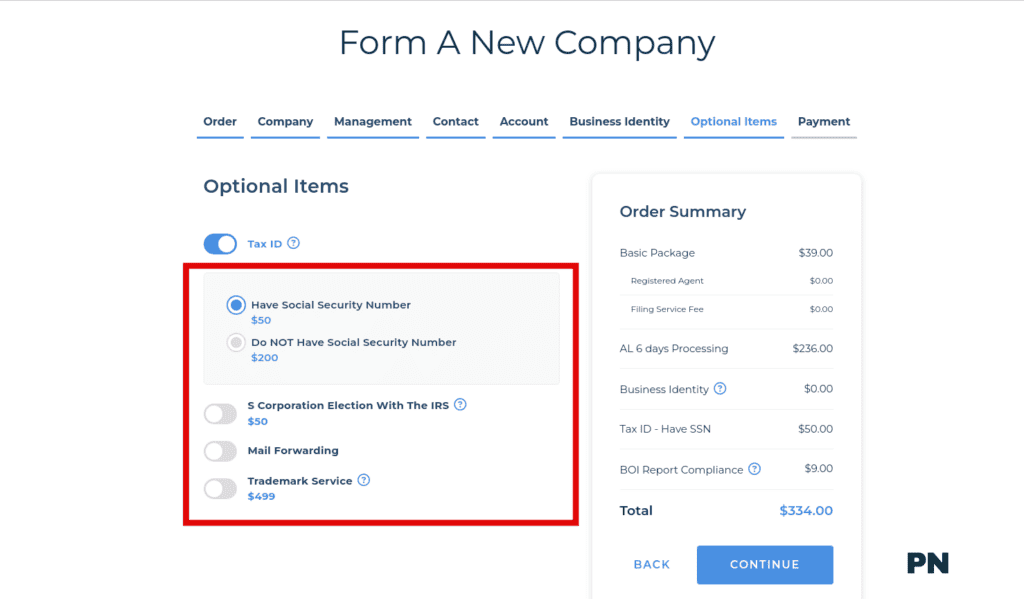

For instance, below is that of Alabama ($334):

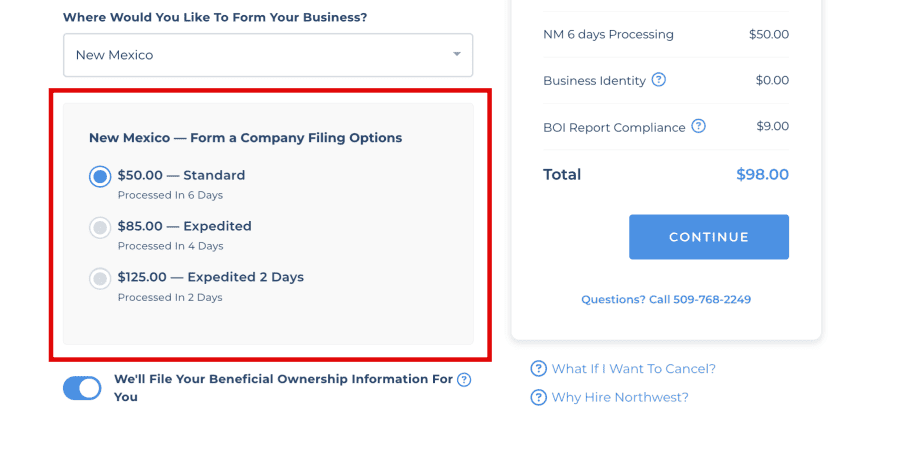

Here’s that of New Mexico ($98):

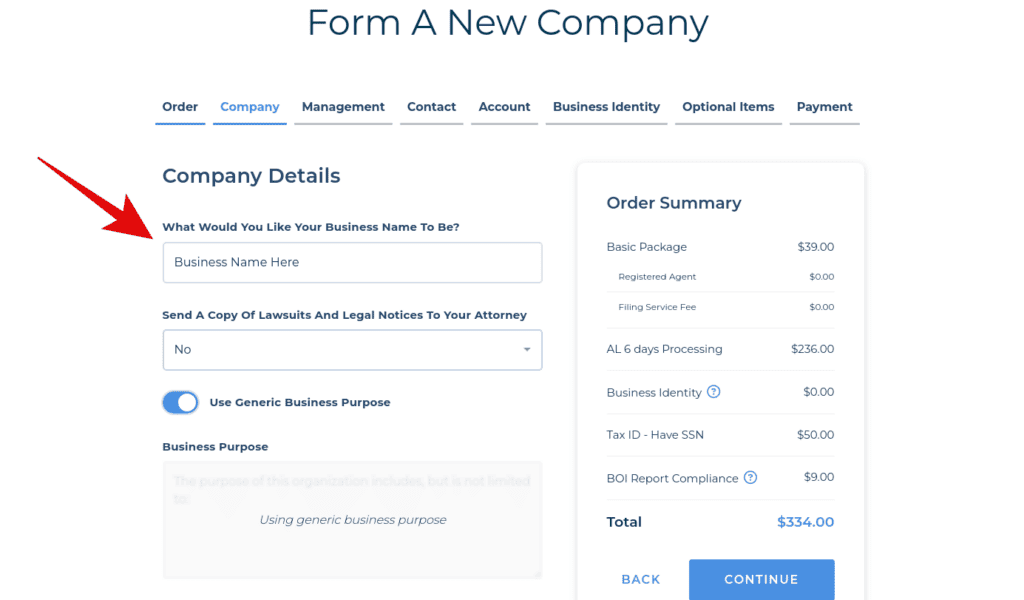

Step 3. Enter Your New/Existing Details

After you’ve chosen your business entity and state, you’ll need to enter your new or existing details. This includes your company name, address, and other relevant information.

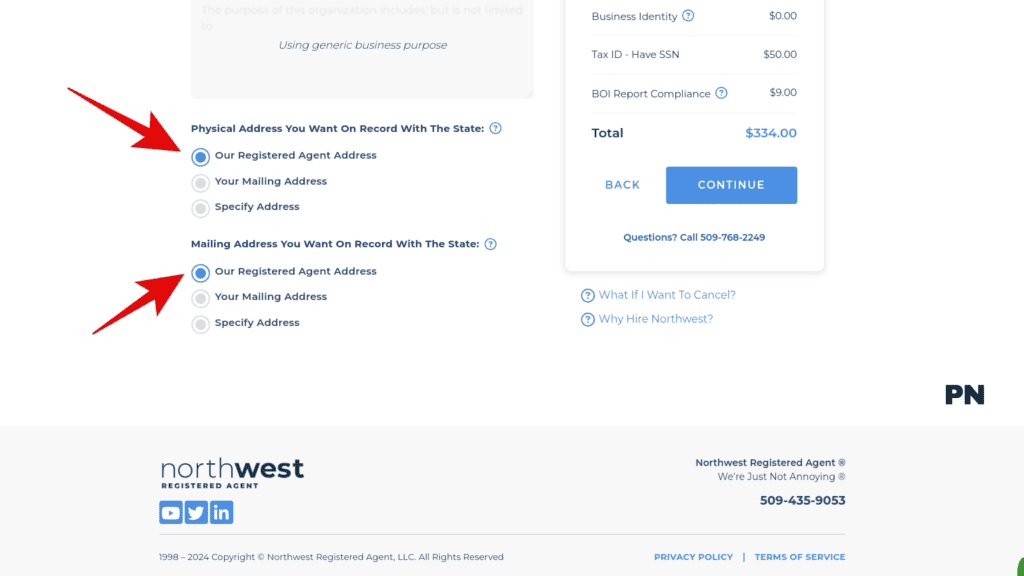

Choose the physical and mailing addresses you would like to use for the business:

The good thing about Northwest Registered Agents is that they offer the convenience of using their address as your business address, eliminating the need for a separate US address for your company.

Similarly, you can utilize their mailing services if you lack a mailing address option. If you require physical documents, you can include a US mailing address.

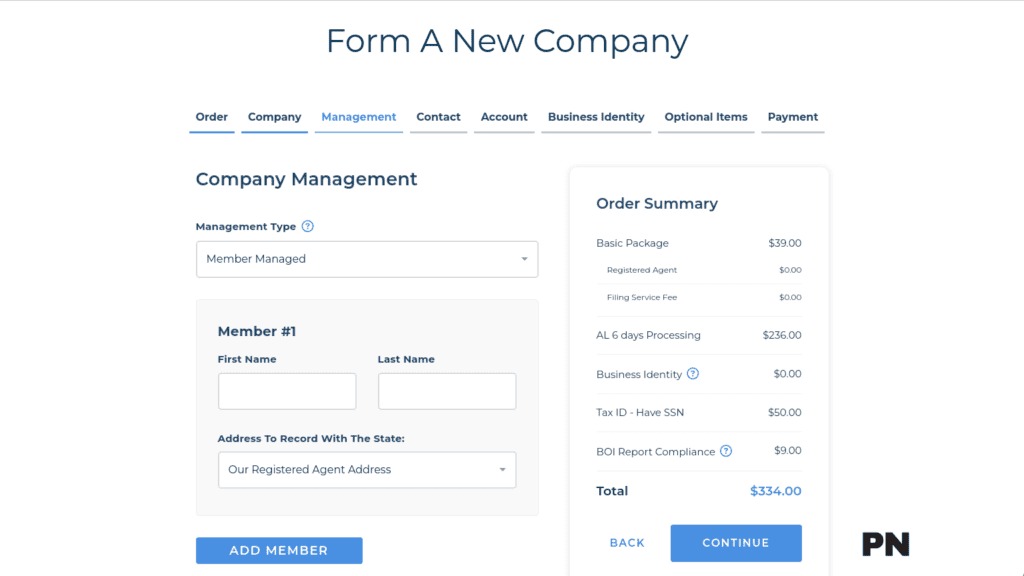

Step 4. Enter The Management For Your LLC

Next, you’ll need to enter the management information for your LLC. This includes the names and addresses of your managers and their roles in the company.

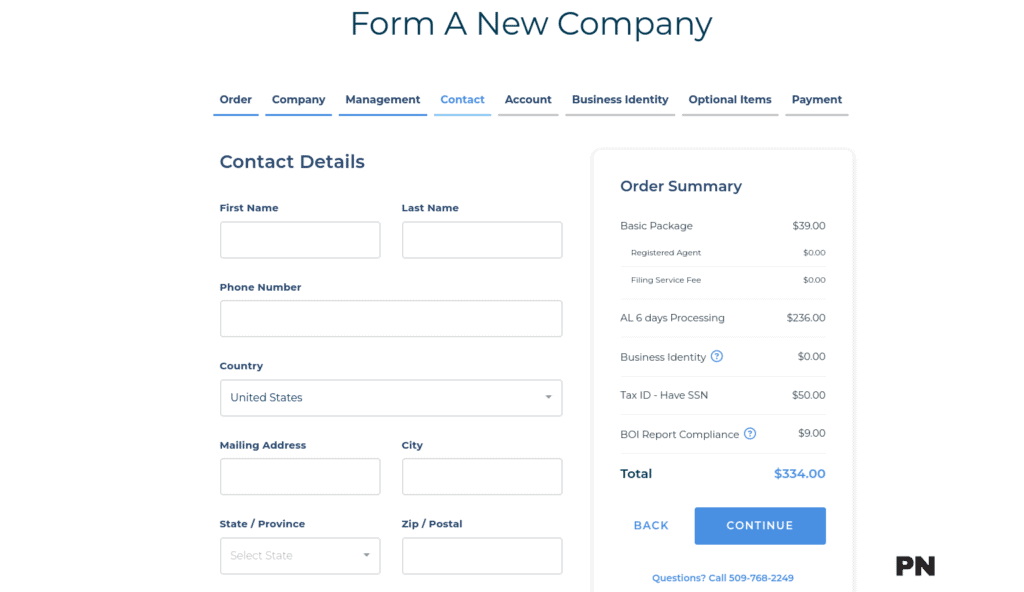

Step 5. Fill in Your Contact Details

This is where you fill in your contact details.

These details will serve as your primary means of contact with Northwest. They can include your local Kenya address, phone numbers, etc.

You do not necessarily need a U.S. contact detail for your Northwest account creation. You can use your local/current details as a point of contact with Northwest.

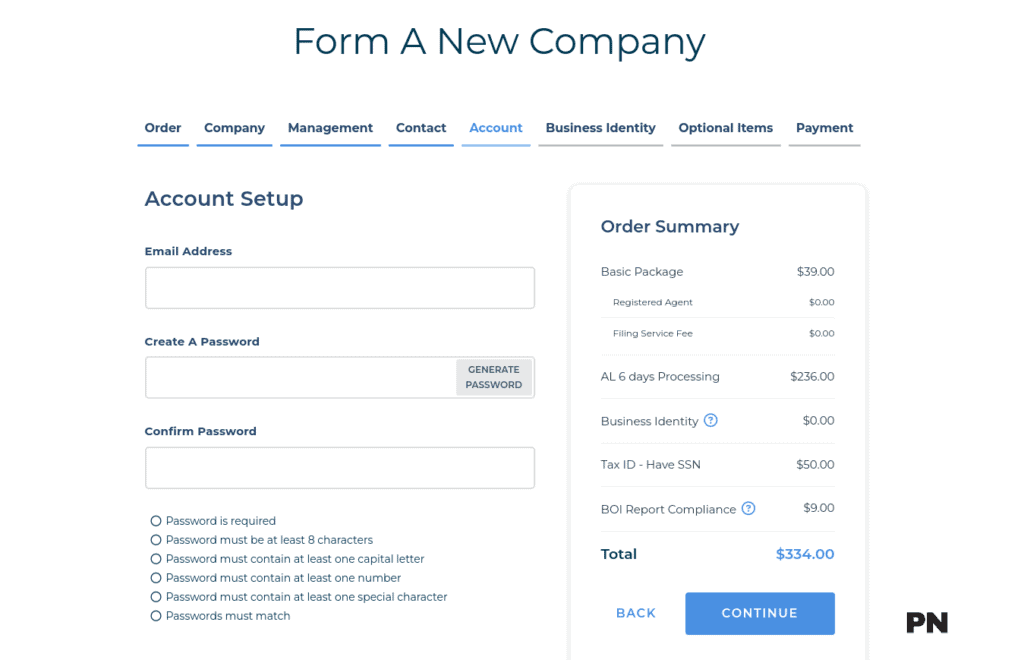

Step 6. Setup Your Account with Northwest Registered Agent

After entering all your information, you must set up your account with Northwest Registered Agent – using your email and preferred password. This will allow you to access their services and complete the following steps to form your LLC.

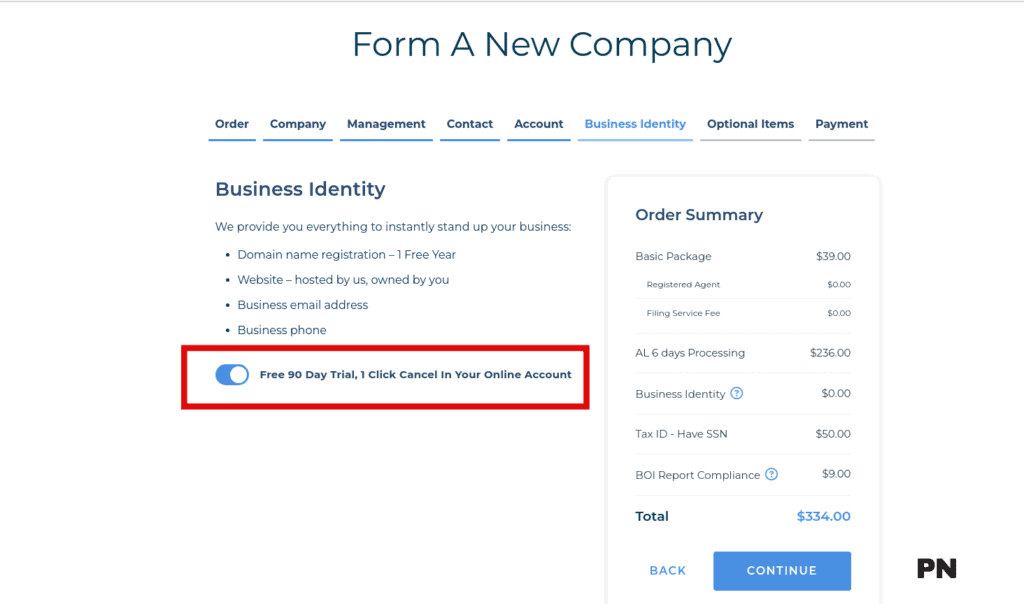

Step 7. Get Your Business Identity (optional)

You can add the Northwest Business Identity option for your LLC. It includes the following, free for 90 days: Domain name registration – 1 Free Year, Website – hosted by us, owned by you, Business email address, and Business phone.

Step 8. Getting Your Tax ID or EIN – optional

If you want your LLC’s tax ID (EIN), you can also do so through Northwest Registered Agent. They will help you complete and submit the necessary forms to the IRS and create a viable Stripe account.

It would be best to have an EIN as a foreigner or non-resident.

However, for a fee of $200, Northwest Registered Agent will obtain your EIN or Tax ID. This is particularly beneficial if you lack a Social Security Number (SSN) or are a foreign entity.

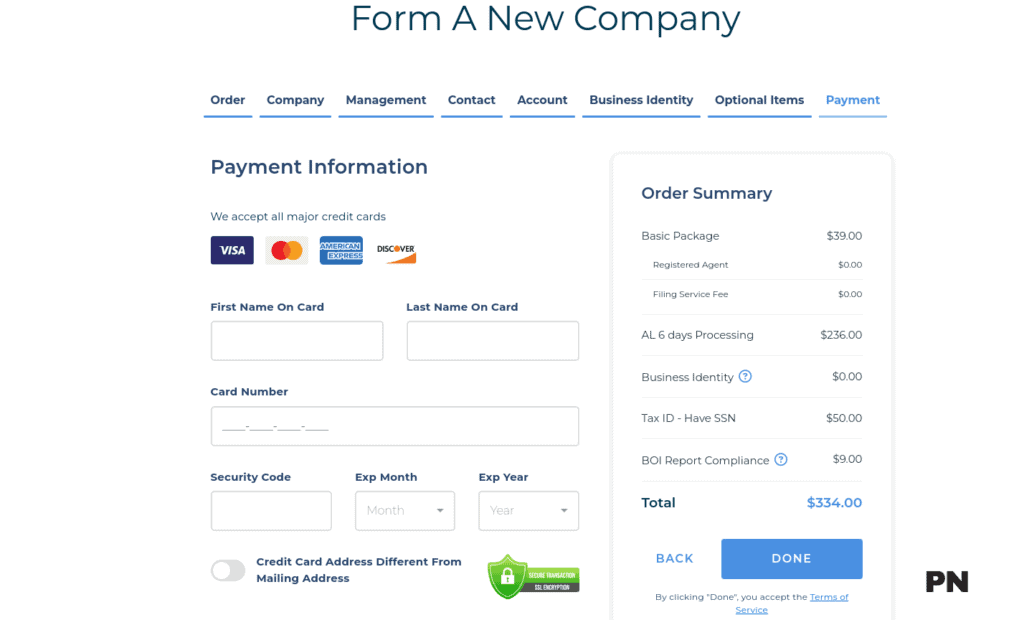

Step 9. Checkout/Payment (Congratulations!)

Once you’ve completed the previous steps, you can check and finalize your LLC formation.

Enter your valid card information, then click Done!

Congratulations—you’ve formed your LLC and are ready to open a Stripe account!

Finally, Create Your Stripe Account (With Your EIN & LLC Information)

If you have completed all the basic requirements to create a Stripe account, you are now ready to create one.

Basic Requirements

Before we begin, let’s review the basic requirements you need to create a Stripe account:

- A business name and email address

- A government-issued ID

- Your EIN (Employer Identification Number)

- Your LLC (Limited Liability Company) information

Make sure you have all of these requirements ready before proceeding.

Creating a Stripe Account Step-by-Step

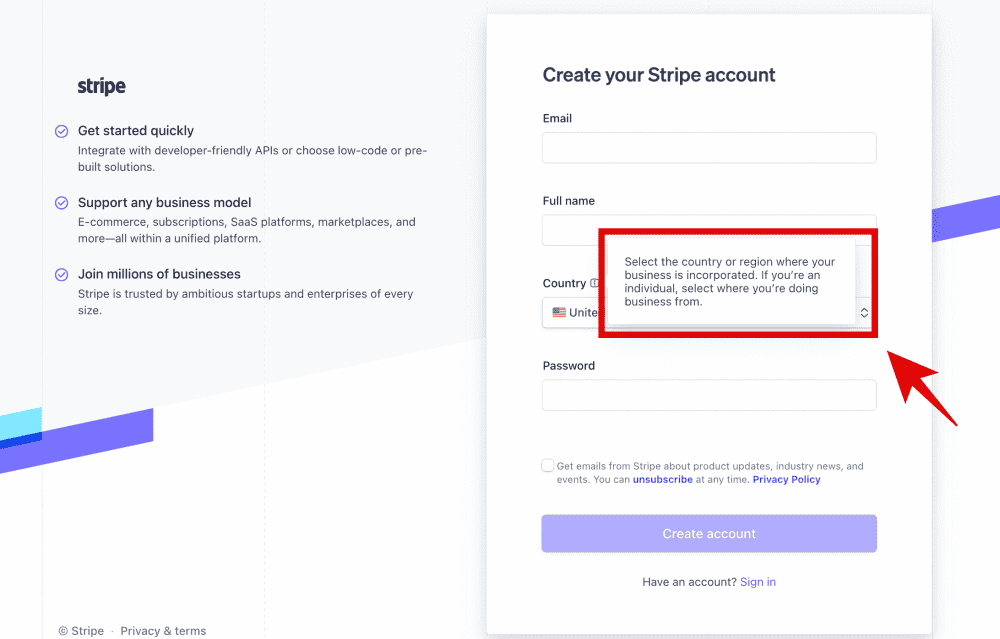

Step 1: Go to the Stripe website and click “Sign Up” in the top right corner.

Step 2: Fill in your email address and create a password. Click “Create your account”.

Step 3: Enter your business name and select your country. Click “Continue”.

Step 4: Enter your personal information, including your full name, date of birth, and government-issued ID. Click “Continue”.

Step 5: Enter your business information, including your EIN and LLC information. Click “Continue”.

Step 6: Review and accept the terms of service. Click “Authorize access to this account”.

Step 7: Congratulations! Your Stripe account is now created. You can now start accepting payments.

Please ensure the country you selected where your business is incorporated in the United States, not Kenya.

Why I Prefer Northwest Registered Agent For My LLC Formation?

Having used Northwest Registered Agent since 2020 to create my Florida LLC, I can confidently say it is one of the best registered agents.

Here are some reasons why I prefer Northwest Registered Agent for my LLC formation:

- Free one-year registered agent: Northwest Registered Agent offers a free one-year registered agent service when you hire them to form your LLC. This is a great value, as many other registered agents charge extra for this service.

- Free operating agreement: Northwest Registered Agent also provides a free operating agreement when you hire them to form your LLC. This important document outlines the ownership and management structure of your LLC.

- $39 to get started: Unlike other registered agents that charge over $1000, Northwest Registered Agent charges only $39. This is a great value, especially if you are starting and don’t have much money to invest in your business.

- Allows you to use one of its local offices as your business address: Northwest Registered Agent allows you to use one of its local offices as your business address. This is a great option if you don’t have a physical office or if you want to keep your home address private.

- Transparent pricing: Northwest Registered Agent has no annoying upsells and recurring monthly fees. Everything is optional, so you only pay for the services you need.

- Privacy by default: Northwest Registered Agent keeps your address off public record by default. This is important if you want to keep your personal information private.

- Free Domain, Website, Email & Business Phone: Northwest Registered Agent also provides a free domain, website, email, and business phone when you hire them to form your LLC. This is a great value and can save you a lot of money on these essential business tools.

What Are The Benefits Of Forming A US Limited Liability Company (LLC) For a Kenyan Stripe Account?

Here are some potential advantages:

Fulfilling Stripe’s Requirement

One of the main benefits of forming a US LLC is that it can fulfill Stripe’s requirement for opening an account. Stripe requires that all businesses have a legal business entity, such as an LLC or corporation, to open an account. By forming an LLC, you can meet this requirement and start accepting payments through Stripe.

Limited Liability Protection

Another benefit of forming an LLC is that it offers limited liability protection.

This means that the personal assets of the LLC’s members are protected from business-related debts and lawsuits. If your business were to face legal issues or debt, your personal assets would be shielded from any liability.

Tax Benefits

LLCs also offer some tax benefits. They are considered pass-through entities, which means that the profits and losses of the business are passed through to the individual members and reported on their personal tax returns. This can potentially result in lower taxes for the business and its members.

Flexibility

LLCs are also flexible in terms of management and ownership structure. They can be managed by the members themselves or by a designated manager. Additionally, ownership can be divided among multiple members or held by a single member.

Overall, forming a US LLC for your Kenyan Stripe account can have several potential benefits, including fulfilling Stripe’s requirements, providing limited liability protection, offering tax benefits, and allowing for flexibility in management and ownership structure.

Alternative Payment Solutions for Kenyan Businesses

In this section, we’ll compare Stripe with other gateways and explore local payment options.

Comparing Stripe with Other Gateways

PayPal and Payoneer are two of the most popular payment gateways used in Kenya.

Both offer similar features to Stripe, including the ability to accept payments from customers around the world. However, PayPal and Payoneer charge higher transaction fees compared to Stripe.

PayPal charges a transaction fee of 4.4% + $0.30 for international transactions, while Payoneer charges a fee of 3% for receiving payments. Stripe, on the other hand, charges a transaction fee of 2.9% + $0.30 for international transactions.

If you’re looking for a payment gateway that offers lower transaction fees and worldwide acceptance, Stripe is the best option.

Local Payment Options

M-Pesa is a popular mobile payment service used in Kenya. It allows users to transfer money, pay bills, and buy goods and services using their mobile phones. M-Pesa is widely accepted in Kenya and is a convenient payment option for Kenyan customers.

PesaPal is another payment gateway that is popular in Kenya. It supports various payment methods, including credit cards, mobile money, and bank transfers. PesaPal’s online transactions are secure, convenient, and accessible to all.

If you’re a Kenyan business owner looking for a local payment option, M-Pesa and PesaPal are great choices.

Frequently Asked Questions

How Do I Use Stripe In Kenya?

If you are a Kenyan business owner and want to use Stripe, you will need to form a Limited Liability Company (LLC) in the United States. Once you have formed an LLC, you can use your EIN to register for a Stripe account.

What are the requirements for setting up a Stripe account in Kenya?

To set up a Stripe account in Kenya, you must have a valid email address, a business website, and a bank account. You will also need to provide your business information, including your business name and address.

How can I obtain an Employer Identification Number (EIN) as a Kenyan resident?

As a Kenyan resident, you can obtain an EIN by filling out an IRS Form SS-4. You will need to provide your personal information, including your name, address, and social security number. You will also need to provide information about your business, including your business name and address.

Are there any limitations to using Stripe for Kenyan businesses?

Stripe is available in Kenya, but there may be some limitations to using the platform. For example, Kenyan businesses may not be able to use certain features of Stripe, such as the ability to accept payments in multiple currencies.

How does Stripe handle currency conversion for Kenyan users?

Stripe handles currency conversion for Kenyan users by automatically converting payments into the local currency. This means that if you receive a payment in a foreign currency, Stripe will automatically convert it into Kenyan shillings.

How can I integrate Stripe with M-Pesa for my business?

Unfortunately, it is not currently possible to integrate Stripe with M-Pesa for Kenyan businesses. However, Stripe does offer other payment options that may be suitable for your business needs.

Final Thoughts on Stripe Account Set up in Kenya

In conclusion, opening a Stripe account in Kenya is possible and straightforward. However, it requires a few additional steps compared to opening an account in the US.

To open a Stripe account in Kenya, you will need to have a business formation in the US, such as an LLC, and obtain an Employer Identification Number (EIN) or Tax ID. You will also need a US business address, a US phone number, and a US bank account to be linked to Stripe for payouts.

If you don’t have a US business address, you can use a registered agent service like Northwest to provide you with a physical address in the US.

Once you have all the necessary information, you can proceed to create a Stripe account and verify your personal details. Stripe is considered a highly secure payment platform for online transactions in Kenya, implementing advanced security measures to protect sensitive data and transactions.

By following the detailed steps provided in this article and leveraging Paystack for your business operations in Kenya, you can effortlessly open a Stripe account in Kenya and set the stage for a seamless online payment experience.

Remember to always keep your personal and business information up to date and accurate. If you encounter any issues during the account set up process, don’t hesitate to contact Stripe’s customer support for assistance.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.