How to Create a Stripe Account for Non-US Residents & Non-Supported Countries: A Step-by-Step Guide

Creating a Stripe account is essential for businesses that want to accept online payments. However, the process can be challenging for non-US residents and businesses in non-supported countries.

Fortunately, it is possible to create a Stripe account in these circumstances.

This guide will teach you how to create a Stripe account for non-US residents and non-supported countries.

Key Takeaways

- To open a Stripe account as a non-US resident, you’ll need to follow a few steps.

- First, you’ll need to form a business in the US, such as an LLC.

- Then, you’ll need to obtain an Employer Identification Number (EIN) or Tax ID, a US business address, a US phone number, and a US bank account to link to Stripe for payouts.

- Once you have all this information, you can create your Stripe account and use its services.

- The easiest way to go about these is to use Northwest’s registered agent service.

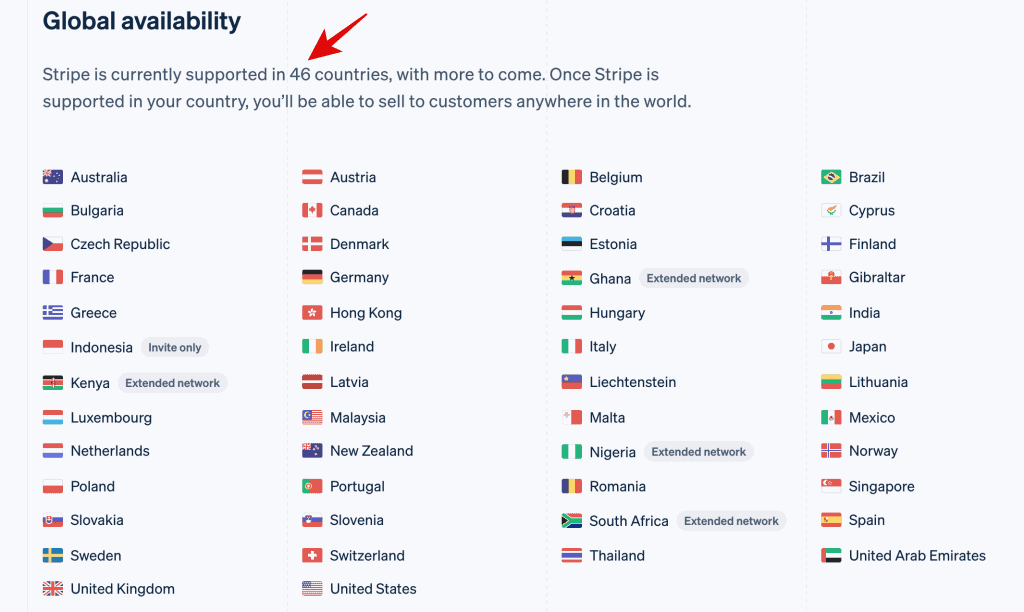

Understanding Stripe and Its Global Availability

If you are a non-US resident or your country is not currently supported by Stripe, you may wonder if creating a Stripe account and accepting payments globally without limitations is still possible.

The good news is that Stripe is constantly expanding its global availability and is currently supported in 46 countries, with more to come.

Once Stripe is supported in your country, you can sell to customers worldwide.

Stripe supports over 135 currencies, so you can easily accept customer payments in their local currency. Stripe also provides multilingual support, making communicating with your customers in their preferred language easy.

However, if Stripe does not support your country, you may still be able to create an account. Stripe allows non-US residents to create an account.

However, this is only possible after establishing a business entity in the United States (or a Stripe-supported country). All is possible with the help of a Northwest registered agent.

More on this pretty soon.

Requirements To Open A Stripe Account For Non-US Residents

As a non-US resident, opening a Stripe account can be challenging, but it’s possible.

Here are the requirements you need to fulfill to open a Stripe account:

| Requirements | Where to Get |

|---|---|

| Business Formation/LLC | Registered Agent (Northwest) |

| Employer Identification Number (EIN) or Tax ID | IRS (through Northwest) |

| US Business Address | Virtual Mailbox |

| US Phone Number | Virtual Phone Number Provider |

| US Bank Account | Use Wise or Mercury |

The primary focus lies in establishing an LLC within the US as a U.S. non-resident to acquire your Employer Identification Number (EIN). After securing your EIN, then setting up your Stripe account becomes effortless. The best part about this entire process is that with the help of Northwest Registered Agent service, you can fulfill all these requirements within a mere 24 hours.

Lets dive in deeper into each of these requirements and why they matter.

1. A Business Formation/Entity In The U.S (LLC)

Creating a Stripe account can be challenging if you are a non-US resident or live in a non-supported country.

However, forming a Limited Liability Company (LLC) in the United States can make the process easier. An LLC is a legal entity providing personal liability protection and flexibility in taxation and management.

One of the main benefits of forming an LLC is that it provides a separate legal entity for your business.

This means that your assets will be protected from any business liabilities.

Additionally, an LLC is a pass-through tax entity, which means that the profits and losses of the business will be passed through to the individual members and reported on their tax returns. This can potentially lead to lower tax rates for the business.

To set up an LLC, you must choose a state to register your business.

Each state has different requirements and fees, so it’s important to research available options. You will also need to file organizational articles, which outline your business’s structure and purpose.

One important aspect of forming an LLC is choosing a registered agent.

A registered agent is a person or company designated to receive legal documents and other important information on behalf of your business. Using a registered agent, such as Northwest Registered Agent, can provide additional benefits like privacy and convenience.

2. Obtaining An Employer Identification Number (EIN) Or Tax ID

If you are a non-US resident or your country is not supported by Stripe, you must obtain an EIN or Tax ID to create a Stripe account for your LLC.

An EIN is a unique nine-digit number issued by the Internal Revenue Service (IRS) to identify your business for tax purposes. It is necessary for LLCs because it separates your personal and business finances and requires you to open a business bank account.

An EIN is also necessary to create a Stripe account because Stripe is a US-based company and requires US tax identification numbers.

You can apply online through the IRS website, by mail, fax, or phone to obtain an EIN. You must provide information about your LLC, such as the name, address, and type of business.

There are several benefits to obtaining an EIN for your LLC.

First, it separates your personal and business finances, which can protect your assets in case of legal issues or debts.

Second, opening a business bank account is necessary, as it can help you manage your finances more effectively. Third, you must create a Stripe account to expand your business’s reach and increase your revenue.

3. U.S Business Address

As a non-US resident, having a U.S. business address is crucial for creating a Stripe account. Stripe requires a physical address in the United States to verify your business.

You can obtain a U.S business address as a non-resident in several ways.

One option is to use a mail forwarding service. This service provides you with a U.S address that you can use for your business. The service will receive your mail and forward it to your actual address.

This way, you can receive important documents and correspondence from Stripe and other U.S.-based companies.

Another option is to use a virtual office service. This service provides you with a physical address in the United States and other business services such as mail forwarding, phone answering, and meeting room rental.

This option may be more expensive than a mail forwarding service, but it gives you a more professional image.

4. A U.S Phone Number

To create and verify your Stripe account as a non-US resident, you will need a U.S phone number. Stripe requires a phone number associated with the country where your business is registered.

Having a U.S phone number will enable you to receive verification codes and other important information from Stripe.

Without a U.S phone number, you may not be able to complete the verification process and start using your Stripe account.

Fortunately, obtaining a U.S phone number is easy and affordable.

Many apps and services allow you to get a U.S phone number from anywhere in the world. Some popular options include Dingtone and Skype.

With Dingtone, you can get a U.S phone number for free by downloading the app and completing a quick registration process. Once you have your U.S phone number, you can use it to verify your Stripe account and start accepting payments.

Similarly, Skype also offers U.S phone numbers for a small fee. With a Skype U.S phone number, you can receive calls and messages like a regular phone. This makes it a great option for non-US residents who need a U.S phone number for their Stripe account.

5. U.S Bank Account (To Be Linked To Stripe For Payouts)

If you’re a non-US resident or living in a non-supported country, you’ll need a U.S bank account to link to your Stripe account for payouts.

This is because Stripe only supports payouts to bank accounts in countries where it operates.

There are several ways to get a U.S bank account, including Wise, Payoneer, and Mercury. Wise (formerly TransferWise) is an online platform that allows you to open a U.S bank account remotely.

Payoneer is another option that provides a U.S bank account and a Mastercard debit card.

Mercury is a U.S bank that offers free business checking accounts for startups and small businesses.

When choosing a U.S bank account provider, make sure to consider the fees, features, and requirements. Some providers may require a certain minimum balance or charge fees for transactions or transfers. It’s important to read the terms and conditions carefully before opening an account.

Once you have a U.S bank account, you can link it to your Stripe account for payouts.

Stripe supports various types of bank accounts, including traditional accounts offered by established financial institutions and virtual bank accounts such as Wise, Revolut, and N26.

What’s the Best State to Form Your LLC in as a Non-US residents?

New Mexico, Nevada, Delaware, and Wyoming are the three most popular states. Each state has unique advantages for different types of companies.

New Mexico

New Mexico is one of the few states that does not require the member or manager’s name to be included in the filing of the certificate of formation.

This makes it an attractive state for those who value privacy. Additionally, the filing fee for registering an LLC in New Mexico is only $50, and no annual report fees are required.

Nevada

Nevada is known for having a business-friendly environment, with no corporate, franchise, or personal income tax. Additionally, no annual report fees are required. However, the initial filing fee for registering an LLC in Nevada is $425.

Delaware

Delaware is often considered the best state to form an LLC due to its well-established legal system and business-friendly environment. It is also home to many large corporations. However, Delaware has a higher initial filing fee of $90 and requires an annual franchise tax.

Wyoming

Wyoming is a popular state for forming an LLC due to its low taxes and business-friendly environment. It has no state income tax, franchise tax, or personal property tax. Additionally, the annual fee for LLCs in Wyoming is only $60. This makes it an attractive option for non-US residents looking to form an LLC.

It’s worth noting that California is not a recommended state for non-US residents looking to form an LLC. California has high taxes and strict regulations, making it difficult for new businesses to thrive.

Steps On How To Form Your LLC & Open A Stripe Account

Here are the steps to follow:

Step 1. Sign up For Northwest Registered Agent

The first step is to sign up for Northwest Registered Agent, a registered agent service that can help you form your LLC.

Northwest Registered Agent can act as your registered agent and assist you in filing your articles of organization.

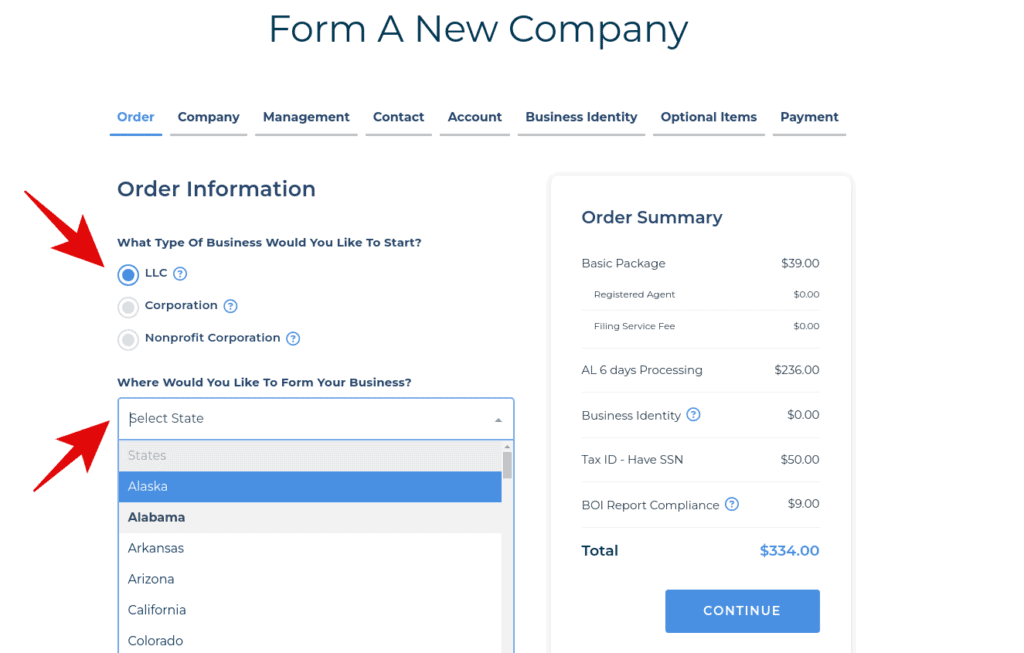

Step 2. Choose Your Business Entity and State

When forming an LLC, you must choose your business entity and state.

You’ll also need to select the state where you want to form your LLC.

The state you choose and the processing time (Standard and Expedited) would determine the total amount.

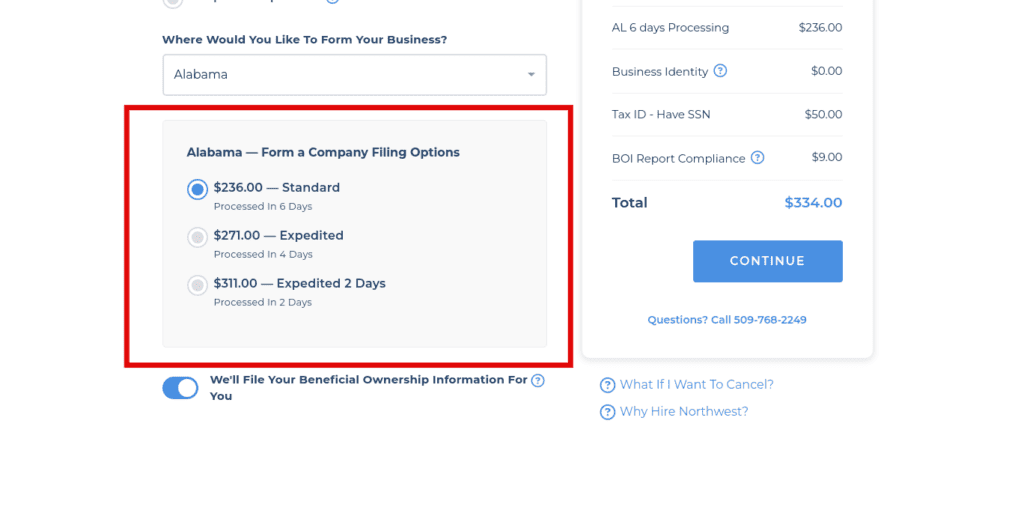

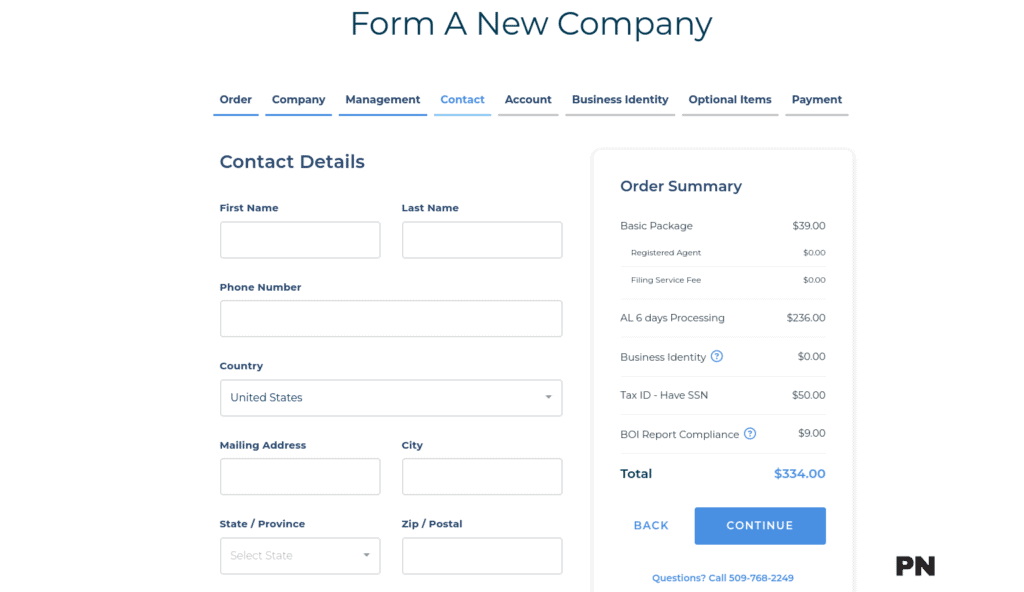

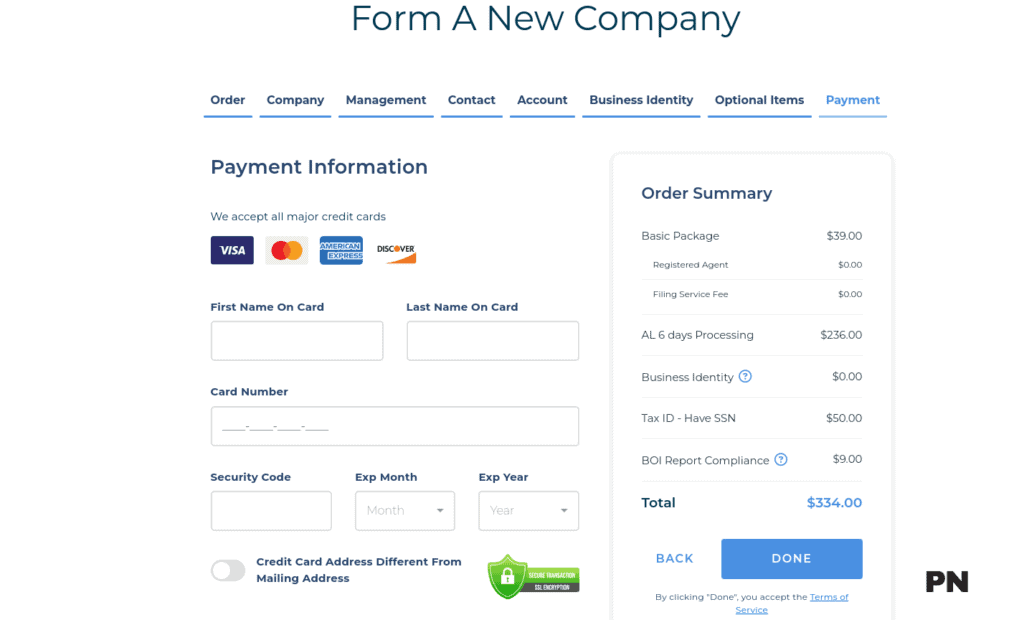

For instance, below is that of Alabama ($334):

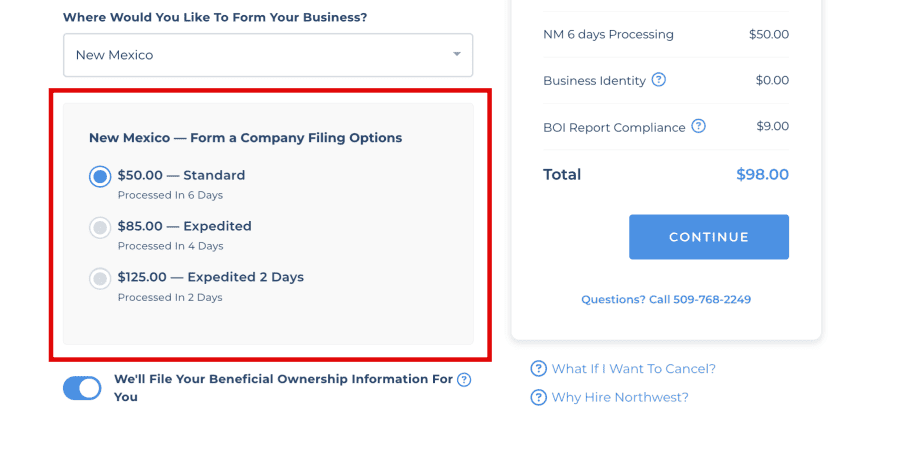

Here’s that of New Mexico ($98):

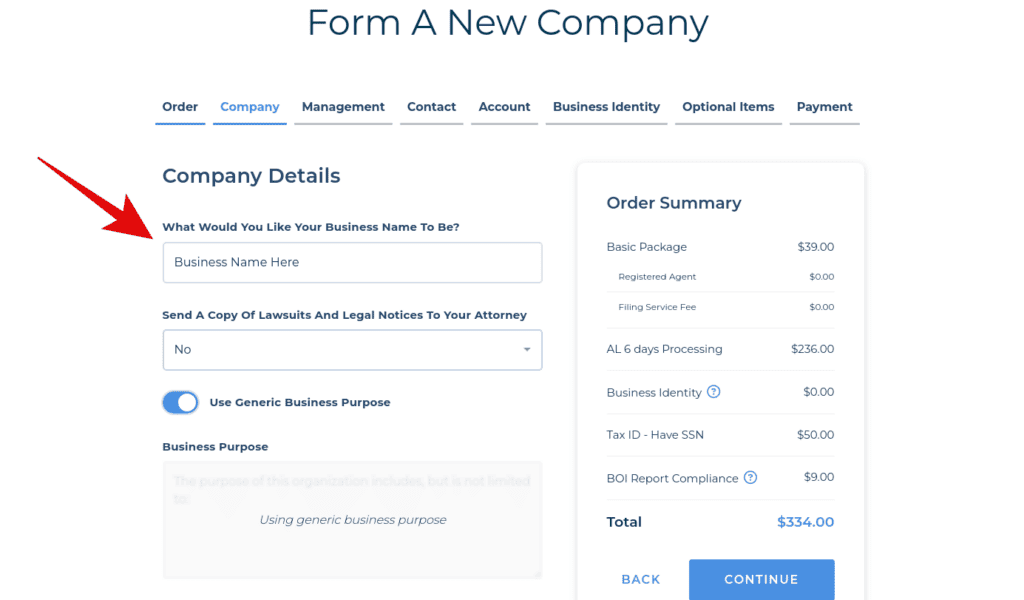

Step 3. Enter Your New/Existing Details

After selecting your business entity and state, you’ll need to enter your new or existing details, including your name, address, and other essential information.

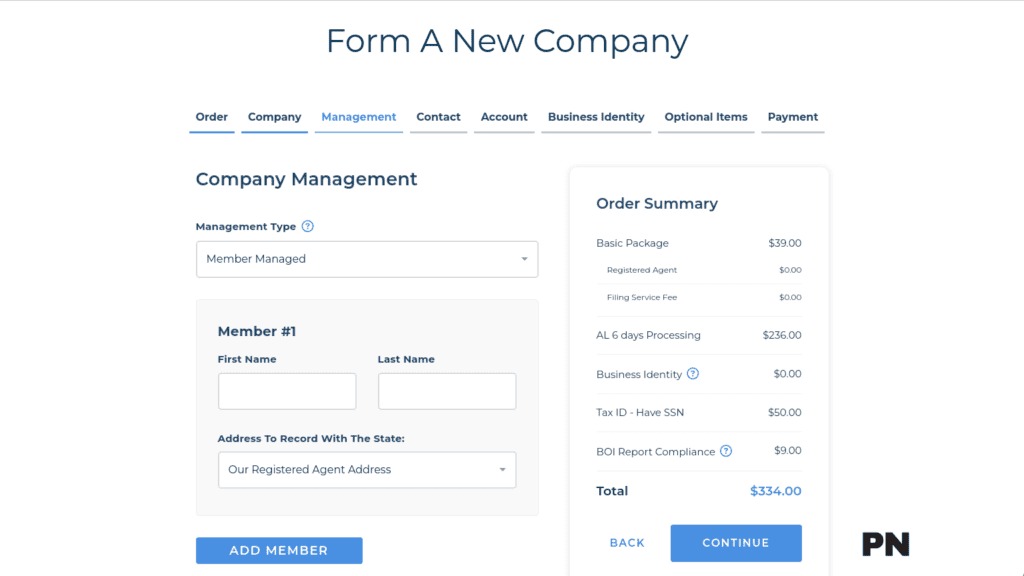

Step 4. Enter The Management For Your LLC

You’ll also need to enter the management for your LLC. This includes the members or managers who will run your business.

Step 5. Fill in Your Contact Details

Next, you’ll need to fill in your contact details, including your email address, phone number, and other information.

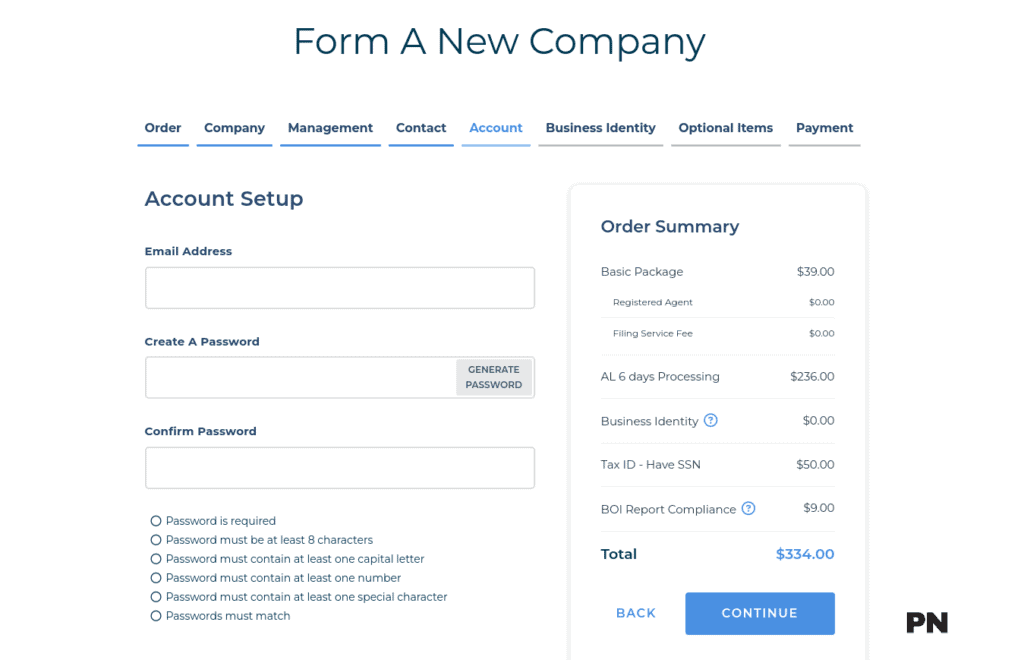

Step 6. Setup Your Account with Northwest Registered Agent

After entering all your information, you must set up your account with Northwest Registered Agent using your email and preferred password.

This will allow you to access their services and complete the following steps to form your LLC.

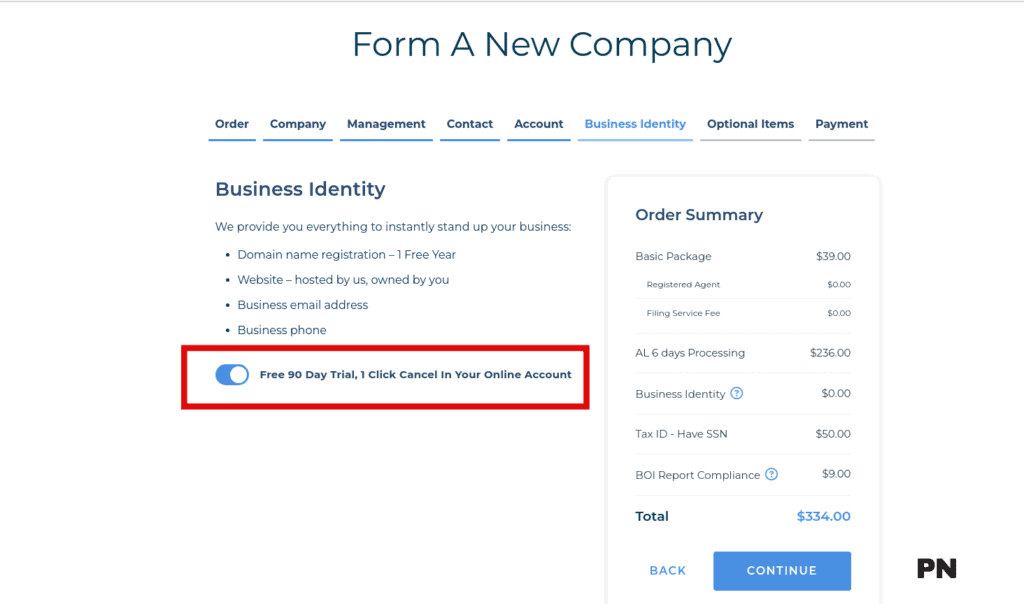

Step 7. Get Your Business Identity (optional)

You can toggle this on to add the Northwest Business Identity option for your LLC.

It includes the following, free for 90 days:

- Domain name registration – 1 Free Year

- Website – hosted by us, owned by you

- Business email address

- Business phone

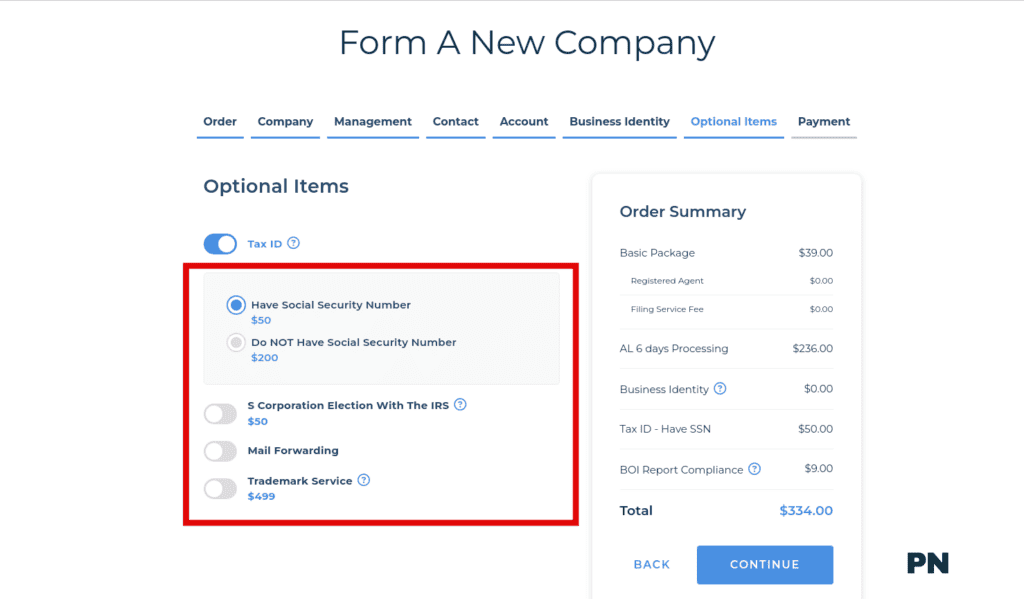

Step 8. Getting Your Tax ID or EIN – optional

If you want your LLC’s tax ID (EIN), you can do so through Northwest Registered Agent.

They will help you complete and submit the necessary forms to the IRS.

It would be best to have an EIN as a foreigner or non-resident. It’s pretty easy to get this (and cheaper) without the help of registered agents. But if you’d like to include it in your order, that’s also great!

However, for a fee of $200, Northwest Registered Agent will obtain your EIN or Tax I

Step 9. Checkout/Payment (Congratulations!)

Finally, you’ll need to check and make payment to complete the process of forming your LLC. Once you’ve done this, congratulations!

You can now open a Stripe account and start accepting payments.

Finally, Create Your Stripe Account (With Your EIN & LLC Information)

Basic Requirements

Before you begin, make sure you have the following:

- A registered business entity with a valid EIN (Employer Identification Number) issued by the IRS

- A government-issued ID such as a passport or driver’s license

- A valid email address

- Your business name and address

Creating a Stripe Account Step-by-Step

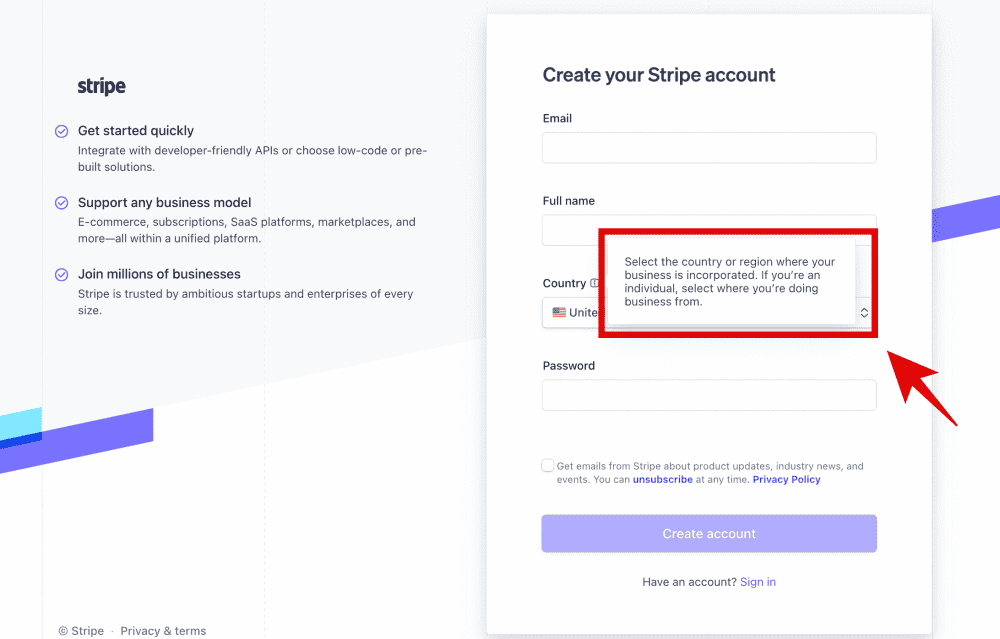

- Go to the Stripe website/registration page (https://dashboard.stripe.com/register) and click the “Sign Up” button.

- Fill in your email address and password to create an account.

- Provide your business information, including your name, address, and EIN.

- Verify your email address by clicking on the link in the email Stripe sent to you.

- Provide your personal information, including your name and government-issued ID.

- Choose your account type and the services you plan to use on Stripe.

- Add your bank account information for payouts.

- Review and accept Stripe’s terms and conditions.

Once you have completed these steps, your Stripe account will be created and ready to use. However, your account may take a few days to fully verify and activate.

Please ensure the country you selected where your business is incorporated in the United States, not your home country.

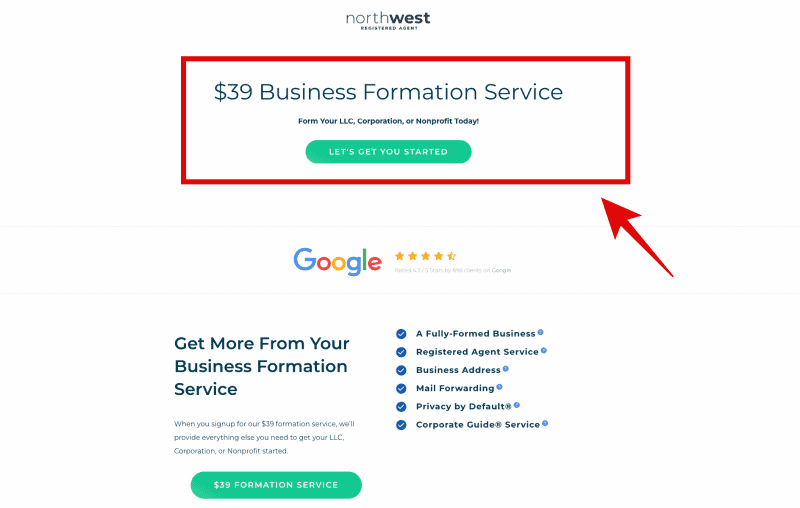

Why I Prefer Northwest Registered Agent For My Non-US LLC Formation?

If you’re a non-US resident looking to create a Stripe account, you must form an LLC in the US. I’ve been using Northwest Registered Agent since 2020 to create my Florida LLC, and I highly recommend them for their excellent service and affordable pricing.

Here are some of the reasons why I prefer Northwest Registered Agent for my non-US LLC formation:

- Free One Year Registered Agent:

Northwest Registered Agent offers a free one-year registered agent service when you form your LLC with them. This is a great value, as many other registered agents charge over $100 annually for this service.

- Free Operating Agreement:

Northwest Registered Agent also provides a free operating agreement when you form your LLC with them. This essential document outlines the LLC’s ownership and management structure.

- Affordable Pricing:

Northwest Registered Agent charges only $39 to get started, significantly less than other registered agents, who charge over $1000 for similar services.

- Local Office Address:

Northwest Registered Agent allows you to use one of its local offices as your business address. This is especially useful if you don’t have a physical address in the US.

- Transparent Pricing:

Northwest Registered Agent has a transparent pricing model with no annoying upsells or recurring monthly fees. Everything is optional, so you only pay for what you need.

- Privacy by Default:

Northwest Registered Agent keeps your address off the public record, which is essential for maintaining your privacy and security.

- Free Domain, Website, Email & Business Phone:

Northwest Registered Agent also provides a free domain, website, email, and business phone when you form your LLC with them. This is a great value, as these services can be expensive to purchase separately.

What Are The Benefits Of Forming A US Limited Liability Company (LLC) Non-US Residents Stripe Account?

Here are some of the benefits of forming a US LLC for your Stripe account:

Limited Liability Protection

One of the primary benefits of forming an LLC is that it provides limited liability protection.

This means that the personal assets of the LLC’s owners are protected from the company’s debts and legal liabilities. In other words, if the LLC is sued or goes bankrupt, the owners’ assets, such as their homes and cars, are not at risk.

Pass-Through Taxation

Another benefit of forming an LLC is that it is a pass-through entity for tax purposes.

This means that the LLC itself does not pay taxes; instead, the profits and losses of the company are passed through to the owners, who report them on their tax returns. This can benefit non-US residents, as they may be able to take advantage of lower tax rates in their home countries.

Easier Access to Business Services

Forming an LLC can also make accessing business services unavailable to non-US residents or non-supported countries easier.

For example, Stripe may require a US-based business entity in order to create an account. By forming a US LLC, non-US residents can satisfy this requirement and gain access to Stripe’s payment processing services.

Final Thoughts on Stripe Account Set in Non-Supported Countries

Setting up a Stripe account in non-supported countries can be a challenge, but it’s not impossible.

By following the steps outlined in this article, you can create a Stripe account and start accepting payments from customers worldwide.

To recap, the first step is to form a business entity in the United States as a non-resident, preferably an LLC. This will give you a U.S business address and a registered agent, which are both necessary for setting up a Stripe account.

Next, you must obtain an Employer Identification Number (EIN) or Tax ID. This can be done online through the IRS website or by mail.

Once you have your EIN or Tax ID, you can use it to open a U.S bank account, which will be linked to your Stripe account for payouts.

It’s important to note that you’ll need a U.S phone number to set up a Stripe account. You can use a virtual phone number service like Google Voice to get a U.S phone number if you don’t have one already.

Once you have all of these pieces in place, you can begin setting up your Stripe account. Ensure to provide all the necessary information and documentation, including your EIN or Tax ID, U.S. bank account information, and a valid U.S. business address.

Frequently Asked Questions

Can I use Stripe in an unsupported country?

You can use Stripe in unsupported countries by setting up a registered agent, EIN, or LLC. This allows you to register your business in the United States and obtain a US-based bank account, which is required to use Stripe. You can then link your US-based bank account to your Stripe account and start accepting payments.

Is Stripe better than PayPal?

Stripe is known for its flexibility and customization options, making it a good choice for businesses with more complex payment needs. PayPal, on the other hand, is known for its ease of use and widespread acceptance, making it a good choice for smaller businesses or those just starting.

How can I obtain an Employer Identification Number?

A non-US resident can obtain an EIN using a registered agent. A registered agent is a company that provides a physical address in the United States and acts as a liaison between you and the government. They can help you obtain an EIN and register your business in the United States, which is required to use Stripe.

What documentation is needed to activate a Stripe account for someone outside the supported countries?

To activate a Stripe account for someone living outside the supported countries, you must provide documentation such as a government-issued ID, proof of address, and a bank statement.

Can a non-US citizen establish a US-based Stripe account, and what are the requirements?

Yes, a non-US citizen can establish a US-based Stripe account by setting up a registered agent, EIN, or LLC.

Read Our Other Stripe-Related Posts

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.