Is Stripe Available in Pakistan? Here’s How to Create an Account

Does Stripe Work in Pakistan? Well, Stripe is not yet available in Pakistan. However, there are still ways for Pakistani businesses to use Stripe to accept online payments.

Key Takeaways

- While Stripe does not officially list Pakistan as a supported country, you can still create an account by meeting specific requirements.

- The best option is to set up a US-based LLC and obtain an Employer Identification Number (EIN), allowing you to create a Stripe account.

- While this process may seem daunting, it’s quite straightforward and can be done online using Northwest’s registered agent service.

But there’s more.

In this article, I’ll guide you through creating a Stripe account in Pakistan, including forming an LLC, obtaining an EIN, and opening a US bank account.

I’ll also discuss the benefits of forming an LLC for a Pakistan Stripe account and answer some frequently asked questions. By the end of this article, you’ll clearly understand how to set up a Stripe account in Pakistan and start accepting payments from customers worldwide.

Does Stripe Work In Pakistan?

If you are a Pakistani entrepreneur looking to expand your business and receive payments from global customers, you might wonder if Stripe is available in Pakistan. The answer is yes; Pakistani individuals and companies can open a Stripe account.

While Stripe does not officially list Pakistan as a supported country, you can still create an account by following simple steps.

To set up a Stripe account from Pakistan, you must register a business in a Stripe-supported country, acquire a tax ID, secure a foreign phone number, address, and bank account, and then use these to create a Stripe account. You can use a virtual mailbox service to get a foreign address and a virtual phone number service to get a foreign phone number.

You can also use a service like Wise to open a bank account in a supported country.

Once you have all the necessary documentation and have created your Stripe account, you can start accepting payments from customers worldwide. Stripe allows you to accept payments in over 135 currencies and offers a variety of payment methods, including credit cards, debit cards, and digital wallets.

Requirements To Open A Stripe Account In Pakistan For Your Business

Below is a table that lists the requirements and where to get them:

| Requirements | Where to Get |

|---|---|

| Business Formation/LLC | Registered Agent (Northwest) |

| Employer Identification Number (EIN) Or Tax ID | IRS |

| U.S Business Address | Virtual Mailbox |

| U.S Phone Number | Virtual Phone Number Provider |

| U.S Bank Account (To Be Linked To Stripe For Payouts) | Use Wise or Mercury |

To open a Stripe account in Pakistan, you must have a legal entity in the United States, such as an LLC. You can form an LLC through a registered agent who can assist you with registering your business in the United States.

1. A Business Formation In The U.S (LLC)

First, you’ll need to form a business in the United States. One of the most common business formations in the U.S. is a Limited Liability Company (LLC). An LLC is a type of business structure that combines a corporation’s liability protection with a partnership’s tax benefits.

There are several benefits to forming an LLC.

First, an LLC protects its owners’ personal liability, meaning that their assets are protected from business debts and lawsuits.

Second, an LLC is a pass-through entity for tax purposes, meaning that the business’s profits and losses are passed through to the owners’ personal tax returns. This can result in lower tax rates for the owners.

If you decide to form an LLC on your own, it’s important to use a registered agent.

A registered agent is a person or company authorized to receive legal documents for your business. Using a registered agent can help ensure that you receive important legal documents promptly.

2. Obtaining An Employer Identification Number (EIN) Or Tax ID

An EIN is a unique nine-digit number the IRS assigns to identify your business entity. It is like a Social Security number for your business.

Obtaining an EIN is necessary for your LLC for tax purposes, opening a business bank account, and applying for credit. Moreover, you must link your EIN with your Stripe account to receive payments.

After forming your LLC, there are a few best ways to get an EIN.

You can apply online through the IRS website, by fax, mail, or telephone. A registered agent can also help you with this process.

The easiest and fastest method is to apply for an EIN online via a service. After completing the online application, you can get your EIN immediately.

3. U.S Business Address

As a non-resident business owner based in Pakistan, you must obtain a U.S. business address to open a Stripe account. Stripe requires all businesses to have a physical address in a supported country.

A mail forwarding service is one way to obtain a U.S. business address. These services provide you with a U.S. address that you can use to receive mail and packages. Some popular mail forwarding services include MyUS.com, USA2Me.com, and Shipito.com.

Another option is to use a virtual office service. These services provide you with a physical address and other business services such as phone answering and mail forwarding. Some popular virtual office services include Regus, Davinci Virtual Office Solutions, and Alliance Virtual Offices.

It is important to note that having a U.S. business address does not mean you must be physically present in the country. With the abovementioned options, you can easily obtain a U.S. business address as a non-resident business owner based in Pakistan.

4. A U.S Phone Number

You need a U.S. phone number to create a Stripe account in Pakistan. Stripe requires a phone number associated with the country where your business is registered.

Since Stripe does not yet support Pakistan, you need to provide a U.S phone number to sign up.

Having a U.S. phone number is important because it helps verify your identity and proves you have a legitimate business in the United States. It also helps Stripe to contact you in case of any issues related to your account.

Fortunately, obtaining a U.S phone number is not difficult. You can use apps and services like Dingtone and Skype to get a U.S phone number. These services provide virtual phone numbers that can be used to receive calls and messages from anywhere in the world.

5. U.S Bank Account (To Be Linked To Stripe For Payouts)

If you are based in Pakistan and want to use Stripe, you must link a U.S. bank account to your Stripe account for payouts. This is because Stripe currently does not support bank accounts from Pakistan.

There are different ways to go about getting a U.S. bank account.

Here are a few options:

- Wise: Wise (formerly TransferWise) is a popular online money transfer service that allows you to open a U.S. bank account remotely. You can then use the account details to link it to your Stripe account for payouts. Wise offers competitive exchange rates and low fees.

- Payoneer: Payoneer is another online money transfer service providing a U.S. bank account. You can use the account details to link it to your Stripe account for payouts. Payoneer also offers a prepaid Mastercard that you can use to withdraw funds from ATMs and make purchases online or in-store.

- Mercury: Mercury is a U.S. bank that caters to startups and small businesses. You can open a Mercury account remotely and use the account details to link it to your Stripe account for payouts. Mercury offers free ACH transfers, wire transfers, and debit cards.

A U.S. bank account linked to your Stripe account is necessary to receive payouts. Without a U.S. bank account, you won’t be able to receive payouts from Stripe. Therefore, choosing a reliable and trustworthy service to open a U.S. bank account is essential.

What’s the Best State to Form Your LLC as a Foreigner in Pakistan?

While you can technically form an LLC in any state, a few popular options exist. Three of the most popular states for LLC formation are New Mexico, Delaware, and Wyoming.

Wyoming

Wyoming is a popular choice for non-US residents because it is a low-cost option. The filing fee for an LLC in Wyoming is only around $150, and no corporate-level tax exists.

However, you will still need to pay federal taxes. Wyoming also has a reputation for being business-friendly, making it an attractive option for entrepreneurs.

Delaware

Delaware is a popular option for companies that plan to raise money from investors in the future. Nearly 80% of US public companies choose to incorporate in Delaware.

The state has a well-established legal system and a business-friendly environment. However, the downside is the higher cost of filing and maintaining the company.

New Mexico

New Mexico is another attractive option for non-US residents because the filing costs are low, and you do not have to file an annual report.

New Mexico is one of the few US states that does not require the member or manager’s name to be included in the certificate of formation filing. An LLC must register in New Mexico and pay a $50 filing fee, but no annual report fees are required.

Why to Avoid California

It is important to note that some states, like California, have high franchise tax fees. This can make it an expensive option for non-US residents. For this reason, we recommend avoiding California if you are looking for a cost-effective option.

Steps On How To Form Your LLC & Open A Stripe Account

Here are the steps to form your LLC and open your Stripe account:

Step 1. Sign up For Northwest Registered Agent

You must sign up for a registered agent service to form your LLC. I strongly recommend Northwest Registered Agent, which provides excellent service and support.

You can sign up for their service on their website.

Go to https://www.northwestregisteredagent.com/

You’ll be directed to the page below. Click on the button – “LET’S GET YOU STARTED.”

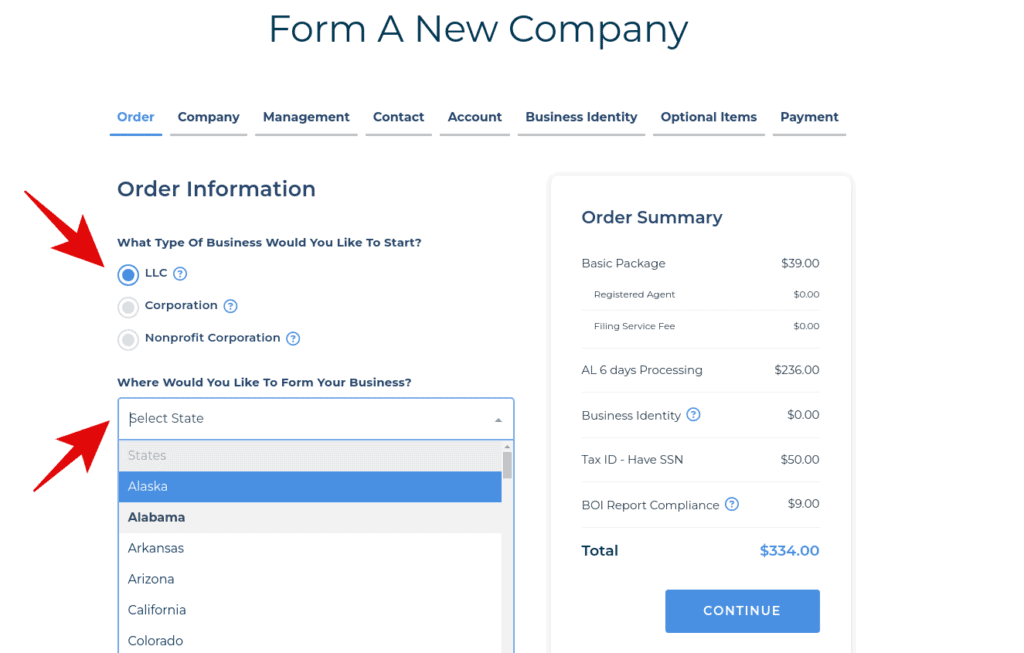

Step 2. Choose Your Business Entity and State

Next, you’ll need to choose your business entity and state. Depending on your needs, you can form an LLC, corporation, or other business entity.

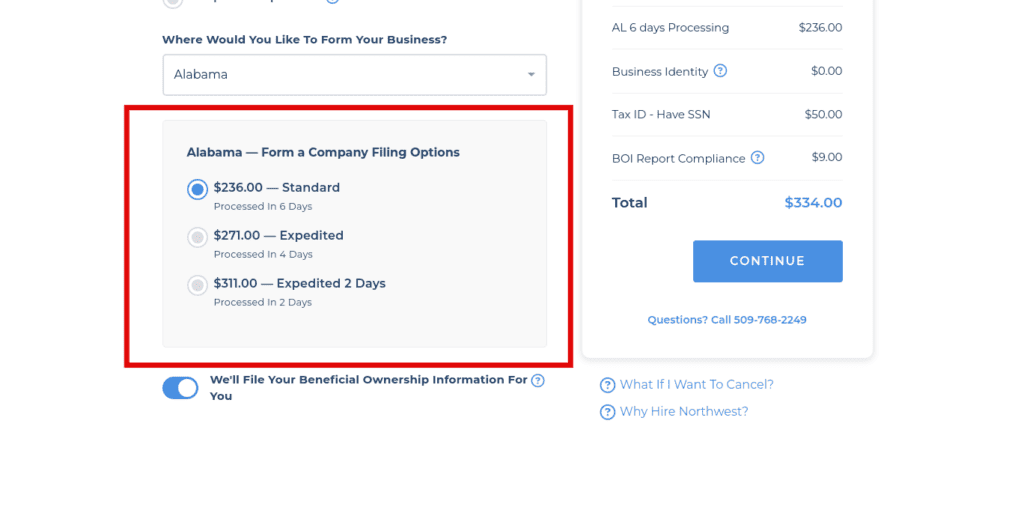

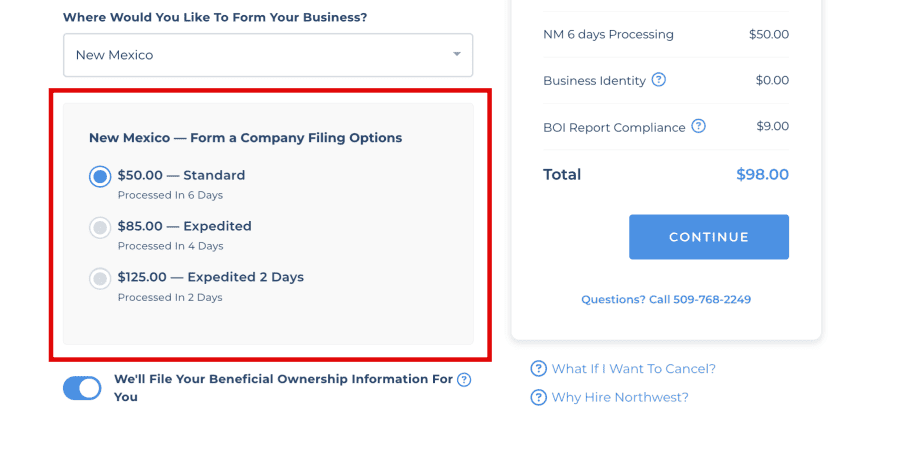

The state you choose and the processing time (Standard and Expedited) would determine the total amount.

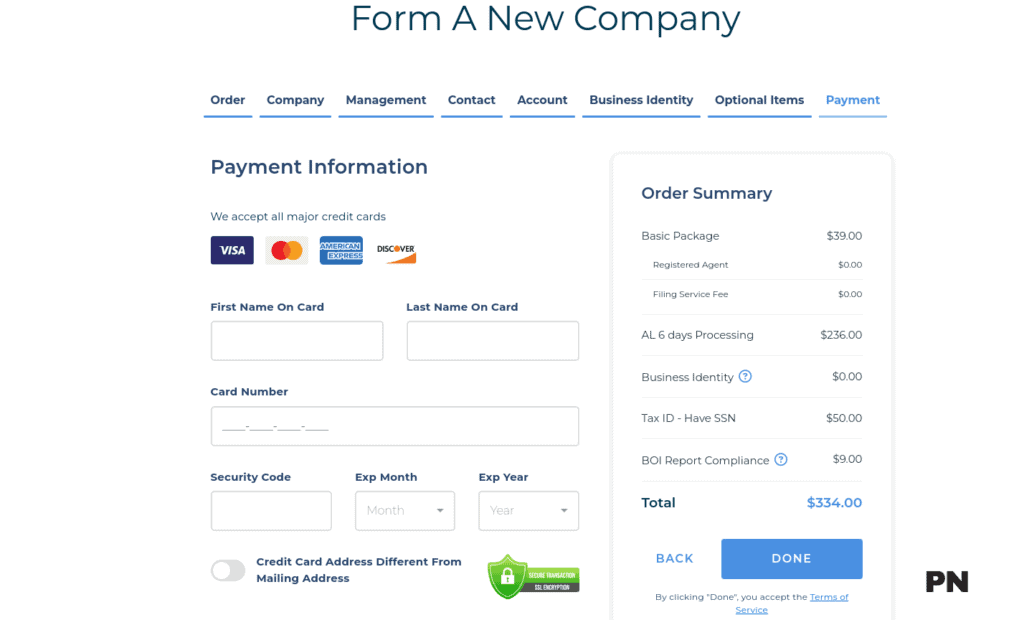

For instance, below is that of Alabama ($334):

Here’s that of New Mexico ($98):

Step 3. Enter Your New/Existing Details

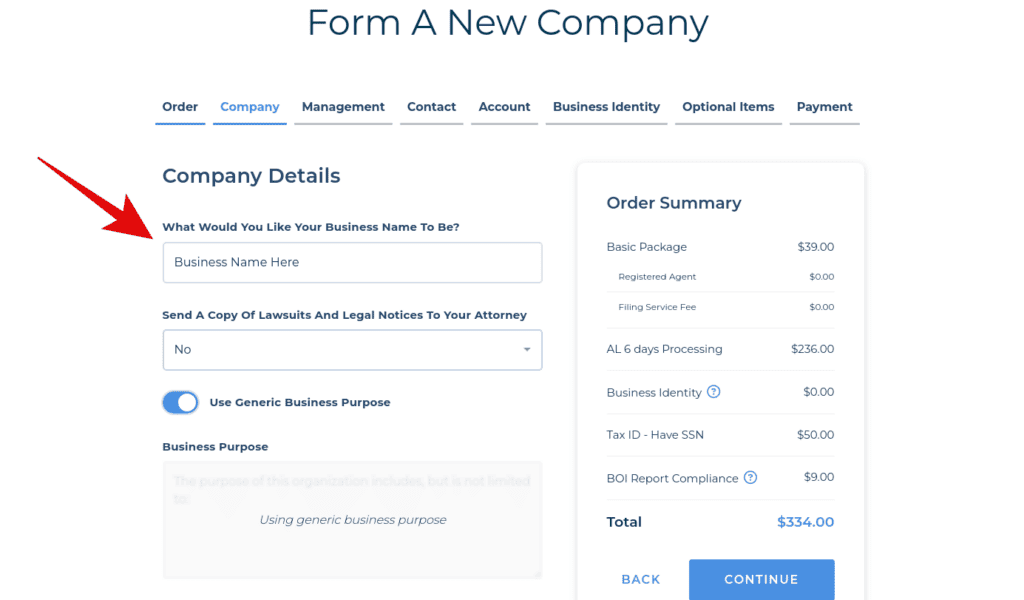

After choosing your business entity and state, you must enter your new or existing details, including your business name, address, and other important information.

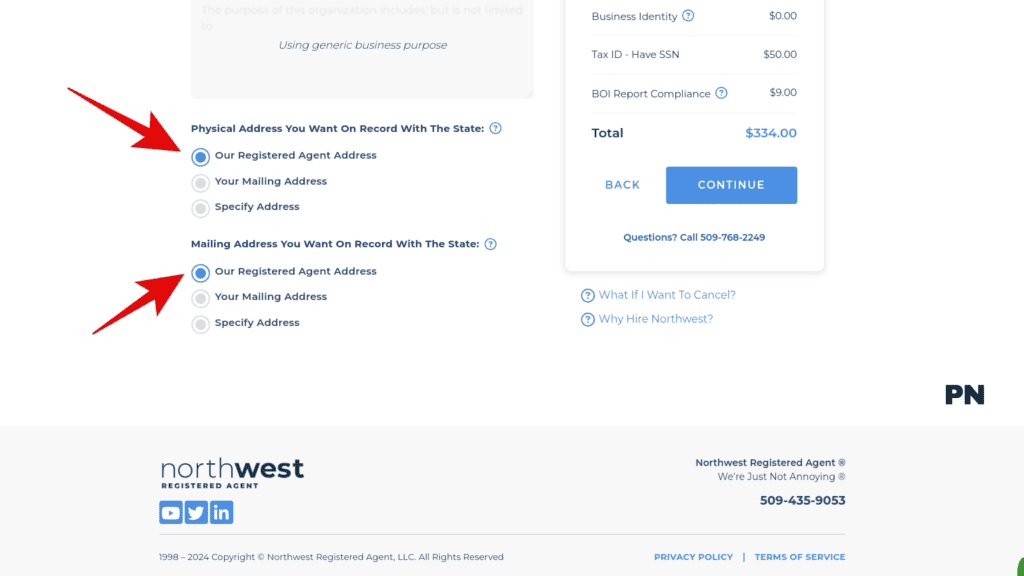

Choose the physical and mailing addresses you would like to use for the business:

The good thing about Northwest Registered Agents is that they offer the convenience of using their address as your business address, eliminating the need for a separate US address for your company.

Similarly, you can utilize their mailing services if you lack a mailing address option. If you require physical documents, you can include a US mailing address.

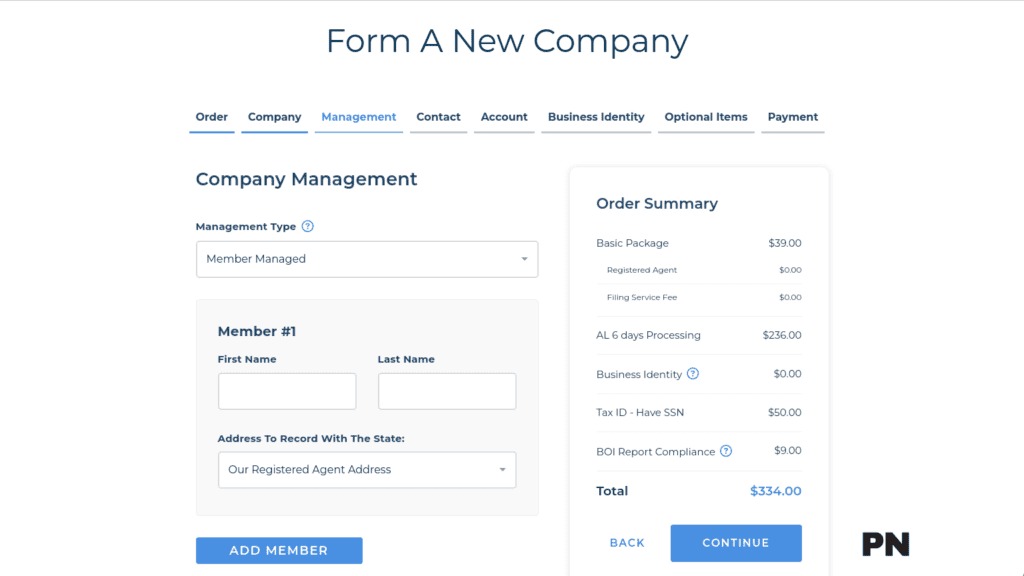

Step 4. Enter The Management For Your LLC

You’ll also need to enter your LLC’s management, including its managers’ or members’ names and addresses.

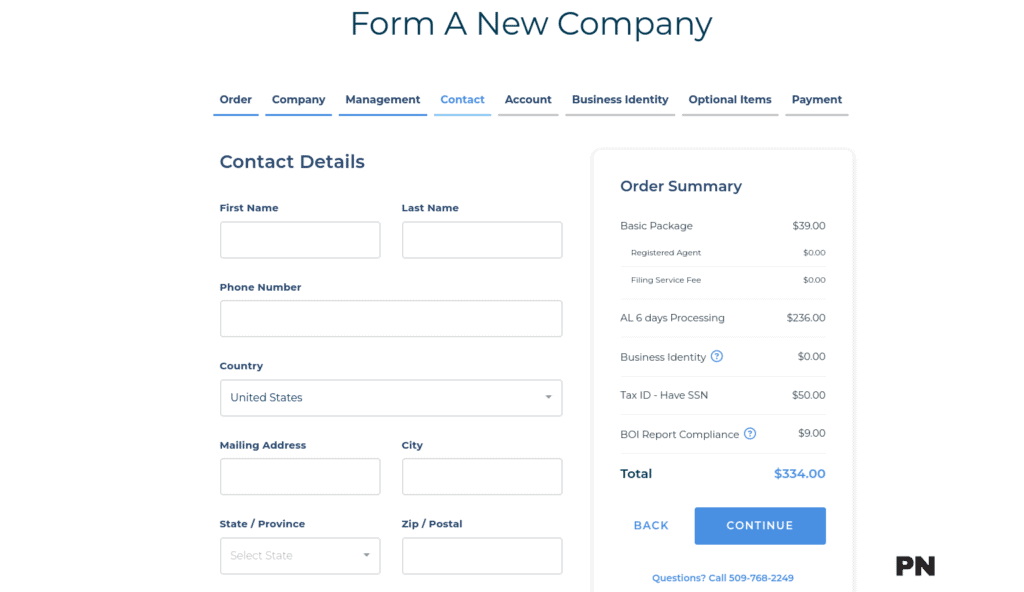

Step 5. Fill in Your Contact Details

Next, you’ll need to fill in your contact details, including your name, address, phone number, and email address.

These details will serve as your primary means of contact with Northwest. They can include your local Pakistan address, phone numbers, etc.

You do not necessarily need a U.S. contact detail for your Northwest account creation. You can use your local/current details as a point of contact with Northwest.

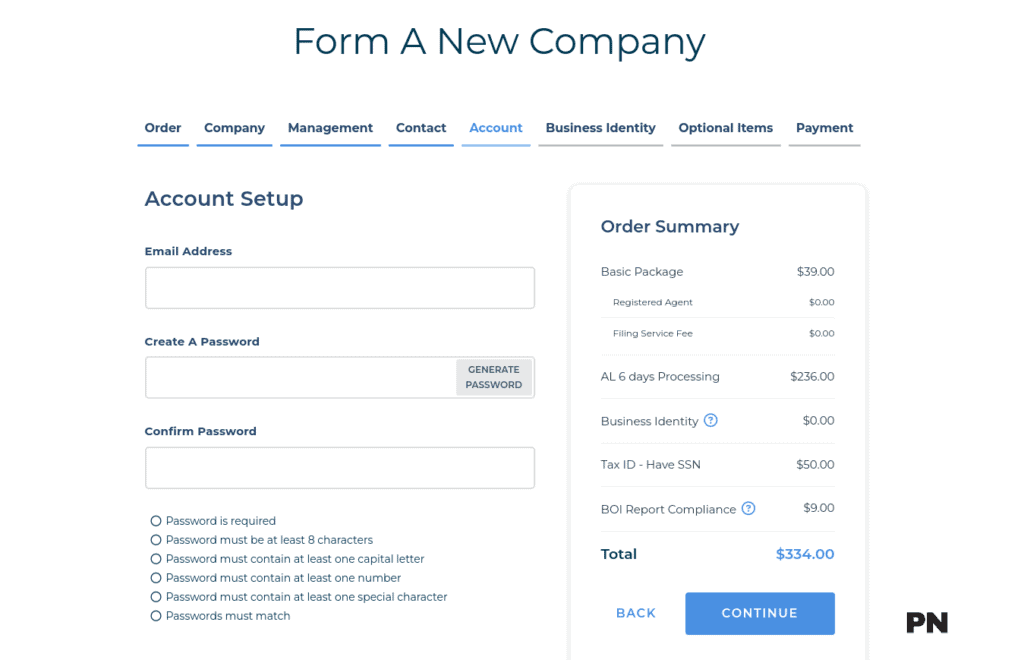

Step 6. Setup Your Account with Northwest Registered Agent

Once you’ve filled in your details, you must set up your account with Northwest Registered Agent. This will allow you to manage your LLC and receive important notifications.

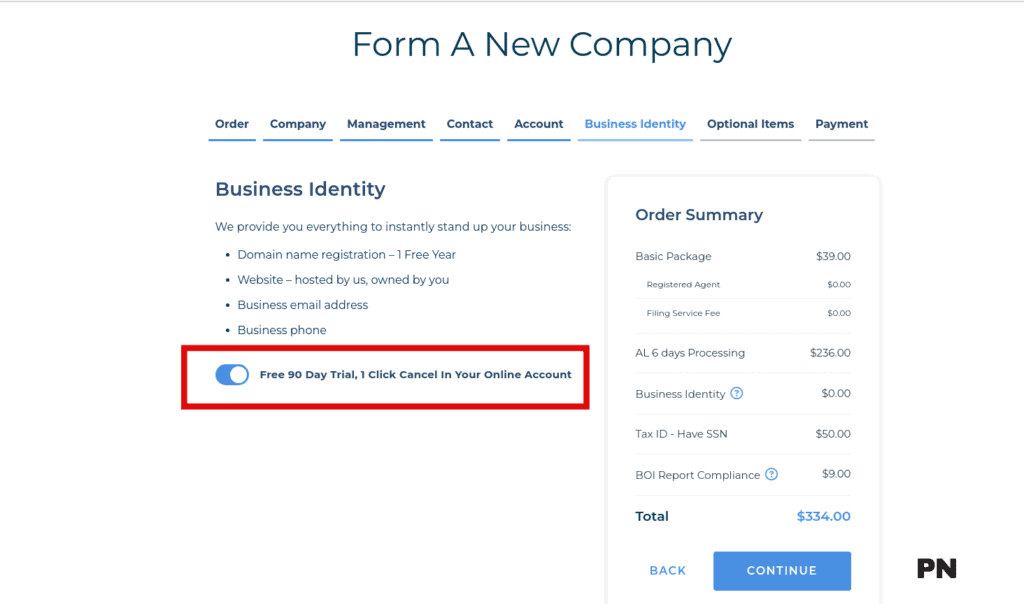

Step 7. Get Your Business Identity (optional)

You can toggle this on to add the Northwest Business Identity option for your LLC.

It includes the following, free for 90 days:

- Domain name registration – 1 Free Year

- Website – hosted by us, owned by you

- Business email address

- Business phone

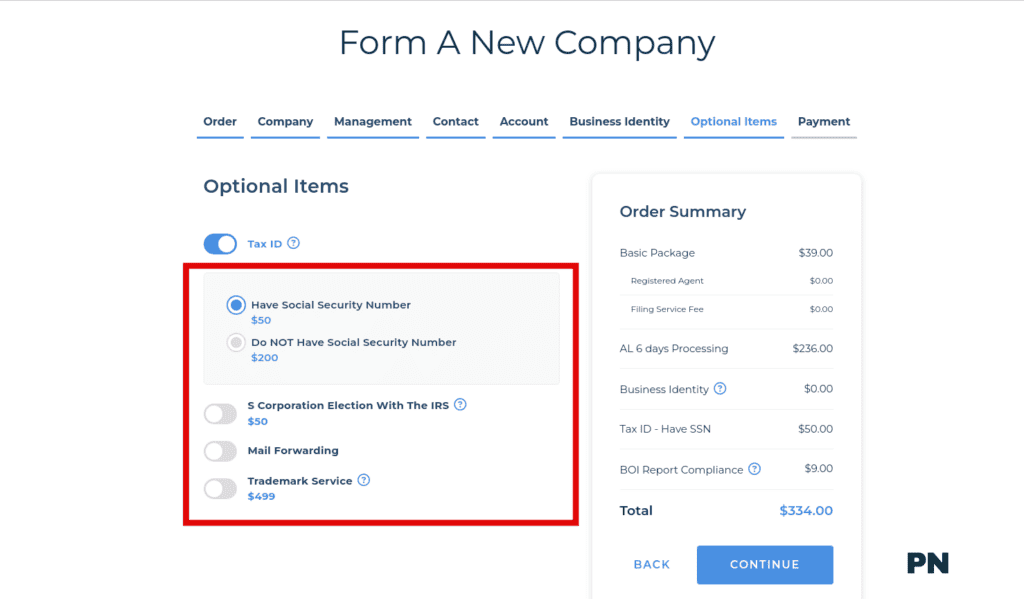

Step 8. Getting Your Tax ID or EIN – optional

If you want your LLC’s tax ID (EIN), you can do so through Northwest Registered Agent.

It would be best to have an EIN as a foreigner or non-resident. It’s pretty easy to get this (and cheaper) without the help of registered agents. But if you’d like to include it in your order, that’s also great!

However, for a fee of $200, Northwest Registered Agent will obtain your EIN or Tax ID. This is particularly beneficial if you lack a Social Security Number (SSN) or are a f

Step 9. Checkout/Payment (Congratulations!)

Finally, you’ll need to complete the checkout process and make your payment. Once you have done so, you’ll have successfully formed your LLC and opened your Stripe account.

Congratulations!

Finally, Create Your Stripe Account (With Your EIN & LLC Information)

Basic Requirements

Before creating your Stripe account, you must meet a few basic requirements.

You must have a business name, email address, and government-issued ID.

You will need an EIN (Employer Identification Number) for your LLC (Limited Liability Company). You can apply for one on the IRS website if you don’t have an EIN.

Creating a Stripe Account Step-by-Step

You can create your Stripe account once you have met the basic requirements.

Here are the steps you need to follow:

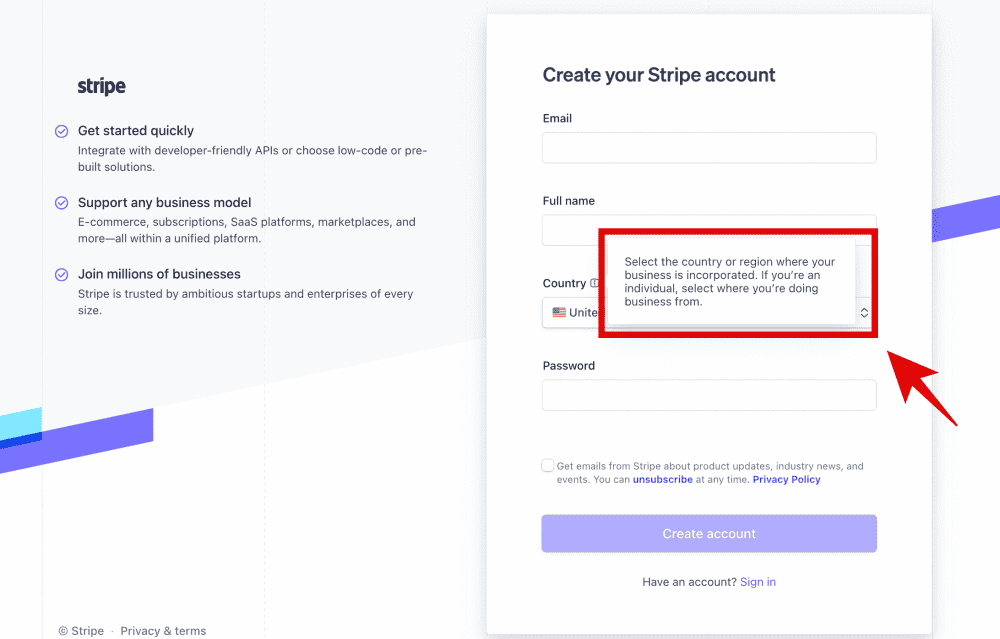

- Go to the Stripe website and click the “Sign Up” button.

- Enter your email address and create a password for your account.

- Enter your business name and select the country where your business is located.

- Provide your EIN and LLC information.

- Enter your personal and business information, including your name, address, and phone number.

- Verify your email address by clicking on the link Stripe sends you.

- Add your bank account information so you can receive payments from Stripe.

Once you have completed these steps, your Stripe account will be created, and you can start accepting payments. However, Stripe may require additional information from you to verify your account. This could include providing additional documentation or answering additional questions.

Please ensure the country you selected where your business is incorporated in the United States, not Pakistan.

Why I Prefer Northwest Registered Agent For My LLC Formation?

As someone who has been using Northwest Registered Agent since 2020 to create my Florida LLC, I can confidently say they are a reliable and trustworthy service provider.

One of the main reasons why I prefer Northwest Registered Agent is because they offer a free one-year registered agent service. This is a great value, as other registered agents often charge hundreds of dollars annually for this service.

That’s not all.

Northwest Registered Agent provides a free operating agreement, which can be a helpful tool for organizing your LLC.

Another great benefit of using Northwest Registered Agent is its pricing.

You can start with their LLC formation service for just $39. This is significantly less than other registered agents charge, which can be over $1000. Their pricing is transparent, with no annoying upsells or recurring monthly fees, as everything is optional.

Northwest Registered Agent also allows you to use one of their local offices as your business address. This can be a great option if you do not have a physical location for your business or want to keep your address private.

Privacy is also a top priority for Northwest Registered Agent. They keep your address off the public record by default, which can be important for protecting your personal information.

Northwest Registered Agent provides a free domain, website, email, and business phone. This can be a great way to establish a professional online presence for your business.

What Are The Benefits Of Forming A US Limited Liability Company (LLC) For a Pakistan Stripe Account?

Here are some benefits of forming a US LLC for your Pakistan Stripe account:

Limited Liability Protection

One of the main benefits of forming a US LLC is that it offers limited liability protection. This means that your assets, such as your home or car, are protected from creditors if your business is sued or goes bankrupt. By forming a US LLC, you can limit your liability and protect your assets.

Tax Benefits

Forming a US LLC can also offer tax benefits. LLCs are considered pass-through entities, meaning the business profits and losses are passed to the owners and reported on their tax returns. This can result in lower taxes than other business structures, such as a corporation.

Credibility

Forming a US LLC can also add credibility to your business.

It shows you are serious about your business and willing to take the necessary steps to protect it. This can be especially important if you are dealing with international clients or partners who may be hesitant to do business with a company that is not properly registered.

Easy to Form

Forming a US LLC is relatively easy. The process involves choosing a name, filing articles of organization, and obtaining necessary licenses and permits. While some fees may be involved, the benefits can outweigh the costs.

Frequently Asked Questions

What are the requirements for creating a Stripe account?

To create a Stripe account, you must register a business in a Stripe-supported country, obtain an Employer Identification Number (EIN) or Tax ID, secure a foreign phone number, address, and bank account, and then use these to create an account on Stripe.

How Do I Use Stripe In Pakistan?

Since Stripe is not officially available in Pakistan, you can form an LLC in the United States and use that to create a Stripe account. You can then use Stripe to receive payments from customers worldwide.

How can I obtain an Employer Identification Number (EIN) as a Pakistan resident?

As a Pakistan resident, you can obtain an EIN by filling out an SS-4 form and submitting it to the Internal Revenue Service (IRS) in the United States. You can also use the services of a third-party company to obtain an EIN for you.

Can I Get A U.S.-based Address For My Business?

Yes, you can get a US-based address for your business by using a service like Northwest Registered Agent. This service will provide you with a US-based address that you can use to register your business and obtain an EIN.

Can I legally use Stripe for my business in Pakistan?

Yes, you can legally use Stripe for your business in Pakistan if you have formed an LLC in the United States and obtained an EIN. You can then use your Stripe account to receive payments from customers worldwide.

Are there any alternatives to Stripe for online payments in Pakistan?

Yes, there are several alternatives to Stripe for online payments in Pakistan. Some of the most popular alternatives include PayPal, 2Checkout, and Payoneer.

How can I access Stripe services from an unofficially supported country?

To access Stripe services from a country that is not officially supported, you can form an LLC in the United States and use that to create a Stripe account. This will allow you to use Stripe to receive payments from customers worldwide.

Final Thoughts on Stripe Account Set Up in Pakistan

Creating a Stripe account in Pakistan can be challenging, but it is possible. As we have seen, there are several requirements that you will need to fulfill to set up an account.

Firstly, you must register a business in a Stripe-supported country like the United States. This will involve forming an LLC and obtaining an EIN or tax ID. You will also need to have a U.S. business address and phone number.

Once you have these in place, you must set up a U.S. bank account, which will be linked to your Stripe account for payouts. This can be done through services like Northwest or Payoneer.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.