Is Stripe Available in Ethiopia? (Account Opening Guide)

Are you an entrepreneur in Ethiopia looking to expand your online business? If so, you may wonder if Stripe, the popular payment processing platform, is available in your country.

While Stripe is not available by default in Ethiopia, there are legal ways to use it for non-supported countries.

Keep reading to find out how to open a Stripe account for your Ethiopian business and accept payments online.

Key Takeaways

- To open a Stripe account in Ethiopia, you’ll need to follow a few steps.

- First, you’ll need to form a business in the US, such as an LLC.

- Then, you’ll need to obtain an Employer Identification Number (EIN) or Tax ID, a US business address, a US phone number, and a US bank account to link to Stripe for payouts.

- Once you have all this information, you can create your Stripe account and use its services.

- The easiest way to go about these is to use Northwest’s registered agent service.

Does Stripe Work in Ethiopia?

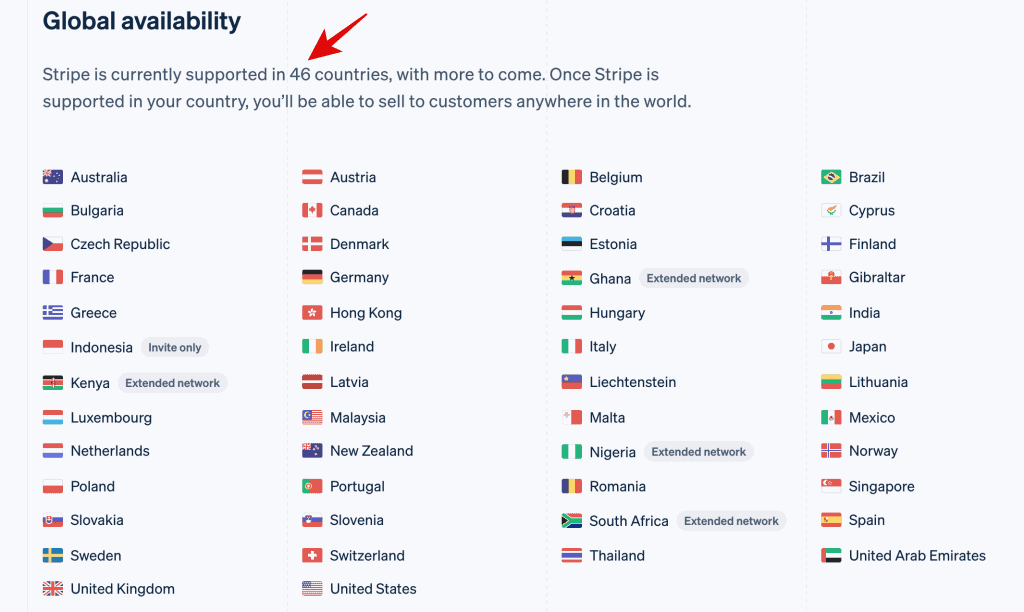

Is Stripe available in Ethiopia? The short answer is no. However, Stripe is constantly expanding its global reach and may become available in Ethiopia.

Some popular payment gateway providers that are available in Ethiopia include:

- PayPal

- Payoneer

- Skrill

- 2Checkout

- Paystack

- Flutterwave

If you’re an entrepreneur in Ethiopia looking to use Stripe, you can still open a Stripe account in Morocco by following these steps:

- Create/form an LLC in the United States (use Northwest)

- Visit the Stripe website and create an account.

- Enter your business information, including your name, address, and phone number.

- Provide your EIN (with the help of Northwest)

- Provide your tax ID and government-issued ID.

- Verify your email address and phone number.

- Add a bank account in Ethiopia where Stripe supports processing payments.

- Start accepting payments.

Some payment methods may not be supported unless you use a US-based LLC to set up your Ethiopian Stripe account. For example, ACH Direct Debit is only available in the United States. If you plan to sell to customers in the US, you may have to explore other payment methods.

Requirements To Open A Stripe Account In Ethiopia For Your Business (via LLC)

To open a Stripe account in Ethiopia, you must follow certain requirements. If you are a business owner in Ethiopia, you can open a Stripe account by forming a U.S.-based Limited Liability Company (LLC) and linking it to a U.S. bank account.

Here are the requirements you need to fulfill:

| Requirements | Where To Get Them |

|---|---|

| Business Formation / LLC | Through a registered agent (Use Northwest) |

| Employer Identification Number (EIN) | Obtain from the IRS after registering your business entity |

| U.S. Business Address | Use a registered agent (Northwest)or virtual mailbox service |

| U.S. Phone Number | Use a virtual phone number service |

| U.S. Bank Account (for Payouts) | Use Wise or Mercury |

1. Business Formation / LLC

To open a Stripe account and link it to a U.S. bank account, you would typically need to have a registered business entity in the United States. This could be a Limited Liability Company (LLC), corporation, partnership, or sole proprietorship registered in a U.S. state.

When you’re setting up an LLC, you have a few paths to choose from. You can handle the process yourself, hire a lawyer, or use a formation service. However, opting for a registered agent service, such as Northwest Registered Agent, stands out as the best choice.

A registered agent acts as your LLC’s official point of contact for legal and tax notifications. Choosing a service like Northwest brings several advantages:

Northwest ensures you receive crucial legal and tax documents promptly and maintains your privacy because the registered agent’s address appears on public documents instead of your personal or business address.

Using a registered agent service can keep your LLC compliant by reminding you of important filing deadlines with the state. This way, you can focus on growing your business while knowing that essential administrative tasks are handled reliably.

2. Employer Identification Number (EIN)

If you’re gearing up to use Stripe for your business, you’ll need to get an Employer Identification Number (EIN) or Tax ID. This unique nine-digit number, issued by the IRS, serves as the business equivalent of a Social Security number.

Having an EIN is essential for your LLC because it enables you to handle taxes, open a business bank account, and apply for loans—all vital for running your business smoothly.

You must provide your EIN when you’re setting up your Stripe account.

Now, when it comes to getting your EIN after forming your LLC, there are a couple of ways to go about it. One option is to apply for an EIN directly through the IRS website. It’s free, though it might take a couple of weeks to process.

Another option is to use a registered agent to obtain an EIN on your behalf. This route can be quicker and more convenient, albeit typically involving a fee.

Whichever way you choose, getting your EIN sorted is a fundamental step toward getting your business up and running smoothly with Stripe.

3. U.S. Business Address

You need a physical address in the United States where your business is located or where you can receive mail and correspondence related to your business.

If you do not have a physical address in the U.S., you can use a registered agent or virtual mailbox service to receive mail and forward it to you.

4. U.S. Phone Number

A U.S. phone number is typically required for verification and communication purposes. This can be a mobile or landline number.

If you do not have a U.S. phone number, you can use a virtual phone number service to get a U.S. phone number that can forward calls and messages to your international phone number.

5. U.S. Bank Account (for Payouts)

Stripe requires a U.S. bank account to transfer funds (payouts) from your Stripe account to your business bank account. The bank account should be in the name of your registered business entity.

You can open a U.S. bank account by contacting a U.S. bank or using an online banking service that specializes in serving non-resident businesses.

Wise is a savvy choice if you need to open a U.S. bank account from Ethiopia. With Wise, you can seamlessly handle payments in USD and various currencies, and then easily transfer funds to your local bank account in Ethiopia.

Another contender is Payoneer, which lets you open a U.S. bank account remotely. Like Wise, Payoneer supports receiving payments in USD and other currencies, making it a versatile solution for global transactions.

And don’t overlook Mercury, a U.S.-based bank designed with startups and small businesses in mind. Mercury offers a comprehensive suite of banking services, including a U.S. bank account that integrates smoothly with Stripe for payouts.

Each option brings its own perks, so choosing the right fit depends on your specific business needs and global financial goals.

What’s the Best State to Form Your LLC as a Foreigner in Ethiopia?

If you are a foreigner looking to form an LLC in Ethiopia, it’s important to consider which state best fits your business needs.

While there are many states to choose from, Wyoming, Delaware, and New Mexico are popular options due to their low cost and low maintenance requirements.

Wyoming

Wyoming is a great option for non-US residents looking to form an LLC due to its low cost and low maintenance requirements.

Filing an LLC in Wyoming costs around $50, and no corporate taxes exist. However, you will still need to pay federal taxes. Wyoming could be a solid choice if you’re looking for a relatively low-cost and low-maintenance option.

Delaware

Delaware is another popular option for non-US residents looking to form an LLC, especially if you plan to raise money from investors. Nearly 80% of US public companies choose to incorporate in Delaware.

The major downside is the higher cost of filing and maintaining the company. It could be the right choice if you’re willing to pay more for the benefits of incorporating in Delaware.

New Mexico

New Mexico is also attractive to non-US residents looking to form an LLC due to its low filing costs and lack of annual report requirements.

You can file an LLC in New Mexico for just $50, and you won’t have to worry about filing an annual report. This makes it a good option for those seeking a low-cost and low-maintenance option.

Nevada

While Nevada is often touted as a good state for forming an LLC, it may not be the best choice for non-US residents.

Nevada has strict requirements for foreign LLCs, including needing a registered agent who resides in the state. This can be difficult for non-US residents to fulfill. Additionally, the state charges high fees for filing and maintaining an LLC.

Related Post: 5 Best States For Non-resident LLCs

It’s important to note that states like California may not be the best choice for non-US residents due to their high fees and strict regulations. It’s important to research and consider all options before deciding which state is the best fit for your business needs.

Steps On How To Form Your LLC & Open A Stripe Account

To form an LLC and open a Stripe account, you need to follow these simple steps:

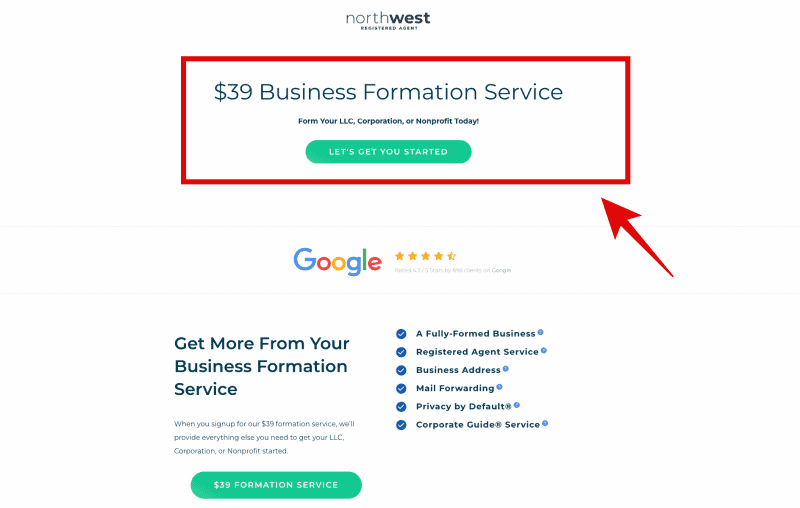

Step 1. Sign up For Northwest Registered Agent

To form your LLC, you can sign up for Northwest Registered Agent services. They will help you form your LLC and provide you with a registered agent, which is required by law.

You can sign up for their services on their website.

Visit https://www.northwestregisteredagent.com/.

Once you get to the website, click on the button – “LET’S GET YOU STARTED.”

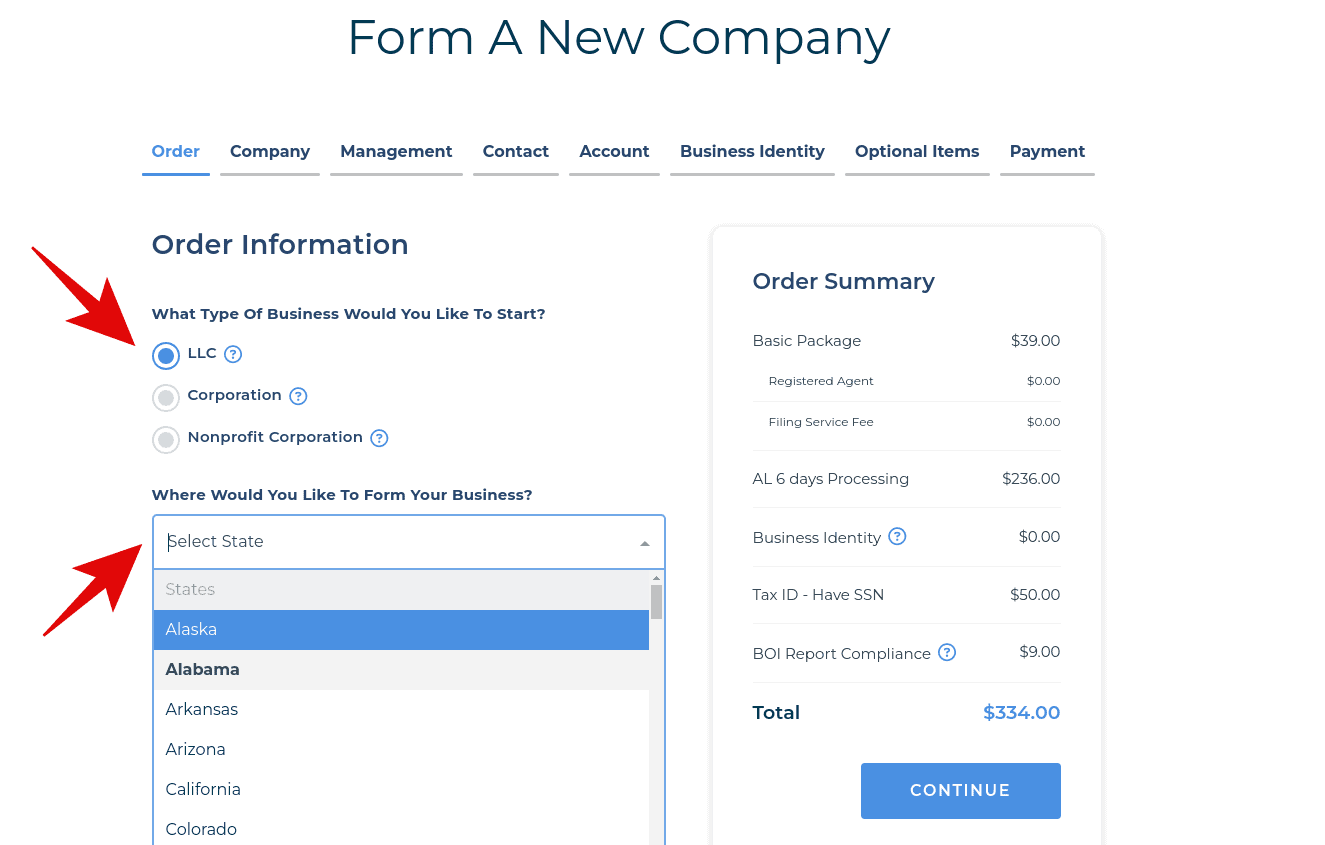

Step 2. Choose Your Business Entity as LLC and Select Your Preferred State

After clicking the “LET’S GET YOU STARTED” button, you’ll be redirected to a page where you can choose your business entity and state.

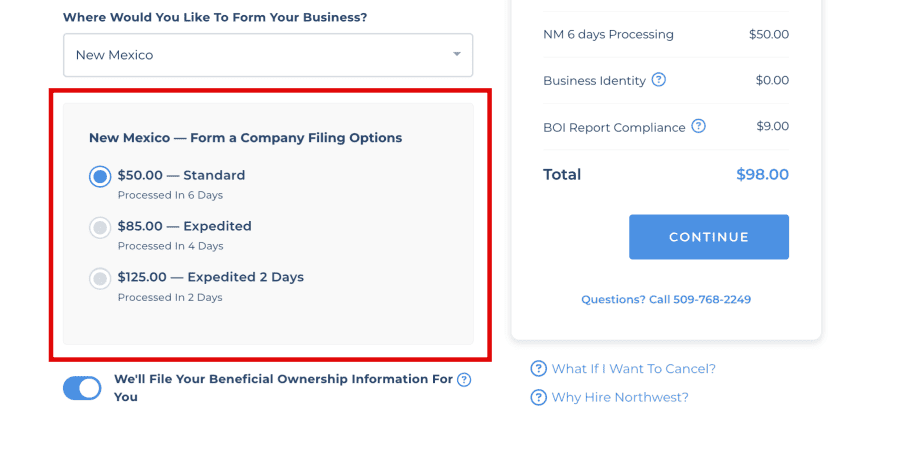

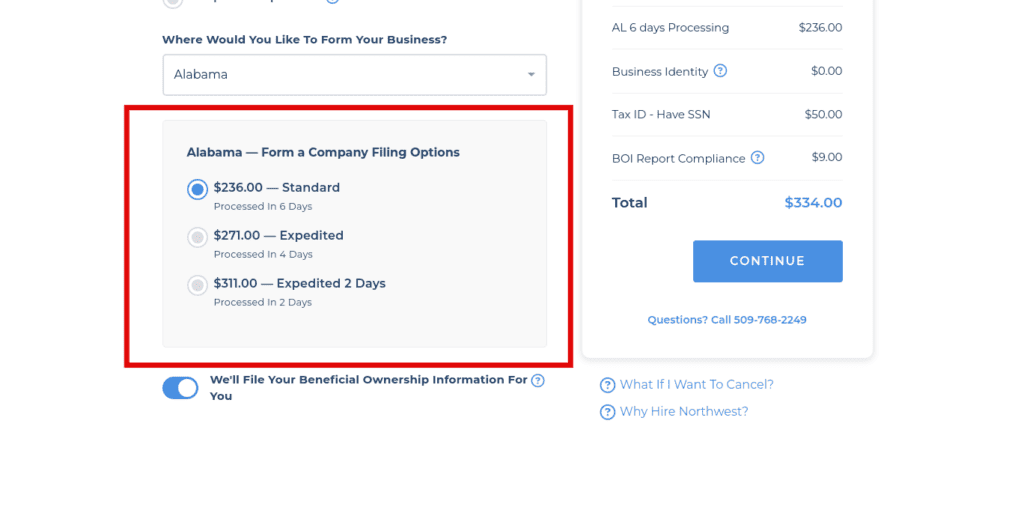

You can choose from various business entities, including LLCs, corporations, and partnerships. You’ll also need to select the state where you want to form your LLC. The state you choose and the processing time (Standard and Expedited) would determine the total amount.

Here’s that of New Mexico ($98):

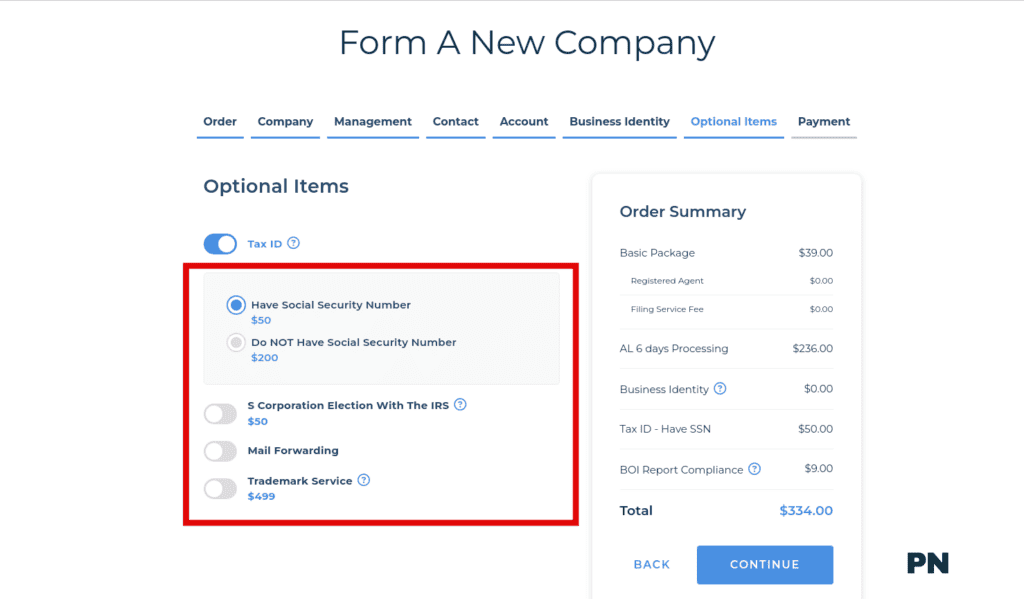

Here’s that of Alabama ($334):

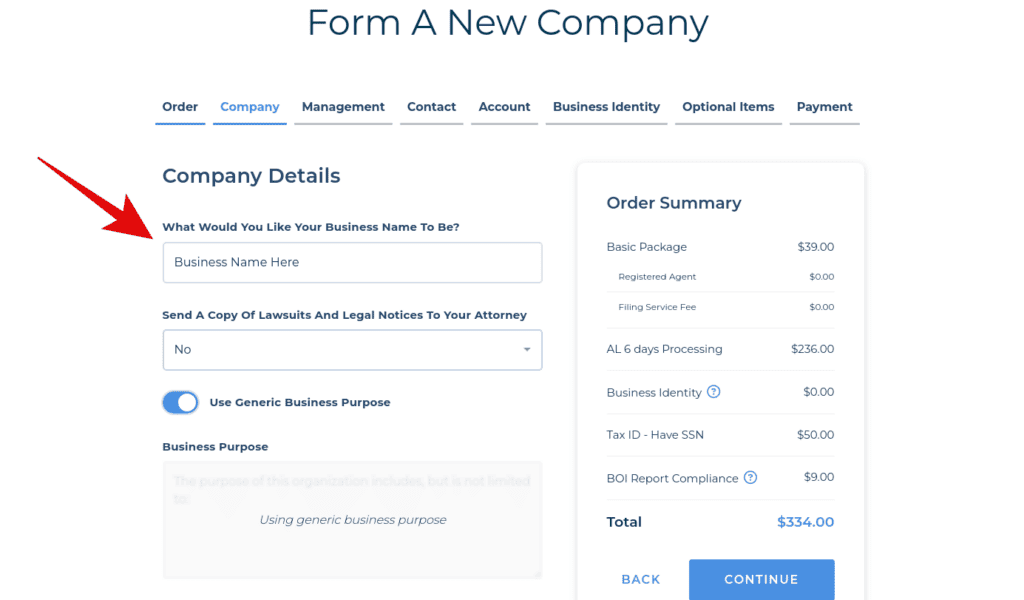

Step 3. Enter Your New/Existing Details

After choosing your business entity and state, you’ll need to enter your new or existing details. This includes your company name, address, and other relevant information.

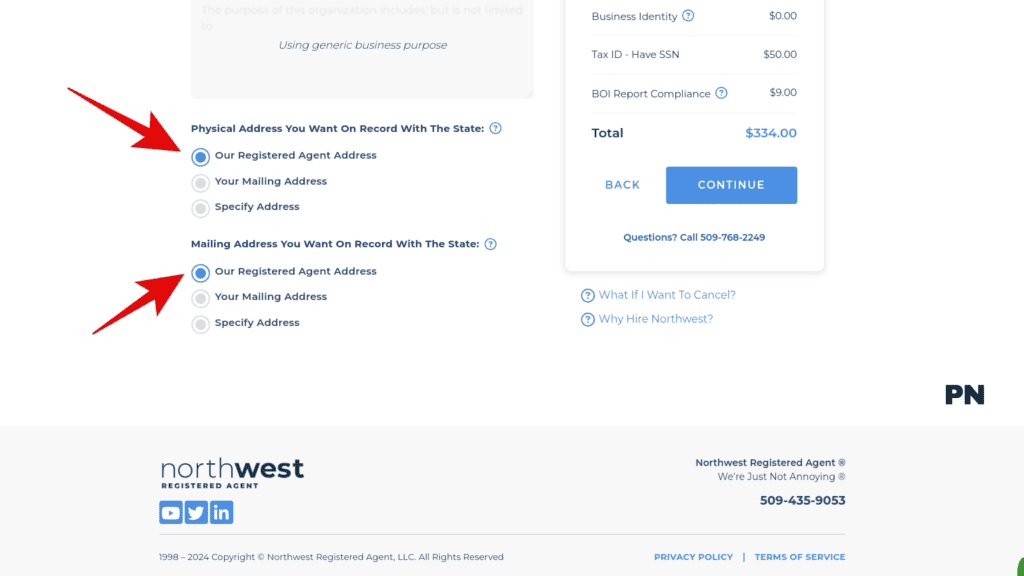

Choose the physical and mailing addresses you would like to use for the business:

Northwest Registered Agents offer the convenience of using their address as your business address, eliminating the need for a separate US address for your company.

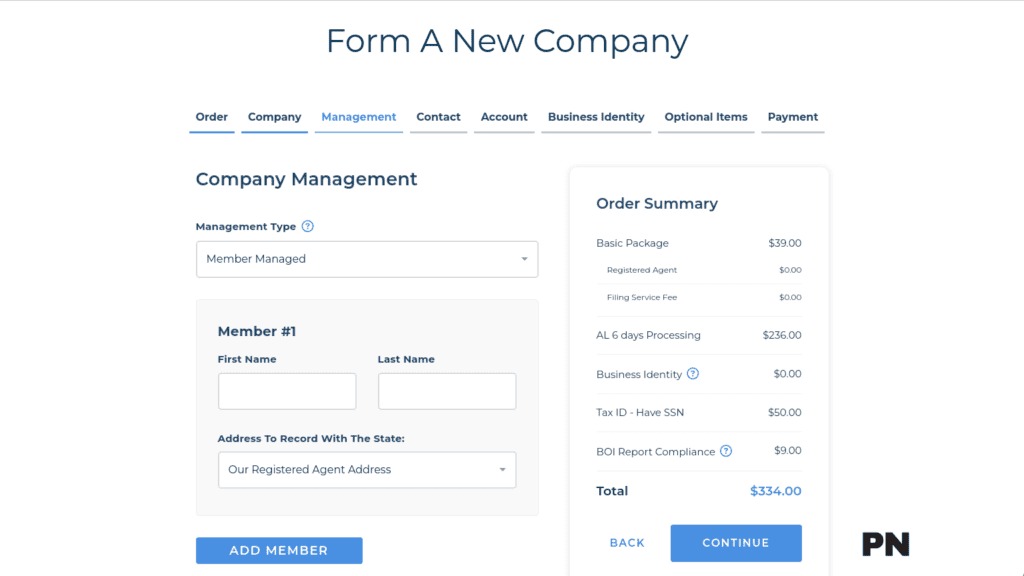

Step 4. Enter The Management For Your LLC

Next, you’ll need to enter the management information for your LLC. This includes the names and addresses of your managers and their roles in the company.

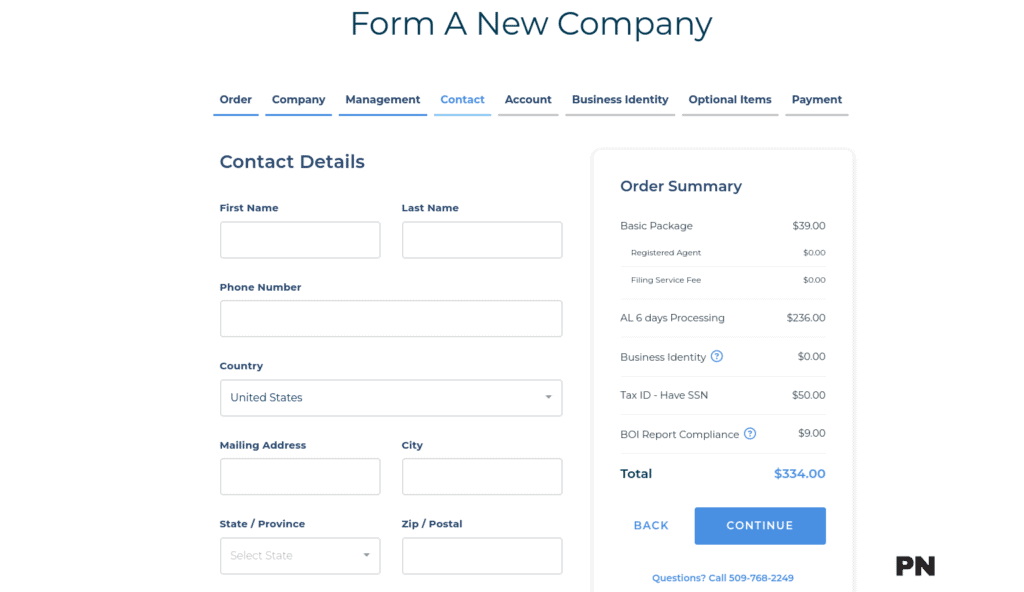

Step 5. Fill in Your Contact Details

Here’s where you fill in your contact details, which will serve as your primary means of contact with Northwest.

You do not necessarily need a U.S. contact detail for your Northwest account creation. You can use your local/current details as a point of contact with Northwest.

You do not necessarily need a U.S. contact detail for your Northwest account creation. You can use your local/current details as a point of contact with Northwest.

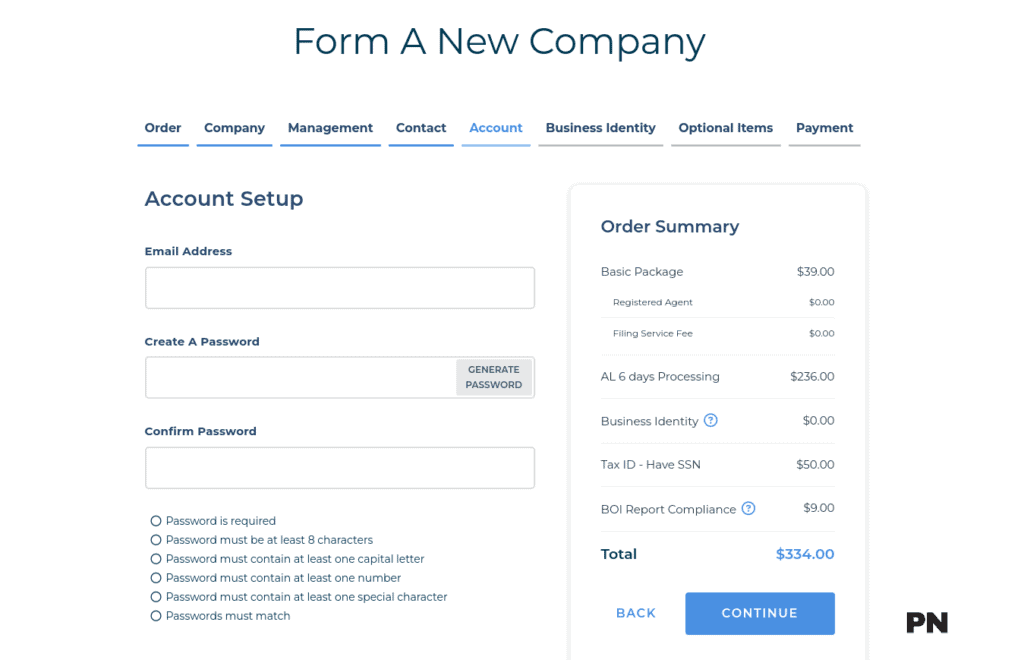

Step 6. Setup Your Account with Northwest Registered Agent

After entering all your information, you’ll need to set up your account with Northwest Registered Agent – using your email and preferred password. This will allow you to access their services and complete the following steps to form your LLC.

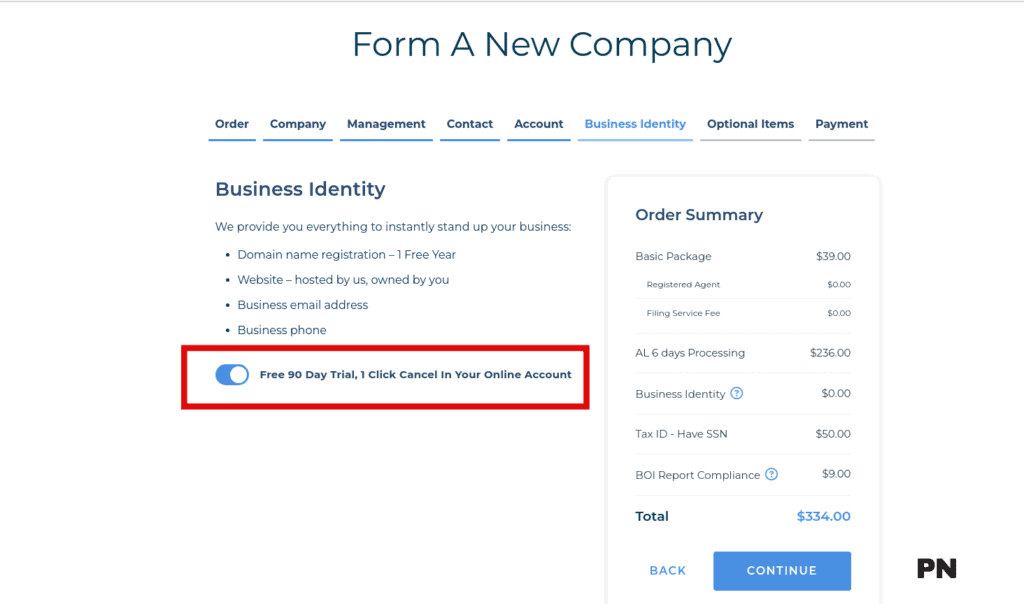

Step 7. Get Your Business Identity (optional)

You can toggle this on to add the Northwest Business Identity option for your LLC.

It includes the following, free for 90 days:

- Domain name registration – 1 Free Year

- Website – hosted Northwest, owned by you

- Business email address

- Business phone

Step 8. Getting Your Tax ID or EIN (Optional)

If you want your LLC’s tax ID (EIN), you can do so through Northwest Registered Agent. They will help you complete and submit the necessary forms to the IRS and create a viable Stripe account.

You need an EIN as a foreigner or non-resident. It’s pretty easy to get this (and cheaper) without the help of registered agents. But if you’d like to include it in your order, that’s also great!

Northwest charges $200 to obtain EIN from the IRS for non-US entities that don’t have a Social Security Number (SSN).

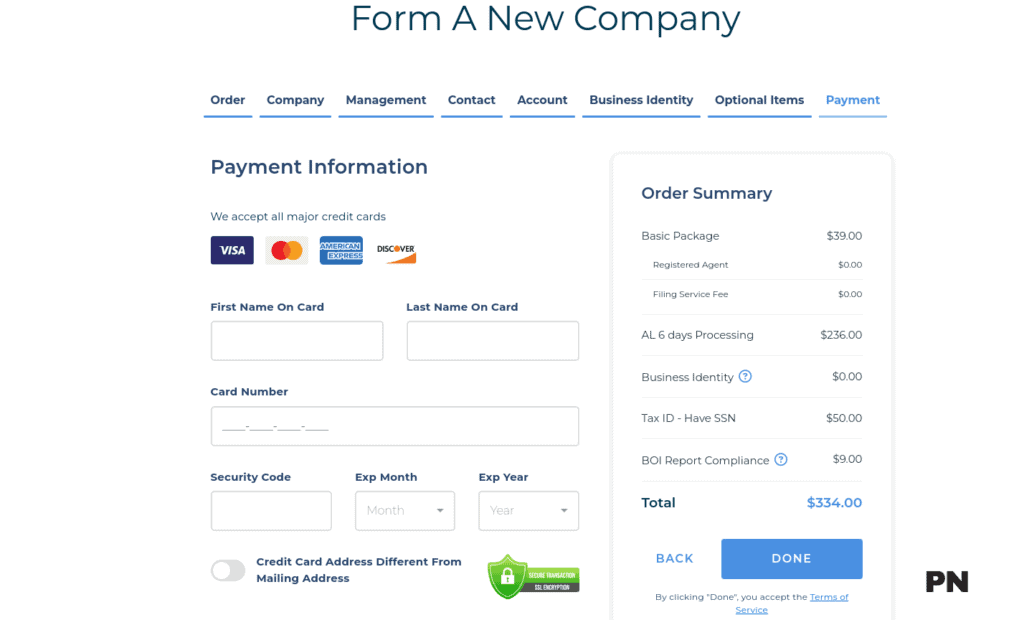

Step 9. Checkout/Payment (Congratulations!)

Once you’ve completed the previous steps, you can check and finalize your LLC formation. Enter your valid card information, then click Done!

Congratulations—you’ve formed your LLC and are ready to open a Stripe account!

Finally, Create Your Stripe Account (With Your EIN & LLC Information)

To create your Stripe account, you will need to have a few things ready. Here are the basic requirements to create a Stripe account:

Basic Requirements for Creating A Stripe Account

Before you create a Stripe account, you need to ensure that you have the following basic requirements:

- Business name: Your business name should be unique and accurately represent your brand. Make sure you have a name in mind before starting the registration process.

- Email address: You will need to use a valid email address to create your Stripe account. This email address will be used for all communications with Stripe.

- Government-issued ID: Stripe requires a government-issued ID to verify your identity. This could be a passport, driver’s license, or national ID card. Make sure you have a scanned copy of your ID ready to upload during the registration process.

- EIN: You will need an Employer Identification Number (EIN) to create your Stripe account. This is a unique nine-digit number assigned by the IRS to identify your business entity. If you don’t have an EIN yet, you can apply for one online through the IRS website.

Creating a Stripe Account (Step-by-Step)

Creating a Stripe account is a simple process that can be completed in a few easy steps. Here’s a step-by-step guide to help you get started:

- Go to the Stripe website/registration page (https://dashboard.stripe.com/register) and click on the “Sign Up” button located in the top right corner of the page.

- Enter your email address and create a password for your account. Make sure to choose a strong password that is difficult to guess.

- Click on the “Get Started” button to create your account.

- Enter your business information, including your business name and EIN. Make sure to provide accurate and up-to-date information.

- Verify your identity by providing your government-issued ID. This step is necessary to ensure the security of your account and prevent fraud.

- Connect your bank account to your Stripe account. This will allow you to receive payments and transfer funds to your bank account.

- Set up your payment processing preferences. You can choose from a variety of payment methods and customize your payment settings to meet your specific needs.

By following these simple steps, you can create a Stripe account and start accepting payments online. If you encounter any issues or have any questions, Stripe offers excellent customer support to help you every step of the way.

Why I Prefer Northwest Registered Agent For My LLC Formation?

When it comes to forming an LLC, choosing the right registered agent is crucial. After conducting extensive research, you have decided to go with Northwest Registered Agent for the following reasons:

1. Free One-Year Registered Agent

Northwest Registered Agent offers a free one-year registered agent service when you hire them to form your LLC. This is a great value, as many other registered agents charge extra for this service.

With Northwest Registered Agent, you can rest assured that your LLC will have a registered agent for the first year without any additional cost.

2. Free Operating Agreement

Northwest Registered Agent also provides a free operating agreement when you hire them to form your LLC. This important document outlines the ownership and management structure of your LLC.

Having a well-drafted operating agreement is critical to the success of your LLC, and with Northwest Registered Agent, you get one for free.

3. Transparent Pricing

Northwest Registered Agent charges only $39 to get started, unlike other registered agents that charge over $1000. This is a great value, especially if you are starting and don’t have much money to invest in your business.

Northwest Registered Agent has no annoying upsells and recurring monthly fees. Everything is optional, so you only pay for the services you need.

4. Allows You To Use One Of Its Local Offices As Your Business Address

Northwest Registered Agent allows you to use one of its local offices as your business address. This is a great option if you don’t have a physical office or if you want to keep your home address private.

With Northwest Registered Agent, you can use their address as your business address and keep your personal address confidential.

5. Privacy By Default

Northwest Registered Agent keeps your address off public record by default. This is important if you want to keep your personal information private. With Northwest Registered Agent, you can rest assured that your personal information will not be available to the public.

6. Free Domain, Website, Email & Business Phone

Northwest Registered Agent also provides a free domain, website, email, and business phone when you hire them to form your LLC. This is a great value and can save you a lot of money on these essential business tools.

With Northwest Registered Agent, you can get your LLC up and running quickly and easily.

What Are The Benefits Of Forming A US Limited Liability Company (LLC) For an Ethiopian Stripe Account?

If you are an Ethiopian business owner looking to expand your business internationally and use Stripe as a payment gateway, forming a US Limited Liability Company (LLC) can offer several benefits.

Limited Liability Protection

One of the main benefits of forming a US LLC is personal liability protection. As a member of an LLC, your assets are protected from creditors and legal action. This means that if your business incurs debt or is sued, your personal finances are not at risk.

By forming a US LLC, you can protect your personal assets while still being able to conduct business internationally.

Tax Flexibility

Another benefit of forming a US LLC is the tax benefits. LLCs are pass-through entities, meaning the business’s profits and losses are passed through to the individual members. This can result in significant tax savings for the LLC members.

As a member of a US LLC, you can take advantage of the many tax benefits available to US businesses.

Credibility

Forming a US LLC can also add credibility to your business. Many customers and partners may view a US LLC as more legitimate and trustworthy than a foreign company. This can help you attract new customers and partners and make it easier to secure financing or investment.

By forming a US LLC, you can increase your business’s credibility and take advantage of the many opportunities available in the US market.

Ease of Formation

Forming a US LLC is a relatively straightforward process. You can form an LLC online, and the process usually takes only a few days. Once your LLC is formed, you can easily open a US bank account and start conducting business in the US market.

By forming a US LLC, you can take advantage of the many benefits of doing business in the US without having to navigate complex legal and financial systems.

Frequently Asked Questions

How Do I Use Stripe In Ethiopia?

To use Stripe in Ethiopia, you need to create a Stripe account and integrate it with your website or app. Once your account is set up, you can start accepting payments from customers using Stripe’s payment platform.

Is it possible to create a Stripe account from Ethiopia?

Yes, it is possible to create a Stripe account from Ethiopia. However, there are some requirements you need to meet before you can open an account. You will need to form a US-based Limited Liability Company (LLC) and obtain an Employer Identification Number (EIN) or Tax ID. You will also need to provide a US bank account and a US address.

In which African countries is Stripe currently available?

Stripe is currently available in several African countries, including South Africa, Egypt, Nigeria, and Kenya. However, it is not yet available in Ethiopia.

What currencies can be processed through Stripe’s payment platform?

Stripe supports over 135 currencies, including major currencies such as USD, EUR, GBP, and JPY. You can also process payments in less common currencies such as Bitcoin and Litecoin.

How can one sign up for Stripe from an unsupported country?

If you live in a country where Stripe is not yet available, you can still sign up for an account by registering your company in the US or the UK. You will need to form a US-based LLC or a UK-based Limited Company and provide a US or UK bank account and address. You can then use your Stripe account to process payments from customers around the world.

How much does it cost to create and run a Stripe account?

Creating a Stripe account is free. However, Stripe charges a fee for every transaction processed through its payment platform. The fee varies depending on the country and currency involved, but it is typically around 2.9% + 30 cents per transaction. Stripe also offers additional features and services, such as fraud prevention and subscription management, for an additional cost.

Disclosure: We may earn commissions if you buy via links on our website. Commissions don’t affect our opinions or evaluations. We’re also an independent affiliate of many platforms, including ClickFunnels, Kartra, GoHighLevel, Podia, Northwest Registered Agent, and others. We’re not employees of these services. We receive referral payments from them, and the opinions expressed here are our own and are not official statements of these companies.