Is Stripe Available in Thailand? (Account Opening Guide)

If you’re a business owner in Thailand, you may wonder if Stripe is available in your country. The answer is yes – Stripe has launched in Thailand and is now available to support businesses in the country.

This expansion is part of Stripe’s investment in the Asia Pacific region, where its services are already available in Australia, Hong Kong, Japan, Malaysia, New Zealand, and Singapore.

With Stripe, Thai businesses can accept payments via major credit cards and Thailand-based payment method PromptPay. This makes it easier and faster for businesses to receive payments from customers.

But there’s more.

Another option is to set up an LLC and obtain an EIN in a Stripe-supported region (U.S.) to accept International payments worldwide as a business owner based in Thailand.

While the LLC process may seem daunting, it’s quite straightforward and can be done online using Northwest’s registered agent service.

Does Stripe Work In Thailand?

Thousands of Thai businesses have already signed up on Stripe, which is now available for general use in Thailand. Stripe is currently supported in 46 countries, with more to come.

Once It is supported in your country, you’ll be able to sell to customers anywhere in the world.

To open a Stripe account in Thailand, you will need to provide some information such as the type of business, legal name, business registration number, business address, business phone number, description of your business, website, business representative details, ownership details, statement descriptor, customer support phone number, and bank details.

For a registered entity, you should provide the legal name as it appears on the Company Affidavit provided by the Department of Business Development.

For Sole Proprietorship or Individual business types, please provide your legal name as indicated on your ID. Thai nationals should provide legal names in Thai script.

Stripe accounts in Thailand can only accept Domestic debit card payments in THB. E-wallets such as Google Pay, WeChat Pay, and Alipay and local wallets such as TrueMoney Wallet, LINE Pay, and Rabbit Pay are also supported.

Apple Pay is not available locally in Thailand. However, Thai merchants can accept Apple Pay from internationally eligible customers.

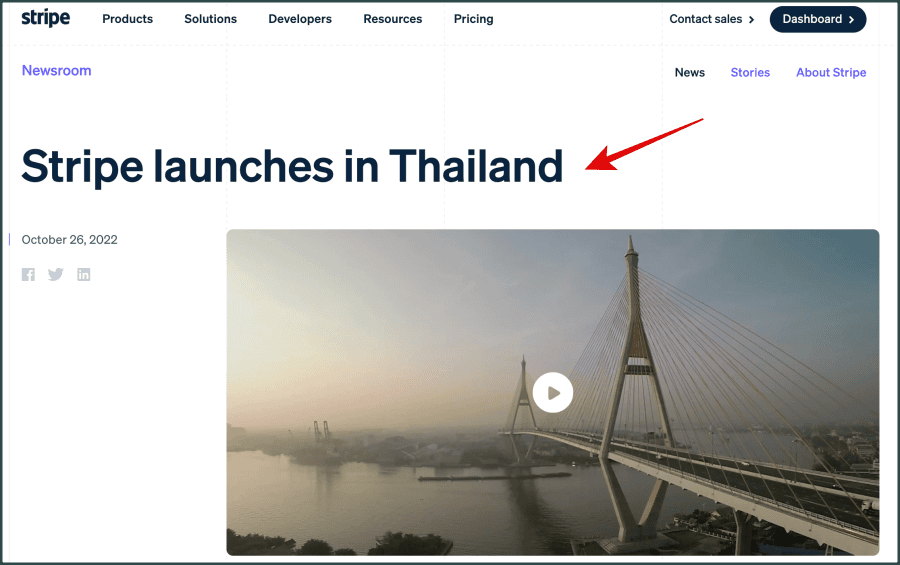

When Did Stripe Launch In Thailand?

Stripe announced its general availability in Thailand on October 26, 2022, making it one of the latest countries to join the Stripe family. The platform’s financial infrastructure will help solve Thai businesses’ complex payment issues.

Thai businesses can now use Stripe to accept payments via major credit cards and the Thailand-based payment method PromptPay, which is very popular in Thailand.

Thousands of Thai businesses have signed up on Stripe during the beta phase, including online real estate platform Baania, luxury furniture distributor Chanintr, tourist resort Coconut Beach Bungalows, accounting software platform FlowAccount, and digital creator platform Storior.

Stripe collaborated closely with the Bank of Thailand while preparing to deploy support for payment services for Thai businesses.

The launch expands Stripe’s investment in the Asia-Pacific region, where its services are available to support businesses in Australia, Hong Kong, Japan, Malaysia, New Zealand, Singapore, and Thailand.

It is important to note that Stripe’s availability in Thailand comes with certain conditions and limitations.

Thai businesses have full access to Stripe’s powerful solutions, such as Billing for subscriptions and recurring payments, Checkout and Payment Links for e-commerce, Invoicing for automated billing and payment reconciliation, Radar for fraud detection and prevention, and Connect for software platforms and marketplaces, among many other solutions.

Thai businesses can accept payments via major credit cards, such as Visa Mastercard and PromptPay.

This Thai payment method uses unique identifiers like a phone number, citizens’ ID, or QR code for customers to make payments with their preferred mobile applications.

Requirements To Open A Stripe Account In Thailand For U.S-based Business

While the traditional option is seamless and doesn’t require many formalities – the foreign business incorporation option seems complicated.

So, I’ve outlined and explained the processes below.

Here are the requirements you need to meet to open a Stripe account in Thailand via LLC:

| Requirements | Where to Get |

|---|---|

| Business Formation/LLC | Through a registered agent |

| Employer Identification Number (EIN) or Tax ID | Through the IRS |

| U.S Business Address | Through a virtual mailbox service |

| U.S Phone Number | Through a virtual phone service |

| U.S Bank Account (To Be Linked To Stripe For Payouts) | Use Wise or Mercury |

By meeting these requirements, you can open a Stripe account in Thailand as a U.S.-based business and start accepting payments from customers in Thailand and around the world.

Let’s delve in further.

1. A Business Formation In The U.S (LLC)

To create a Stripe account in Thailand using an LLC, you must form a business entity in the United States.

One of the most popular business structures in the US is an LLC (Limited Liability Company). An LLC is a flexible business structure that provides personal liability protection for its owners while allowing pass-through taxation.

Forming an LLC is not a complicated process, and it can be done quickly and easily with the help of a registered agent who provides LLC formation services like Northwest.

A registered agent is a professional service that helps you set up your LLC and provides ongoing support for your business. Using a registered agent ensures that your LLC is set up correctly and that you have all the necessary documentation and support to operate your business.

2. Obtaining An Employer Identification Number (EIN) Or Tax ID

If you plan to use Stripe for your business in Thailand, you must obtain an Employer Identification Number (EIN) or Tax ID.

This is a unique nine-digit number assigned by the IRS for businesses in the United States and is required to open a business bank account, pay taxes, and apply for loans.

An EIN is necessary for your LLC as it is your business’s version of a Social Security number.

It helps establish your business’s legal identity and allows the IRS to track your business’s tax obligations. You are also required to open a business bank account, apply for loans, and pay taxes.

Once you have formed your LLC, there are a few ways to go about obtaining an EIN. One of the best ways is to use a registered agent who can help you with the process.

Northwest registered agent will help you fill out the necessary forms and submit them to the IRS on your behalf. This can save you time and ensure that your application is completed correctly.

3. U.S Business Address

If you are a non-resident and a business owner based in Thailand, you may wonder why you need a U.S. business address to open a Stripe account as an LLC owner.

The reason is simple:

Stripe is a U.S.-based company requiring a U.S. business address to verify your identity and business information.

To get a U.S. business address, you have a few options.

One option is to use a mail forwarding service, which will provide you with a U.S. mailing address that you can use for your business. You can then use this address to receive mail and packages from Stripe and other U.S.-based companies.

Some popular mail forwarding services include MyUS, Shipito, and USAbox.

Another option is to use a virtual office service, which will provide you with a physical address in the U.S. that you can use as your business address. This option is more expensive than a mail forwarding service, but it may be worth it if you need a physical address for your business.

4. A U.S Phone Number

When creating or verifying a Stripe account in Thailand, you will need to provide a U.S. phone number. Stripe requires a phone number that can receive SMS messages for account verification purposes.

While this may seem unnecessary, it is quite important for security reasons. By requiring a U.S phone number, Stripe can ensure that the account holder is a real person and that they have a valid way of receiving important account information and alerts.

If you don’t have a U.S phone number, don’t worry. There are several apps and services available that allow you to obtain a U.S phone number easily.

For example, you can use Dingtone or Skype to get a U.S phone number for your Stripe account.

5. U.S Bank Account (To Be Linked To Stripe For Payouts)

To use Stripe for payouts in Thailand, you must link a U.S bank account to your Stripe account. This is necessary because Stripe currently only supports payouts to bank accounts in the United States, Canada, and the European Union.

There are several different ways to get a U.S. bank account. One option is to use Wise, a service that allows you to open a U.S. bank account remotely.

With Wise, you can receive payments in U.S. dollars and then transfer them to your local bank account in Thailand.

Another option is Payoneer, which allows you to remotely open a U.S bank account.

With Payoneer, you can receive payments in U.S dollars and then transfer them to your local bank account in Thailand.

Lastly, you can use Mercury, a U.S bank account provider that is specifically designed for startups and small businesses. Mercury offers various banking services, including checking accounts, savings accounts, and debit cards.

What’s the Best State to Form Your LLC as a Foreigner in Thailand?

If you’re a foreigner looking to start a business in Thailand, forming an LLC in the United States can be a wise choice.

However, it’s important to choose the right state for your LLC.

The three most popular states include New Mexico, Delaware, and Wyoming. Each state has unique advantages for different types of companies.

New Mexico

New Mexico is a great option for foreigners looking to form an LLC in the United States.

It is one of the few states that doesn’t require the member or manager’s name to be included in the certificate of formation filing.

This can be beneficial for those who value privacy. Additionally, the state has a low filing fee of $50 and doesn’t require annual report fees, making New Mexico an attractive state for those looking to save money.

Delaware

Delaware is a popular state for LLC formation due to its well-established legal system and business-friendly environment. It’s also home to many large corporations, making it an attractive state for those looking to do business with these companies.

However, if you don’t reside in Delaware or operate your business solely in Delaware, it may not be the best state to form your LLC due to higher fees and taxes.

Wyoming

Wyoming is often ranked as one of the best states for non-US residents to form an LLC and for a good reason. It has a business-friendly environment and low taxes, including no state income tax, franchise tax, or personal property tax.

Also, the state has a low annual fee of $60 for LLCs. This makes it an attractive option for those looking to save money and simplify their tax obligations.

It’s important to note that California is not recommended for LLC formation for non-US residents due to its high fees and taxes. Wyoming is a great choice for your LLC formation if you’re looking for a state that offers a business-friendly environment, low taxes, and low fees.

Steps On How To Form Your LLC & Open A Stripe Account

To use Stripe in Thailand, you must first form an LLC.

Here are the steps you need to follow:

Step 1. Sign up For Northwest Registered Agent

The first step to forming an LLC is to sign up for Northwest Registered Agent.

This is a service that helps you form an LLC. They will help you with everything from choosing your business entity and state to getting your tax ID or EIN.

Go to https://www.northwestregisteredagent.com/

You’ll be directed to the page below. Click on the button – “LET’S GET YOU STARTED”.

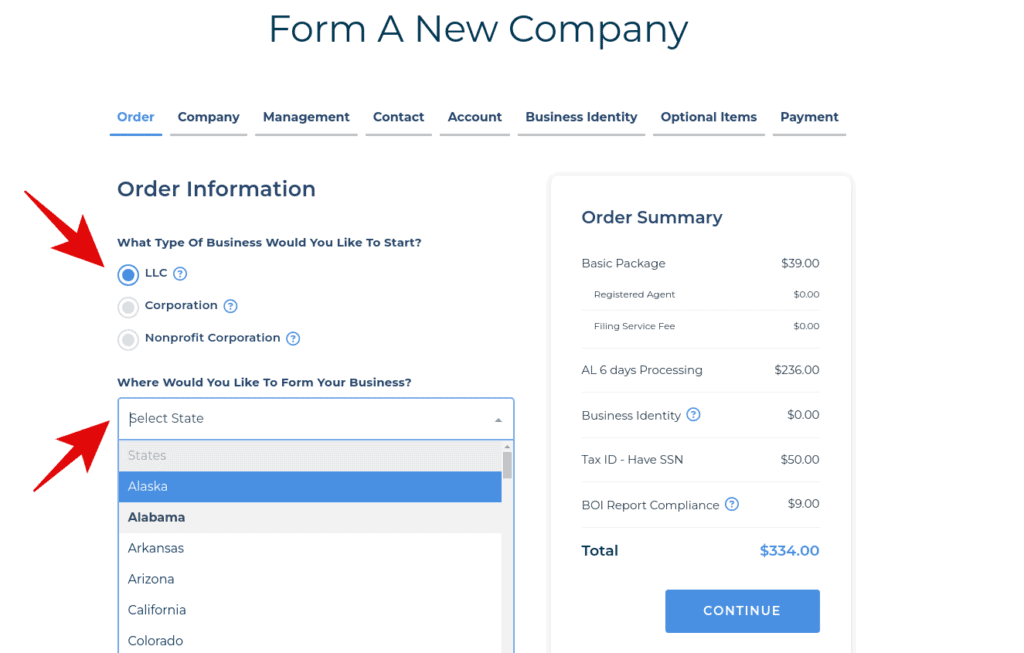

Step 2. Choose Your Business Entity and State

The next step is to choose your business entity and state.

You can choose from several entities, including sole proprietorship, partnership, LLC, and corporation. You’ll also need to choose the state where you want to form your LLC.

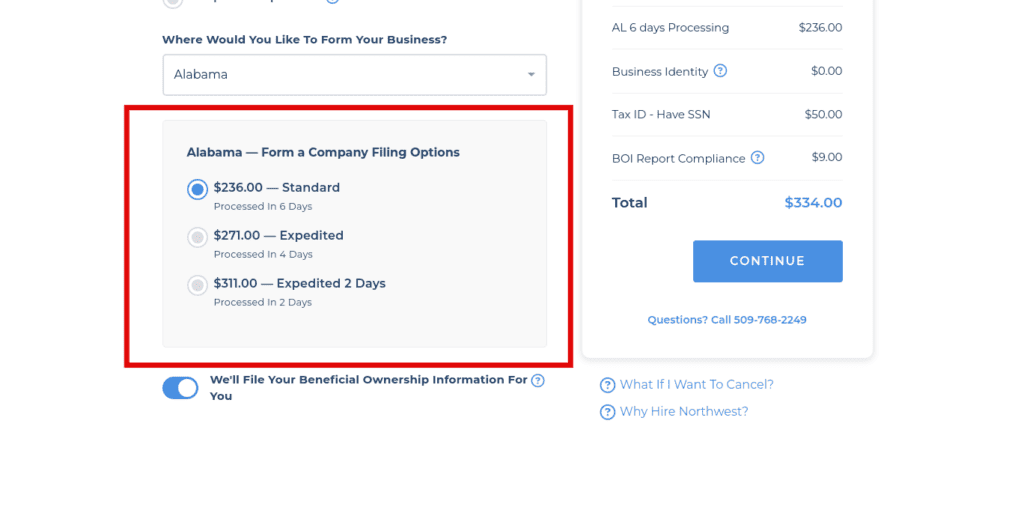

The state you choose and the processing time (Standard and Expedited) would determine the total amount.

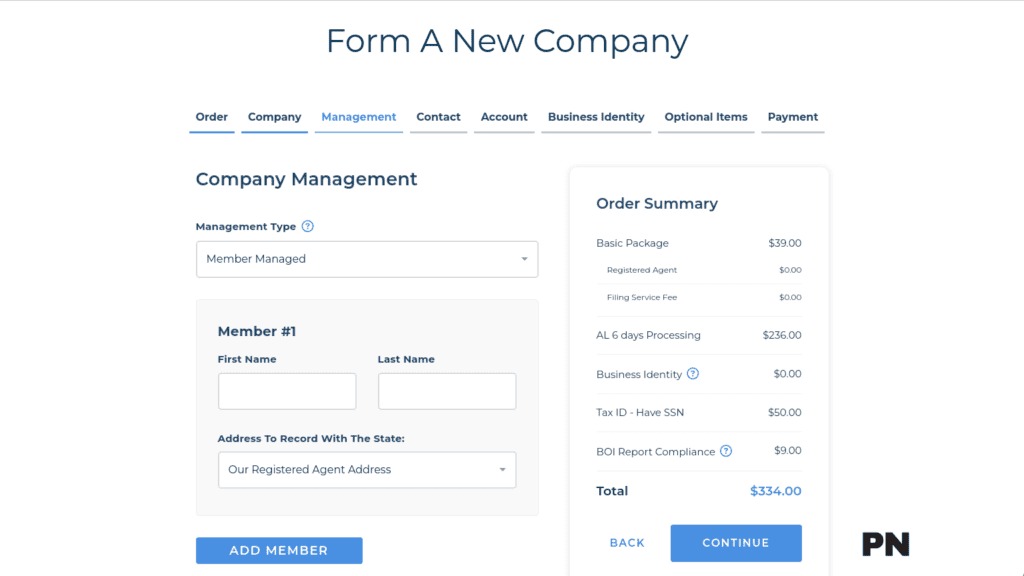

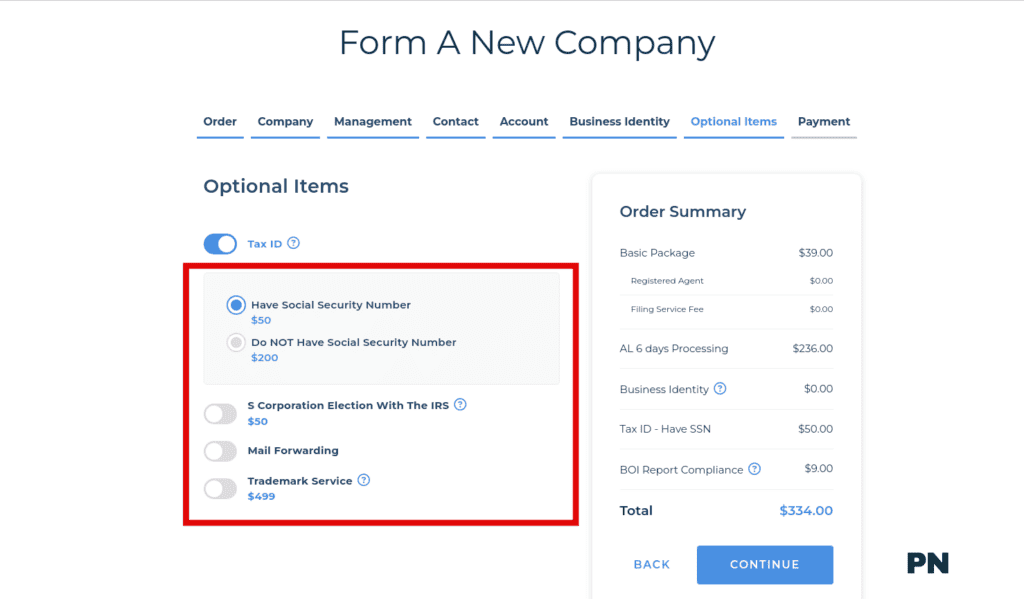

For instance, below is that of Alabama ($334):

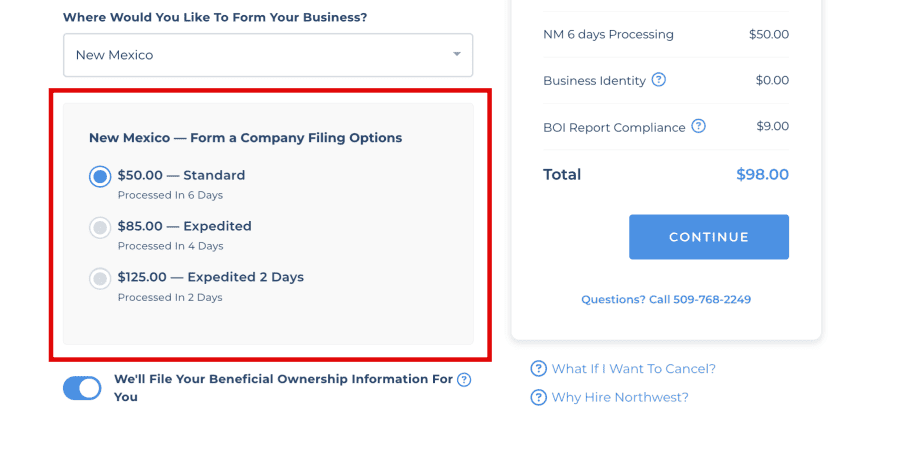

Here’s that of New Mexico ($98):

Step 3. Enter Your New/Existing Details

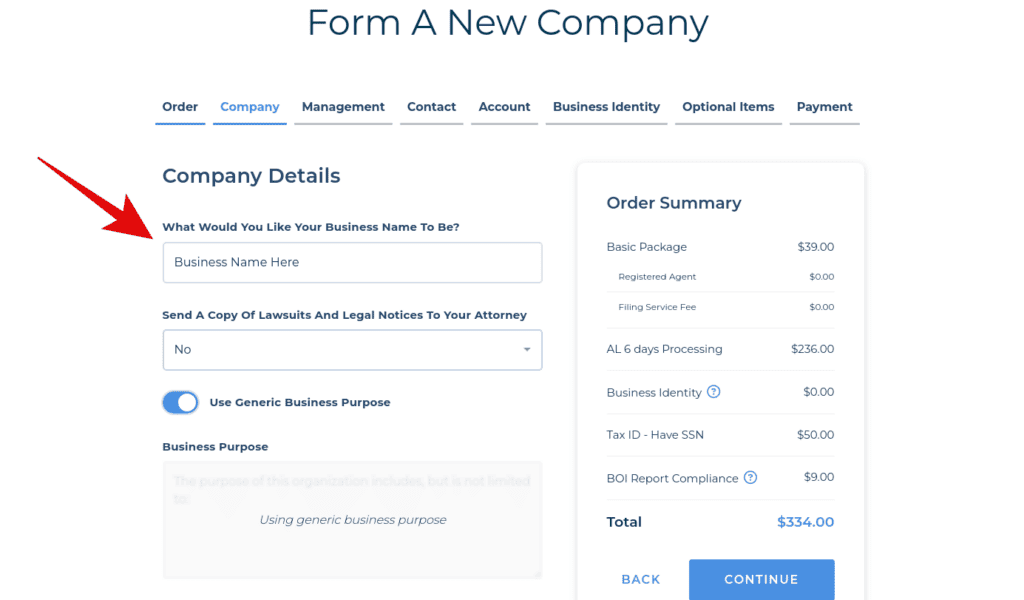

Once you’ve chosen your business entity and state, you must enter your new or existing details, including your business name, address, and other contact information.

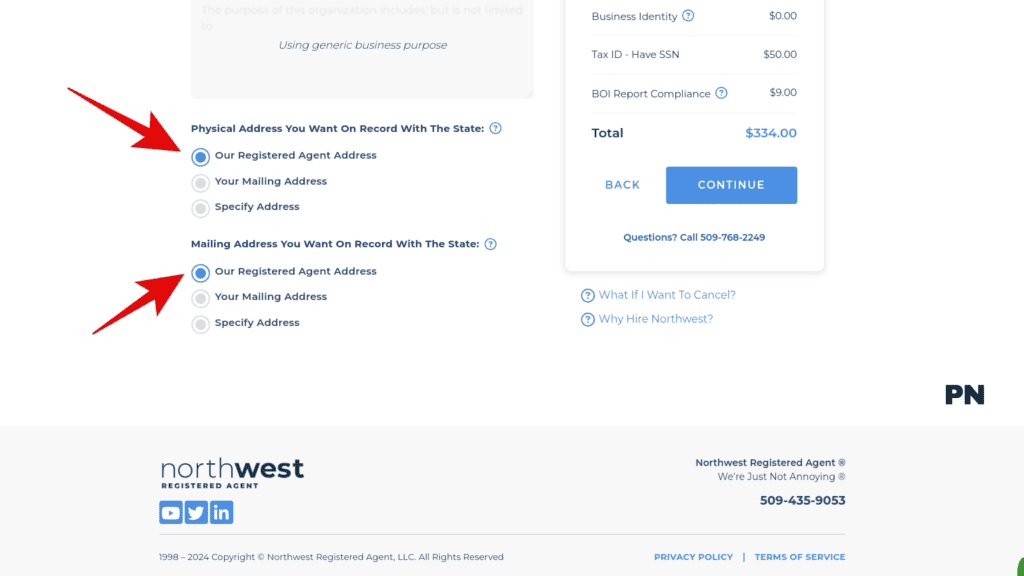

Choose the physical and mailing addresses you would like to use for the business:

The good thing about Northwest Registered Agents is that they offer the convenience of using their address as your business address, eliminating the need for a separate US address for your company.

Similarly, you can utilize their mailing services if you lack a mailing

Step 4. Enter The Management For Your LLC

You’ll also need to enter the management for your LLC. This includes the name and contact information of the person or people who will be managing your LLC.

Step 5. Fill in Your Contact Details

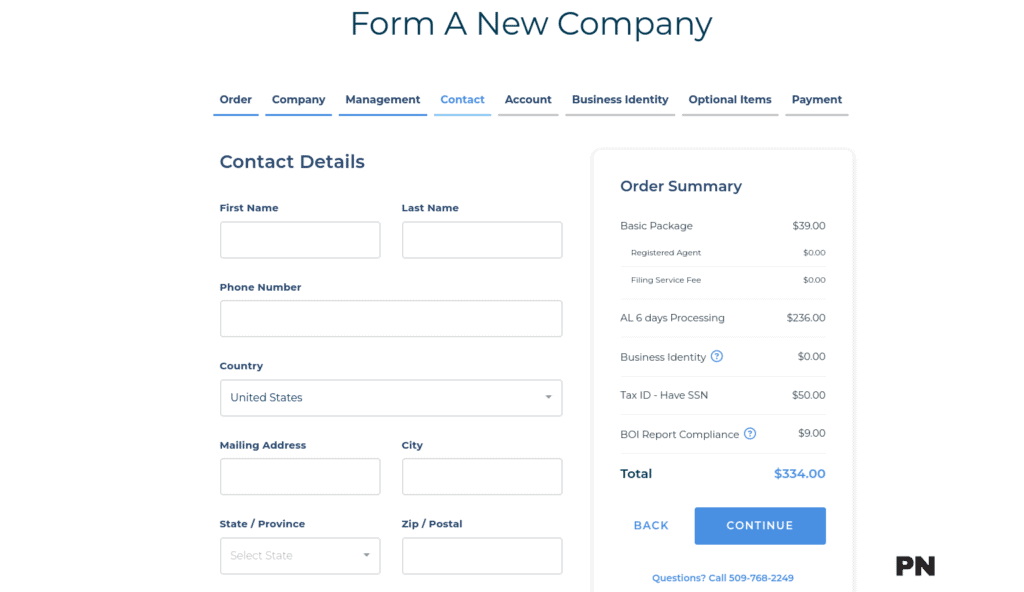

You’ll also need to fill in your contact details, including your name, address, and other relevant information, in addition to your business contact information.

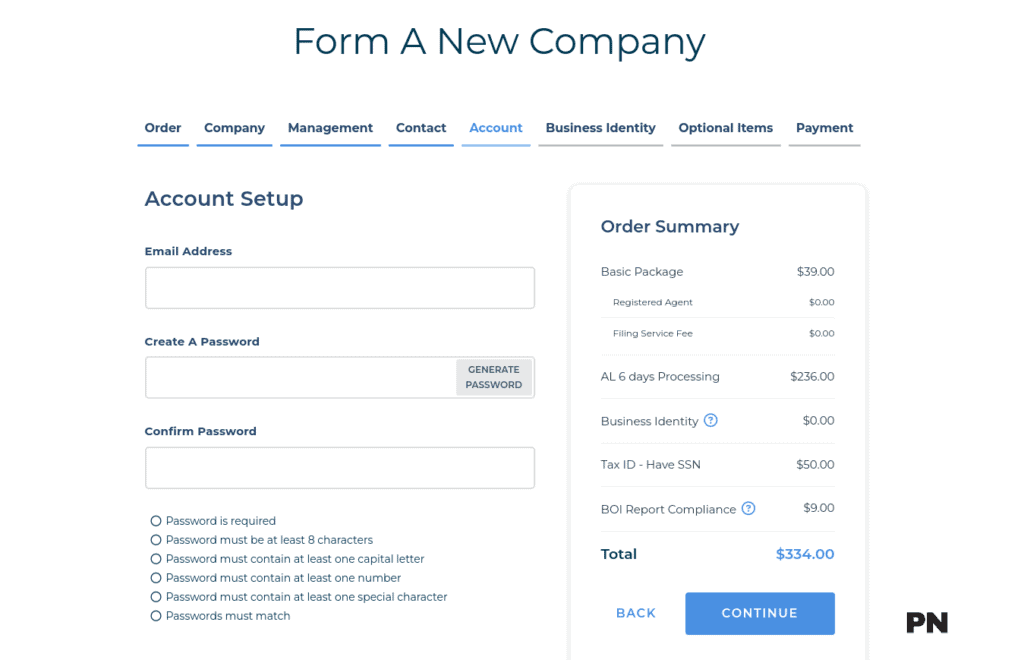

Step 6. Setup Your Account with Northwest Registered Agent

Once you’ve entered your information, you must set up your account with Northwest Registered Agent. This is where you’ll pay for their services and start forming your LLC.

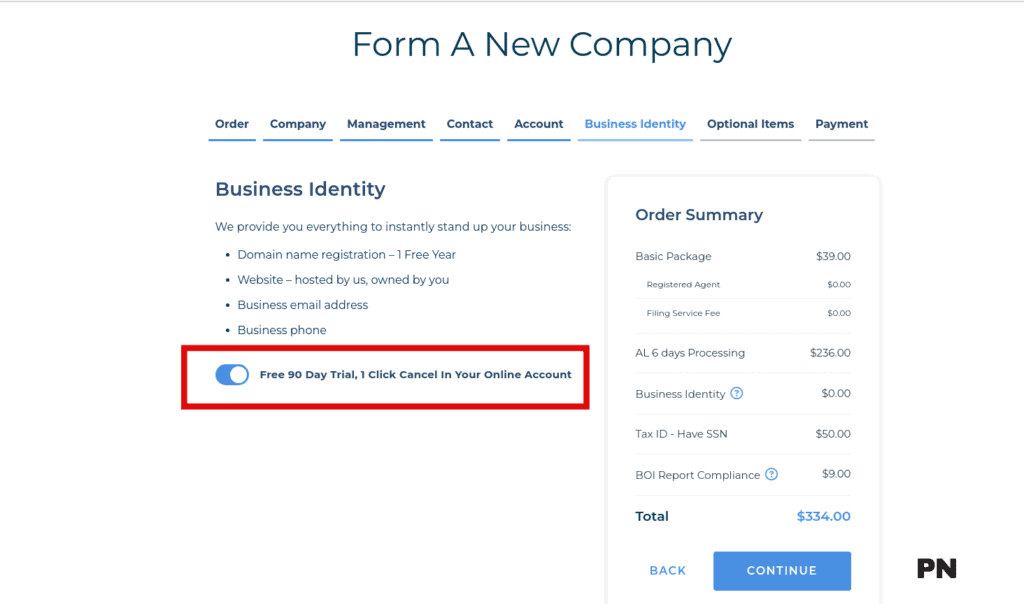

Step 7. Get Your Business Identity (optional)

You can toggle this on to add the Northwest Business Identity option for your LLC.

It includes the following, free for 90 days:

- Domain name registration – 1 Free Year

- Website – hosted by us, owned by you

- Business email address

- Business phone

Step 8. Getting Your Tax ID or EIN – optional

You can get a tax ID or EIN at this point. This is an optional step, but it’s important if you want to do things like open a business bank account or file taxes.

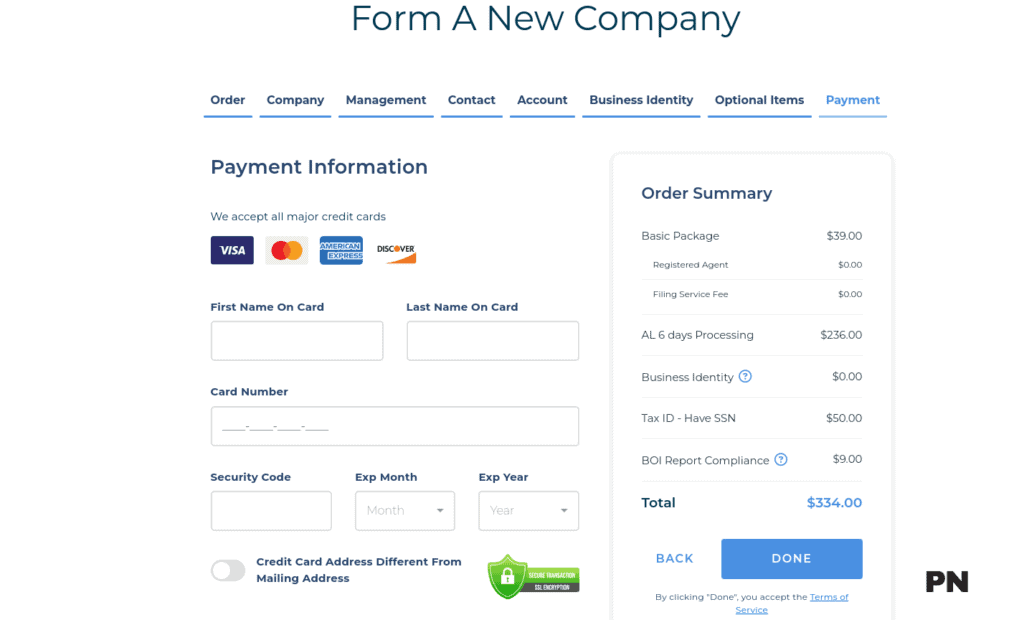

Step 9. Checkout/Payment (Congratulations!)

Finally, you’ll need to complete the checkout process and make your payment once you’ve done this, congratulations!

You’ve successfully formed your LLC and can now open a Stripe account and accept payments.

Finally, Create Your Stripe Account (With Your EIN & LLC Information)

If you’ve made it this far, you’ve done the hard work of setting up your Thai business and obtaining all the necessary documentation.

Now, it’s time to create your Stripe account so you can start accepting payments through your website.

Basic Requirements

Before you get started, make sure you have the following information ready:

- Your business name

- Your email address

- Your government-issued ID

- Your EIN (Employer Identification Number)

- Your LLC information

Creating a Stripe Account Step-by-Step

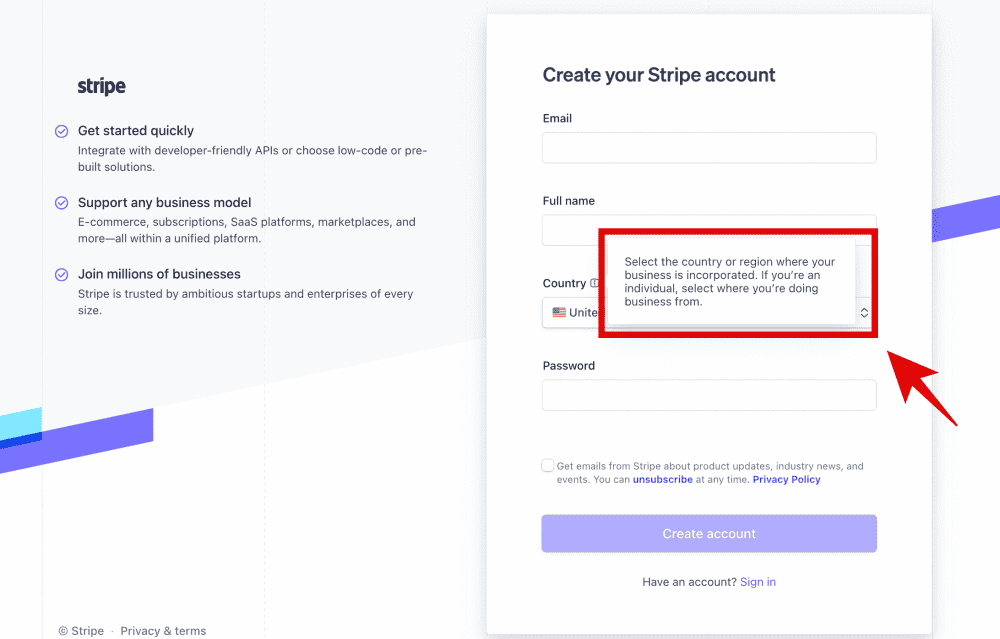

- Go to the Stripe website and click “Sign Up” in the right-hand corner.

- Choose “Business” as your account type and enter your email address and password.

- Enter your business information, including your business name and LLC information.

- Enter your EIN and government-issued ID.

- Choose the type of business you have and the industry you operate in.

- Set up your checkout and automated payment collection preferences.

- Verify your email address and activate your account.

Congratulations!

You now have a Stripe account and can begin accepting payments through your website. Stripe offers a variety of features and tools to help you manage your ecommerce business, so be sure to explore all the options available to you.

Please ensure the country you selected where your business is incorporated in the United States, not Thailand.

Why I Prefer Northwest Registered Agent For My LLC Formation?

When it comes to forming an LLC, there are many options available.

However, after using Northwest Registered Agent to create my Florida LLC in 2020, I can confidently say that it’s my preferred option. Here’s why:

Affordable Pricing

One of the main reasons I chose Northwest Registered Agent is because of its affordable pricing.

Unlike other registered agents that charge over $1000 to get started, Northwest only charges $39 to begin. Additionally, Northwest offers transparent pricing, so you won’t have to worry about annoying upsells or recurring monthly fees. Everything is optional, so you only pay for what you need.

Free One Year Registered Agent

Another great benefit of using Northwest Registered Agent is that they offer a free one-year registered agent service.

This means that they will receive and forward any legal documents on your behalf for the first year. This is a great value, as other registered agents charge for this service.

Privacy by Default

Privacy is important, especially when it comes to your business. Northwest Registered Agent keeps your address off public record by default. This means that your personal information won’t be easily accessible to anyone who wants to find it.

Free Domain, Website, Email & Business Phone

Northwest Registered Agent also offers a free domain, website, email, and business phone.

This is a great value, as these services can be expensive if you were to purchase them separately. Additionally, Northwest allows you to use one of its local offices as your business address, which can be helpful if you don’t have a physical office location.

What Are The Benefits Of Forming A US Limited Liability Company (LLC) For a Thailand Stripe Account?

Here are some benefits of forming an LLC for your Stripe account:

Limited Liability Protection

One of the main benefits of forming an LLC is that it provides limited liability protection.

This means that your personal assets, such as your home or car, are protected from business-related debts and lawsuits. If your business is sued or goes bankrupt, your personal assets won’t be at risk.

Tax Benefits

Another benefit of forming an LLC is that it offers tax flexibility.

By default, LLCs are taxed as pass-through entities, which means that the profits and losses of the business are passed through to the owners’ personal tax returns. This can result in lower taxes and fewer filing requirements than a corporation.

Credibility

Forming an LLC can also add credibility to your business.

It shows that you’re serious about your business and willing to take the necessary steps to protect it. This can be especially important if you’re working with clients or customers in the US or other countries.

Easy to Form

Forming an LLC is relatively easy and inexpensive. You can do it yourself or hire a lawyer to help you. The process involves filing articles of organization with the state where you want to form the LLC, choosing a name for your business, and appointing a registered agent.

Final Thoughts on Stripe Account Set up in Thailand

Setting up a Stripe account in Thailand is a straightforward process that requires you to provide some basic information about your business. The process is quick and easy, and you can start accepting payments from your customers in no time.

To set up a Stripe account in Thailand, you will need to provide the following information:

- Legal name as it appears on the Company Affidavit provided by Department of Business Development

- Business registration number

- Business address and contact information

- Bank account information

- Identification documents of the authorized representative

Once you have provided all the necessary information, Stripe will verify your account and activate it within a few business days.

It is important to note that Stripe only supports VAT for digital services in Thailand, and you must be a remote seller with no physical presence in the country to collect this tax on Stripe. Therefore, it is important to check your potential tax registration obligations before starting to use Stripe in Thailand.

Frequently Asked Questions

Can foreigners utilize Stripe services while residing in Thailand?

Yes, foreigners can use Stripe services while residing in Thailand via a Limited Liability Company (LLC) registered in Thailand. The LLC must be registered with the Ministry of Commerce, and the company’s directors must be Thai nationals.

What payment methods are supported by Stripe in Thailand?

Stripe supports payments in over 135 currencies, but in Thailand, Stripe accounts can only receive funds in Thai Baht (THB). Stripe also supports credit and debit card payments, as well as bank transfers.

Can I Get A U.S. based Address For My Business?

Yes, you can get a U.S. based address for your business through Northwest Registered Agent. This service provides a U.S. mailing address for your business, which can be used to register your business with Stripe.

How can I obtain an Employer Identification Number (EIN) as a Thailand resident?

As a Thailand resident, you can obtain an Employer Identification Number (EIN) by applying online through the IRS website. You will need to provide your personal information, including your Social Security Number (SSN), and your business information, including your business name and address.

What are the pricing and fees for using Stripe in Thailand?

Stripe charges a flat rate of 2.9% + THB 2.50 per successful transaction for credit and debit card payments. Bank transfers are charged at a flat rate of THB 15 per transaction. Stripe also offers customized pricing plans for businesses that process large volumes of transactions.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.